The Fair Labor Standards Act (FLSA), an enduring fixture of American labor law since 1938, quietly strengthens the working lives of millions. Its classification system — exempt, non-exempt, and salaried non-exempt employees — is the linchpin of equitable compensation in the United States.

The classifications and qualifications are moving targets. This system is crucial for employers (who must navigate its legal complexities) and employees (who benefit from its protections). With salary and HCE thresholds changing yearly, a nuanced understanding of these categories has never been more vital — but don’t worry. We’ll give you a rundown of the increased salary threshold.

Today, we’ll help you understand the basics. Now, we’re not employment law experts, but we know a thing or two about workforce management, and we’ve done some research to ensure you’re getting a simple and condensed version of FLSA classifications.

Of course, talking to an expert before making labor classifications is always a good idea. (That’s our nice way of saying, please don’t sue us; we’re just giving out some free advice.)

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysFLSA classifications: exempt vs. non-exempt employees

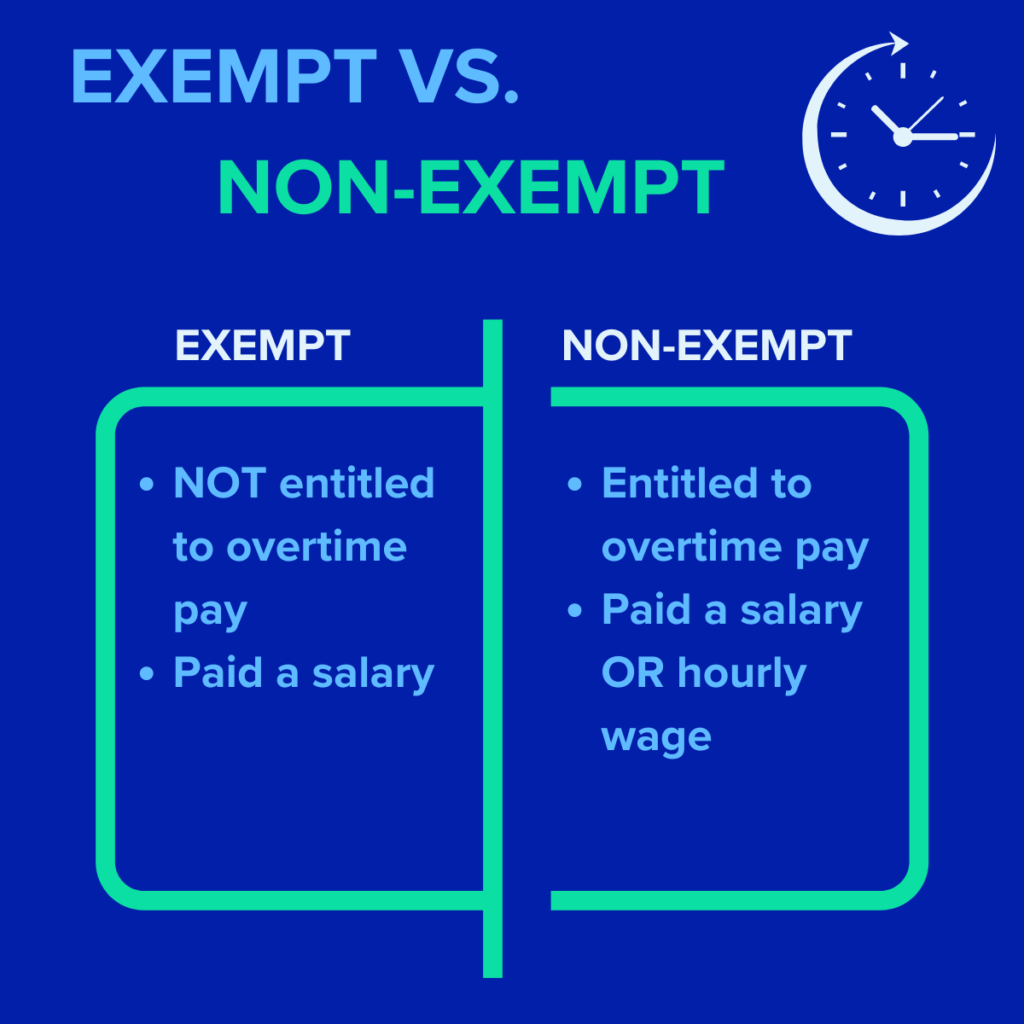

The critical difference between exempt and non-exempt employees is their eligibility for overtime pay under the FLSA.

- Exempt employees are not entitled to receive overtime pay regardless of the hours worked, as they meet specific salary and duty requirements. They often work a typical 9-5 schedule and are paid a salary.

- Non-exempt employees, on the other hand, must be paid overtime at a rate for any hours worked over 40 in a workweek. They typically are hourly wage employees.

Now that you understand the basics, let’s get more in-depth.

What is a non-exempt employee?

Exempt employees are those who are not entitled to overtime pay under the FLSA.

This status is usually for full-time, salaried positions. Exempt employees are your typical “white-collar” employees. Think Suits or Mad Men — those people were all exempt employees. Don Draper was definitely not getting paid overtime for all those late nights in the office.

How to qualify as an exempt employee:

- Meet the (current) minimum wage requirements of $35,568 per year (or $684 per week)

- Be paid on a salary basis

Typical roles that fall into the exempt category include:

- Doctors

- Accountants

- Engineers

Note: While many employers specify in their employee handbooks that exempt employees must work 40 hours per week, the Department of Labor (DOL) does not require a minimum number of hours for exempt status.

Exempt employees are expected to fulfill their job duties for a set salary, regardless of the amount of time required. Their pay remains the same if they work 40, 50, or 60 hours weekly.

What is a non-exempt employee?

Non-exempt employees are individuals who qualify for overtime provisions under federal law for any hours worked beyond 40 in a workweek.

Non-exempt employees are typically paid an hourly wage instead of a salary. These roles are typically service or clerical. Think of your favorite barista. They’re almost certainly getting paid any time they work more than 40 hours a week.

Typical roles that fall into the exempt category include:

- Hourly employees

- Retail staff

- Food service employees

Being a non-exempt employee comes with benefits like eligibility for overtime pay, which can significantly boost earnings. However, there are also drawbacks, such as potentially unpredictable work hours.

Overtime pay must be compensated at 1.5 times their regular pay rate for any extra hours worked. Determining non-exempt status is generally based on an employee’s job duties and how they are paid. Typically, non-exempt employees are hourly — but that isn’t always the case.

Let’s discuss the least common classification under FLSA (David Attenborough voice): the elusive salaried non-exempt employee.

What is a salaried non-exempt employee?

Unlike exempt employees, salaried non-exempt employees are entitled to overtime pay despite receiving a fixed salary. This means they get paid time and a half for any hours worked over 40 a week, just like hourly non-exempt employees.

The critical difference is that they receive a consistent salary regardless of hours worked. Rights and protections for these salaried employees include guaranteed adherence to federal minimum wage and overtime laws.

Typical roles that fall into the salaries non-exempt category include:

- Administrative assistants

- Customer service supervisors

- Technical support staff

However, this classification can pose compliance challenges for employers, who must carefully track work hours and ensure proper compensation.

Understanding the differences between these three categories is the first step to navigating the complexities of labor laws and maintaining fair employment practices. However, there will be some big changes in the next few years regarding FLSA salary thresholds.

To learn more about employee coverage under the FLSA, check out the DOL’s fact sheet.

Upcoming: 2024 and 2025 increased salary and HCE threshold

(Source: Department of Labor)

To keep up with changes in worker pay, salary and compensation thresholds will now be automatically adjusted every three years. This means they’ll stay relevant and fair over time.

- Salary threshold. Starting July 1, 2024, employees must earn a minimum of $43,888 per year (or $844 per week) to qualify for exemption. This threshold will rise to $58,656 annually (or $1,128 per week) beginning January 1, 2025.

- HCE threshold. Effective July 1, 2024, the minimum annual compensation for highly compensated employees (HCE) to qualify for exemption will increase to $132,964, up from the previous $107,432. This threshold will further rise to $151,164 on January 1, 2025.

Now that you know what’s coming for FLSA classifications, let’s discuss the current classification system.

Legal implications of FLSA classifications

FLSA classifications significantly impact legal obligations and rights. Here’s a breakdown of the most critical aspects.

Legal responsibilities for employers

Simply put, employers have a legal duty to classify their employees correctly under the FLSA. This involves ensuring that employees are paid in accordance with their classification, whether exempt, non-exempt, or salaried non-exempt.

Note: Failure to comply with these classifications can result in penalties, which is why we’re here to remind you (once again) to get an expert involved if you have any questions about how to classify employees.

Penalties for misclassifying employees

Failure to properly classify employees can result in penalties including:

- Back pay. Employers may be required to pay back wages for unpaid overtime, covering the entire period of misclassification.

- Fines and penalties. The DOL can impose civil penalties, which can amount to significant sums depending on the severity and duration of the violation.

- Legal fees. Employers might be liable for the legal fees of employees who bring successful claims against them.

- Damages. In some cases, employers may have to pay liquidated damages, which can be equal to the amount of unpaid wages owed.

- Interest. Employers might also have to pay interest on back wages due to employees.

At the risk of repeating ourselves (say it with us this time!), consult an employment law expert or HR professional before making any big decisions on employee classifications.

Best practices for employers

Now that we’ve officially scared you with the consequences of misclassifying employees, we’re swooping in to help with some tips and best practices.

Tips for classifying employees

- Conduct regular audits. Employers should review and audit employee classifications to ensure they are accurate and up-to-date. Audits typically involve assessing job duties, salaries, and hours worked to confirm that employees are accurately classified.

- Stay informed on labor laws. Keeping up to date on changes and updates to labor laws is essential. You’re already one step ahead of the pack by reading this guide, but your education on this subject shouldn’t stop here. Employers should subscribe to legal updates, attend relevant workshops, and consult with legal professionals to stay informed about any changes to the FLSA.

- Provide training. Investing in comprehensive training for HR personnel is vital. HR staff should be well-versed in FLSA requirements, classification criteria, and the implications of misclassification.

- Implement clear policies. Establishing clear policies and procedures for classifying employees helps ensure consistency and compliance. These policies should outline the criteria for each classification and provide guidelines for conducting regular reviews and audits.

- Seek legal counsel. You knew this one was coming, right? Bringing in legal counsel can provide valuable guidance on complex classification issues. Lawyers are pricey, but the cost-savings of not misclassifying employees can’t be overstated.

By following these strategies and maintaining a commitment to compliance, employers can protect their organizations from legal risks, foster a fair and transparent work environment, and uphold the rights and interests of their employees.

Track time and pay exempt and non-exempt employees with Hubstaff

Luckily, you don’t have to do it alone. To help with employee payroll and time tracking, check out Hubstaff’s employee time tracking software for your business. With Hubstaff, you can:

- Track time and create automated timesheets that populate with hours worked in real time.

- Pay exempt and non-exempt employees directly through the Hubstaff app or using powerful integrations with tools like PayPal, Wise, Deel, and Gusto.

- Adjust rates, classifications, and pull reports to keep better tabs on all employees for FLSA compliance.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...