The toolbox for accountants keeps getting bigger yet more refined — and that’s thanks to advancements in time and billing software. Whether you’re upgrading your system or hunting for the first time, choosing the right time and billing software is more crucial than ever.

In today’s post, we’re exploring the top six software picks for accountants this year. With an eye on boosting efficiency and accuracy, we’ll walk you through each option, spotlighting its key features, reviews, and pricing.

So, if you’re ready to streamline your accounting practice, let’s explore the best time and billing software for accountants and find the tool that best suits your needs.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysKey features accountants should look for in time and billing tools

When accountants are on the hunt for the right time and billing software, they should look for features that not only streamline their day-to-day tasks but also enhance accuracy and ensure they’re staying compliant.

Beyond time tracking and automated billing, what features should you look for? Here’s a rundown:

- Customizable invoicing. Since every client is different, being able to customize invoices for different projects and clients is a game changer.

- Expense tracking. Make sure the software can track all client-related expenses — both direct costs like travel and indirect ones like overhead — to ensure everything gets billed correctly.

- Project management capabilities. Task management elements are super helpful for keeping projects on track. Look for features like task assignment, progress tracking, and resource allocation.

- Reporting and analytics. Good software will offer powerful reporting tools that give insights into work hours, client billing, productivity, and more.

- Integration capabilities. The more your software can play nicely with other tools you use, like QuickBooks or CRM systems, the better.

- Compliance and security. The software must keep your data secure and comply with standards and regulations. Make sure it’s up to date with the latest requirements.

Choosing the right software with these features will not only boost your team’s efficiency but also its profitability. It’s all about finding a system that fits seamlessly into your workflow and grows with your business.

Now, let’s get into the software.

Review of top time and billing software for accountants

| Tool | Key features | Base pricing |

| Hubstaff | Automated time trackingBilling and payrollInvoicingIntegrations with other softwareHubstaff TasksInsights add-on | $7 per user/month |

| Paymo | Time trackingInvoicingTask managementExpense managementReporting | $9.9 per user/month |

| Harvest | Time trackingInvoicingExpense trackingProject management and budgetingReporting | $12 per seat/month |

| Freshbooks | Time trackingInvoicingExpense trackingProject managementOnline payments | $7.60 per user/month |

| Quickbooks Time | Time tracking Employee schedulingReal-time reportsAlerts and remindersIntegrations | $28 per user/month |

| Toggl Track | Time trackingReportingProject dashboardBillable ratesIntegrations | $10 per user/month |

1. Hubstaff: Best for all-in-one workforce management

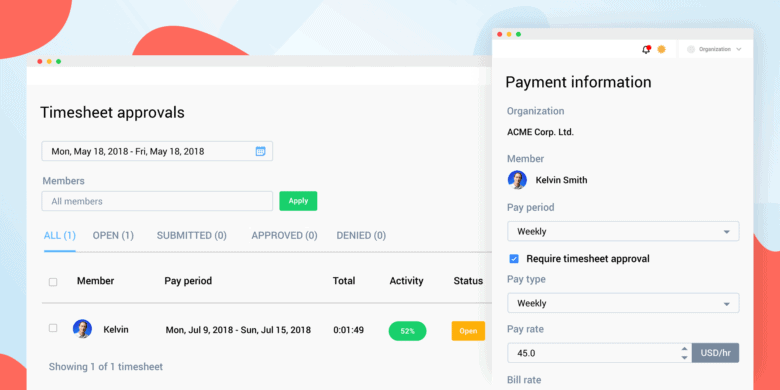

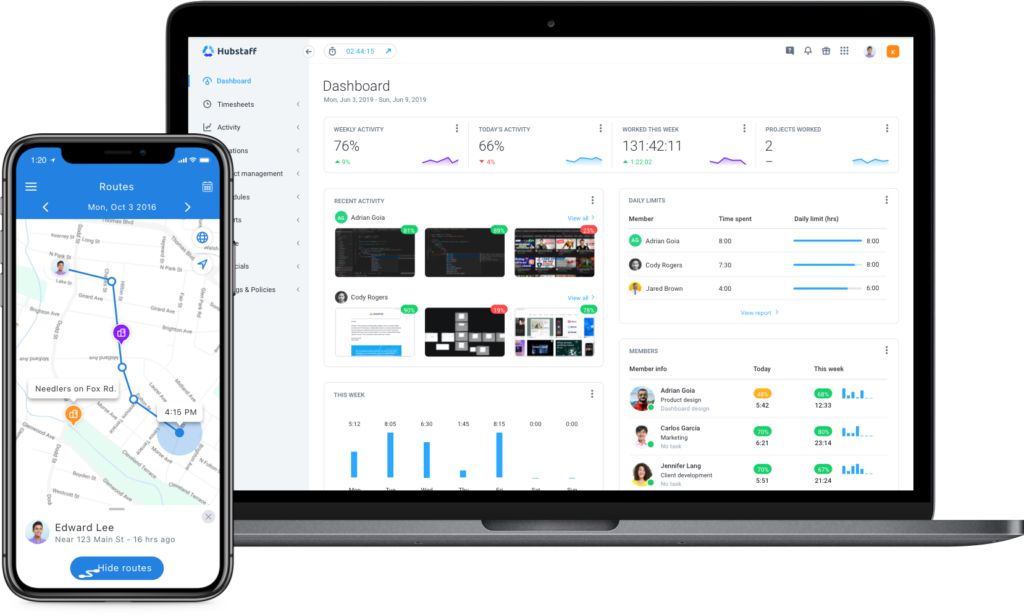

Hubstaff is an all-in-one workforce management tool that simplifies accounting time tracking and billing by offering automated timesheets, integrated payroll services, and detailed productivity analytics.

With productivity Insights and automation, accountants can monitor and manage team performance and finances efficiently. These features make Hubstaff a no-brainer solution for accounting time tracking software.

Key features

- Automated time tracking. Set idle timeout limits, get scheduled reminders to track time, and automatically generate timesheets from time tracking apps. Track billable hours and streamline other administrative tasks so you can spend more time focusing on your clients.

- Billing and payroll. Paying teams is easy with Hubstaff timesheets. Set pay rates for accountants, bookkeepers, and CPAs, have them track time, and automatically run payroll using Hubstaff’s payment integrations.

- Invoicing. Hubstaff’s invoicing feature allows you to track time for each client and automatically generate invoices depending on your team’s bill rates.

- Integrations. Hubstaff integrates with over 30 different software products including Quickbooks, Freshbooks, and others.

- Hubstaff Tasks. With the Tasks add-on, you can add projects and tasks for each client. Then, assign them out to your team for time tracking and billing.

- Productivity Insights. Want to take your time tracking one step further and understand employee productivity, utilization, and project progress? Check out Hubstaff Insights.

Reviews

- G2: 4.4/5

- GetApp: 4.6/5

- Capterra: 4.6/5

Pricing

Hubstaff offers a free version for a single user. It includes time tracking, timesheets, and limited payment features.

If you need more users and features, you can opt for one of the paid plans — all of which support unlimited users:

- Starter: $7 per user/month

- Grow: $9 per user/month

- Team: $12 per user/month

- Enterprise: Custom pricing is available upon request

If that’s still not enough for you, check out the additional add-ons.

- Insights: $2 per user/month

- Tasks: $3 per user/month

- Data retention: $2 per user/month

- More screenshots: $3 per user/month

You can also use a free 14-day trial to evaluate the software and determine whether it meets your needs.

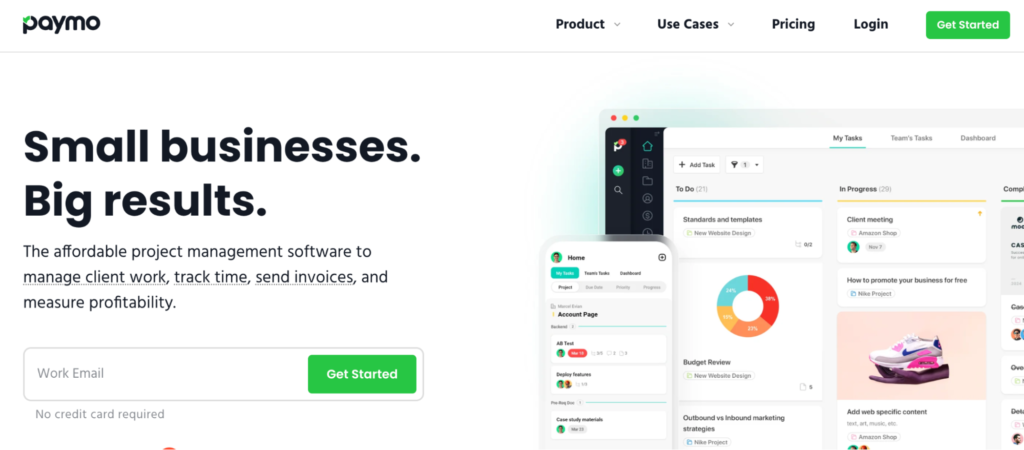

2. Paymo: Best for small businesses

Paymo is a comprehensive tool designed to cater to the needs of small businesses and freelancers, particularly in managing time and billing efficiently. It has many features that work well as a CPA billing software.

Key features

- Time tracking. Paymo allows employees to track the amount of time they spend on projects, ensuring accurate billing and payroll for accounting firms.

- Invoicing. This tool can generate detailed invoices based on the time records and expenses logged. Invoices can be customized and sent directly to clients.

- Task management. Paymo provides robust project management features, including breaking projects down into tasks and subtasks.

- Expense management. Users can record and manage project-related expenses within Paymo, making it easier to track costs and bill clients accurately.

- Reporting. Paymo offers real-time reports that help assess productivity, track billable hours, and analyze expenses. You can customize reports to fit different analysis needs.

Reviews

- G2: 4.6/5

- GetApp: 4.7/5

- Capterra: 4.7/5

Pricing

- Free

- Starter: $9.9 per user/month

- Small Office: $15.9 per user/month

- Business: $23.9 per user/month

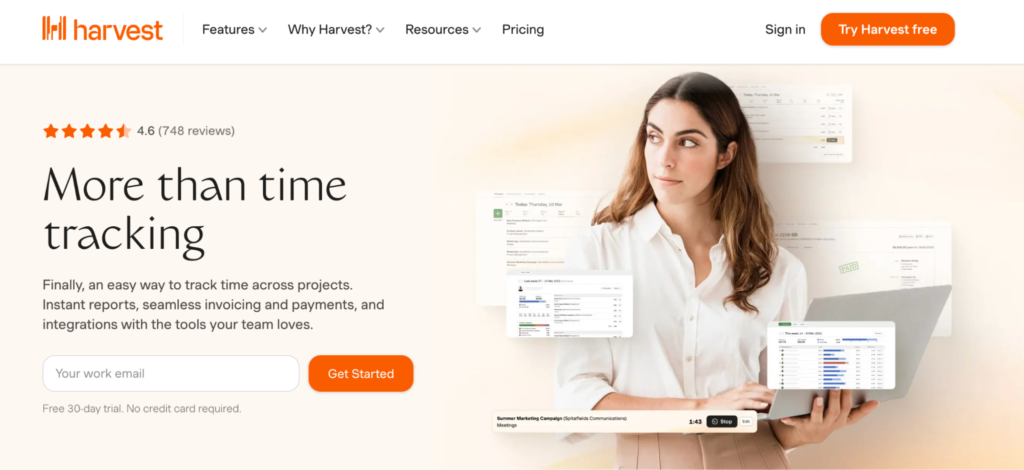

3. Harvest: Best for ease of use

Harvest is a comprehensive tool that offers robust time tracking and invoicing features tailored to meet the needs of freelancers and small to medium-sized businesses.

Key features

- Time tracking. Harvest allows users to track time spent on tasks and projects with start/stop timers or manual entry, ensuring accurate record-keeping for accountants.

- Invoicing. Like Paymo, Harvest automatically generates invoices based on tracked time and expenses. The invoices can then be customized and sent directly to clients.

- Expense tracking. Anyone in an accounting firm can easily upload receipts or enter expenses with Harvest, which can be linked to projects and included in client invoices.

- Project management and budgeting. Manage project timelines, budgets, and tasks right from Harvest. Track the amount of time spent on each project against the budget to improve profitability and simplify your billing process.

- Reporting. Generate detailed reports that provide insights into time spent, project budget health, billable time, and team productivity.

Reviews

- G2: 4.3/5

- GetApp: 4.6/5

- Capterra: 4.6/5

Pricing

- Harvest: Free

- Harvest Pro: $12 per seat/month

4. Freshbooks: Best for freelancers

FreshBooks is well-regarded for its user-friendly interface and comprehensive accounting features that make it ideal for freelancers and small businesses. Then again, we might be a little biased.

Key features

- Time tracking. FreshBooks allows users to log hours directly on individual projects and tasks, making it easy to bill accurately for the time spent. It supports both manual and automatic time tracking.

- Invoicing. Users can create professional-looking invoices that can be customized and sent automatically. Additionally, invoices can include time tracked on projects. This ensures clients are billed for the exact work completed.

- Expense tracking. Record invoices easily with FreshBooks. You can also snap photos of receipts and attach them easily to simplify the expense tracking process.

- Project management. This tool provides features for managing projects, assigning tasks, sharing files, and communicating with clients and team members.

- Online payments. FreshBooks supports online payment options, which allow clients to pay invoices directly through the system with multiple currencies.

Reviews

- G2: 4.5/5

- GetApp: 4.5/5

- Capterra: 4.5/5

Pricing

- Light: $7.60 per user/month

- Plus: $13.20 per user/month

- Premium: $24 per user/month

5. Quickbooks Time: Best for payroll integration

If you’re in the accounting space, you’re probably familiar with Quickbooks Online. QuickBooks Time, on the other hand, offers a robust set of features tailored for effective time tracking and client management that are especially useful for accountants and small businesses.

Key features

- Time tracking. QuickBooks Time enables precise tracking of time spent on various tasks and projects using a simple digital timesheet or mobile app.

- Employee scheduling. This tool offers features for creating and editing employee schedules, which can help manage staff hours and ensure coverage during business hours.

- Real-time reports. Quickbooks Time provides detailed reports that help monitor employee hours, project progression, and overall labor costs.

- Alerts and reminders. This software offers customizable alerts and reminders that can notify managers about important time tracking events, like when employees clock in or are nearing overtime.

- Integrations. QuickBooks Time seamlessly integrates with other QuickBooks products and various payroll and accounting systems, simplifying payroll processing and enhancing overall workflow efficiency.

Reviews

- G2: 4.5/5

- GetApp: 4.7/5

- Capterra: 4.3/5

Pricing

QuickBooks Time offers two plans:

- Premium: $8 per user/month + $20 base fee/month

- Elite: $10 per user/month + $40 base fee/month

6. Toggl Track: Best for simple time tracking

Toggl Track is a popular time tracking tool favored by freelancers and accounting firms for its simplicity and powerful features, which enhance productivity and ensure accurate client billing.

Key features

- Time tracking. Toggl Track offers one-click timers and tracking reminders that make it easy to record every second worked. This then ensures more accurate billing.

- Reporting. This tool offers detailed reports on time spent on projects, allowing for better project management and client billing. You can export reports in various formats for further analysis and document management.

- Project dashboard. Visual dashboards give an overview of project progress in just a few clicks, helping to manage budgets and deadlines efficiently.

- Billable rates. Toggl Track allows users to set up multiple billing rates for different team members or projects, making calculating earnings and creating invoices simple.

- Integrations. This software integrates seamlessly with other tools, including project management tools like Jira and Asana and accounting software like QuickBooks.

Reviews

- G2: 4.6/5

- GetApp: 4.7/5

- Capterra: 4.7/5

Pricing

- Free

- Starter: $10 per user/month

- Premium: $20 per user/month

- Enterprise: Custom pricing

Time to implement your tool

Alright, you’ve picked out the perfect time and billing software for your accounting needs, so what’s next? Let’s break down the setup into bite-sized pieces.

- Initial setup. Start by setting up an account on your chosen platform. This usually involves registering your business details and adding team member profiles.

- Customization. Customize the settings to fit your business operations. This might include setting up billable rates, defining project scopes, or customizing invoice templates.

- Integration. Integrate the tool with other software systems you use, such as QuickBooks for accounting or Slack for communication, to ensure smooth data flow across platforms.

- Training. Educate your team on how to use the new tool. Most platforms offer tutorials, webinars, and customer support to help with this transition.

- Trial run. Conduct a trial run with a few projects to see how the tool fits into your workflow and make adjustments as necessary.

- Feedback and adjustment. After using the tool for a period of time, gather feedback from your team. Use this feedback to tweak and optimize the tool’s usage to suit your needs better.

- Rollout. Once you’re satisfied with the setup and operation, roll it out fully across your business.

Implementing a new tool can be a transformative process for your business, enhancing not just productivity but also the accuracy of your billing and the satisfaction of your clients.

Take it step by step, and don’t hesitate to leverage the customer support offered by these platforms to smooth out any bumps along the way.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...