In the complicated world of employment laws, one number looms large: 1,250 hours. It’s not just a random number; it’s the crux of one of the most vital protections for American workers — the Family and Medical Leave Act (FMLA).

FMLA champions employees’ rights to navigate the most vulnerable moments of their lives without sacrificing their livelihoods. By granting up to 12 weeks of unpaid leave annually, FMLA provides financial support for businesses and employees needing help.

But what exactly does it take to clock those FMLA hours? Is every minute at the office or worksite accounted for? As the pendulum swings between work and life, understanding FMLA’s 1,250-hour rule becomes paramount. It’s often the difference between solace and strife.

However, accessing FMLA’s protective embrace isn’t a free-for-all. To qualify, employees must meet specific eligibility criteria, with one pivotal requirement — the 1,250-hour rule.

So, let’s delve into the intricacies of FMLA hours, deciphering what counts and what doesn’t.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysWhat is FMLA?

The Family and Medical Leave Act (FMLA) is a beacon of support for balancing work and personal life. Enacted in 1993, this federal law allows eligible employees to take unpaid leave for specified family and medical reasons without the fear of losing their jobs.

The FMLA allows eligible employees to take up to 12 weeks of unpaid FMLA leave within a 12-month period for specific family and medical reasons. The Wage and Hour Division of the Department of Labor determines how many hours an employee must work to be eligible for FMLA, ensuring that only the amount of leave required under the law is granted.

How to qualify for FMLA

To qualify for FMLA leave benefits, employees must be experiencing one of the following life-changing events:

- The birth of a child

- Adopting a child

- Handling your own serious health condition (including serious injury or illness)

- Caring for a relative with a health condition

- Military caregiver leave

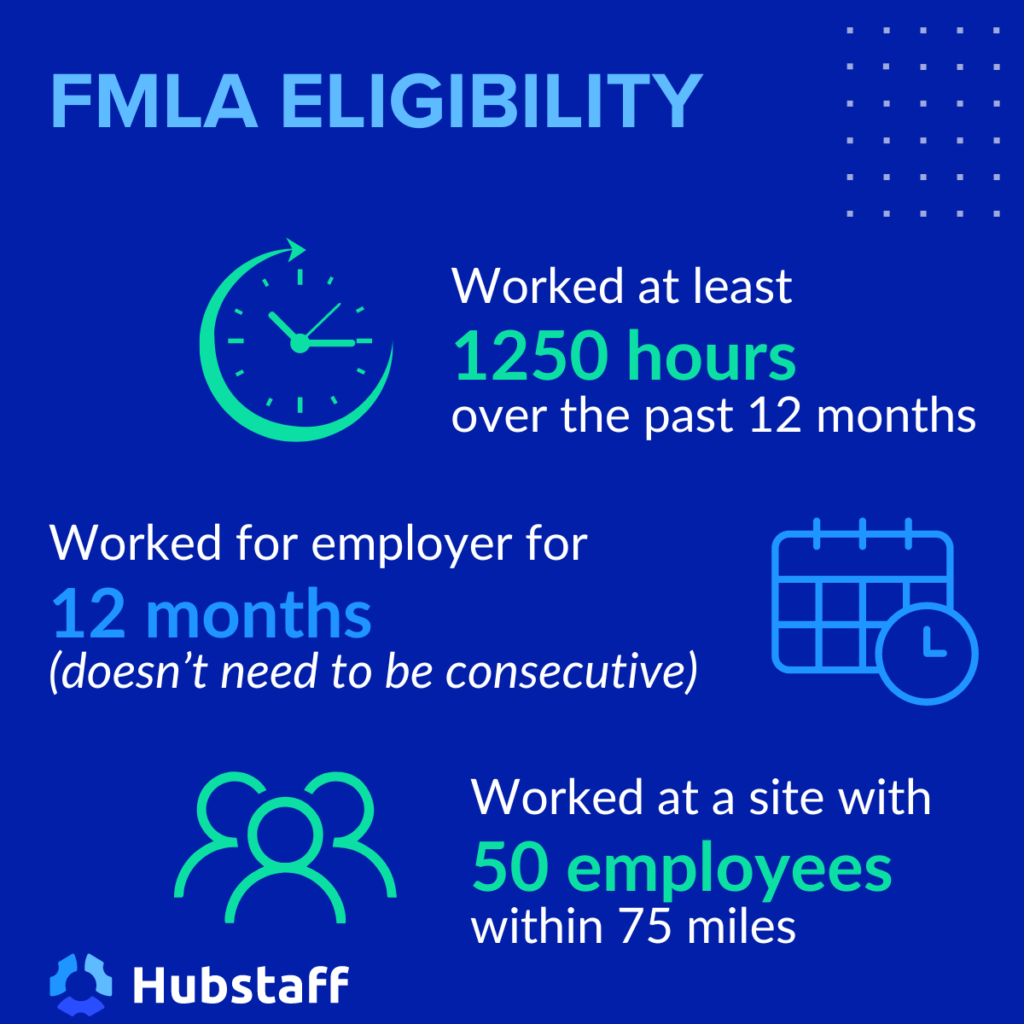

But that’s not all. If you fulfill an FMLA qualifying reason, you also need to fulfill all three of these requirements:

- Have worked for a company for at least 12 months.

- Have worked at a site with 50 company employees within 75 miles.

- Have worked a minimum of 1,250 hours in the last 12 months.

The first two rules are relatively straightforward, but the 1,250 rule can confuse those trying to qualify for FMLA.

What is the 1,250 rule?

This third and final rule of FMLA mandates that individuals must have worked at least 1,250 hours in the past 12 months to be eligible for FMLA leave. Sounds straightforward, right? Not quite.

The devil lurks in the details, as not all hours are equal in FMLA. Understanding what counts (and what doesn’t) toward those elusive 1,250 hours is crucial for anyone navigating employee rights.

So, let’s dive into what does and doesn’t count.

What counts toward 1,250 hours worked?

Here’s a detailed breakdown of what constitutes “hours worked” towards the expected 1,250 hours and how various types of work hours contribute to this threshold.

Definition of “hours worked” under FMLA

“Hours worked” includes all the time an employee is required to be on duty at the employer’s premises or any other workplace. This definition aligns with the Fair Labor Standards Act (FLSA) standards.

Regular work hours

These are the hours an employee is scheduled to work, including full-time or part-time. Every hour of work in this category counts toward the 1,250-hour requirement.

Overtime hours

Overtime hours also count towards the 1,250-hour eligibility threshold. This includes any hours worked beyond the standard full-time hours dictated by the employer’s policies, contractual agreements, and state and federal laws.

On-call hours

On-call hours can be more complex. Suppose an employee is required to remain on the employer’s premises or at a location dictated by the employer, making it impossible for the employee to use that time effectively for their own purposes. In that case, those hours are counted as “hours worked.”

Example: You might see this type of on-call arrangement at a hospital where medical staff are on-site and on-call.

However, suppose the employee is on-call but free to pursue personal activities and must remain reachable. In that case, those hours typically do not count towards the 1,250 hours unless called into work.

Example: A flight attendant might have to head to the airport at any moment if they’re on call, but they don’t have to sit in the airport for the time being.

Part-time work

Hours worked by part-time workers are counted the same way they are for full-time employees. But, depending on the number of hours worked per week, reaching the 1,250-hour threshold might take longer.

For example, a part-time employee working 25 hours a week would accumulate 1,250 hours in approximately 50 weeks.

Source: KFF

What doesn’t count toward 1,250 hours worked?

To determine eligibility for FMLA leave under the 1,250-hour requirement, it’s essential to understand what types of time are explicitly excluded from this calculation.

Here are the critical exclusions:

- Paid leave (sick leave, vacation, etc.). Employees’ time on paid leave, such as sick, vacation, and personal leave, does not count towards the 1,250 hours required for FMLA eligibility.

- Unpaid leave. Like paid leave, any period during which an employee is on unpaid leave (such as an unpaid sabbatical or a leave of absence without pay) also does not contribute to the 1,250-hour threshold.

- Alternative types of compensation (bonuses, perks). Compensation that does not directly relate to the hours worked, such as bonuses, incentives, and other perks, does not count as hours worked toward FMLA eligibility.

By excluding this time, the FMLA ensures that the hours counted towards eligibility reflect actual work performed.

How to calculate your 1,250 hours

Calculating the 1,250 hours required for FMLA eligibility involves keeping a detailed record of all qualifying work hours over the last 12 months.

Here are six simple steps to follow when calculating your hours worked for FMLA.

Step-by-Step Guide to Calculating Your 1,250 Hours

- Identify qualifying hours. Begin by determining what counts as “hours worked” in your own schedule. You can use the Department of Labor FMLA page and our guide above to determine how many of your work hours count.

- Gather your work records. Collect your past payroll, timesheets, and other documentation that records your work hours. If your employer uses a time tracking tool, you can access your historical data directly through the system.

- Tally regular hours. Sum up all your regular hours during the last 12 months. Include only the hours you worked or required to be at your employer’s premises or a designated workplace.

- Add overtime hours. Include all hours that qualify for overtime pay beyond your regular work schedule. Remember, these hours count toward the 1,250-hour threshold even if they are paid more.

- Exclude non-qualifying time. Remember to exclude any time off, such as vacation days, sick leave, unpaid leave, and time spent on bonuses or perks that do not involve actual work hours.

- Calculate the total. Add all the qualifying regular and overtime hours to see if they reach the 1,250-hour requirement.

At the end of this calculation, you should know whether you qualify for FMLA. If this process seems daunting to you, don’t worry. There are tools out there that can help you make this process simple.

Resources and tools

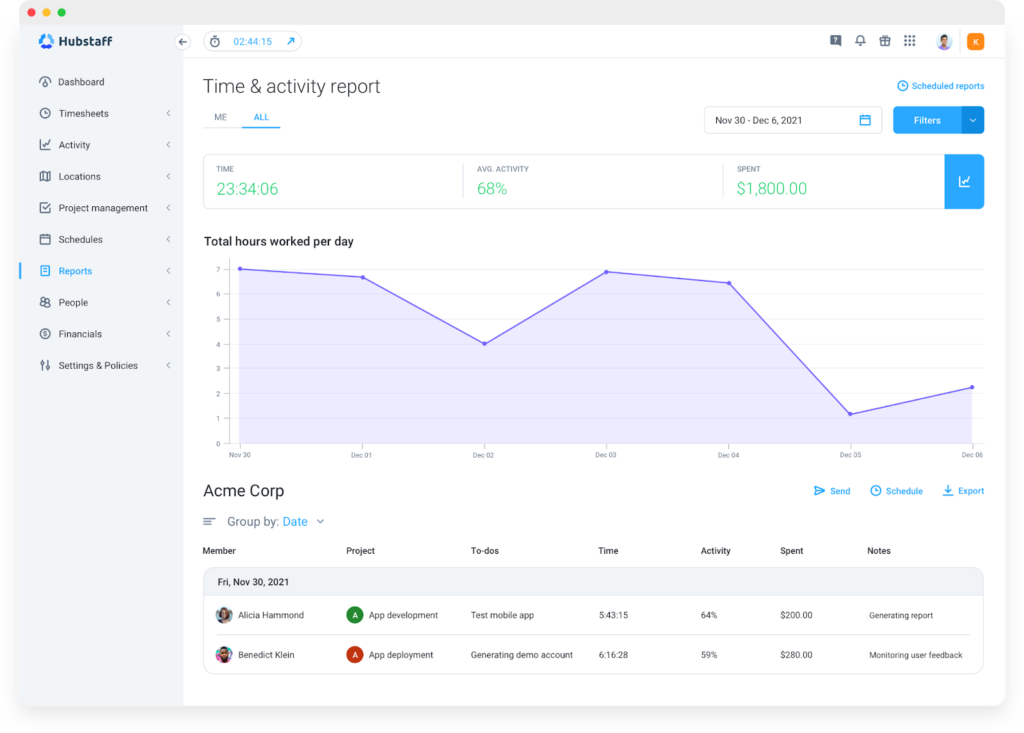

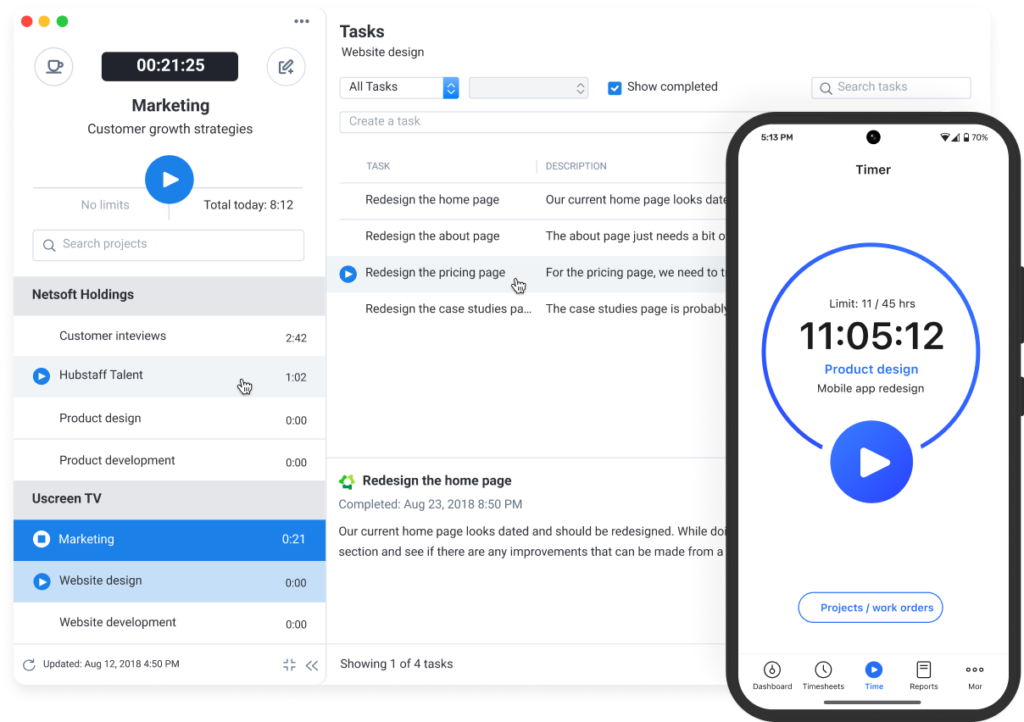

- Workforce management apps. Apps like Hubstaff can help you record your work hours in real time and store historical data for easy access. You can see real-time updates on hours worked, generate automated timesheets, and pull time reports to make meeting FMLA requirements a breeze.

- Excel spreadsheets. You can use a simple Excel spreadsheet to keep track of your hours. Set up columns for dates, regular hours, overtime hours, and any notes on exclusions.

We love Excel as much as the next person (which is to say, we hate it). So, our obvious choice for tracking work hours is a time tracking tool. Automated time tracking not only aids in this process but also equips you with solid evidence in case your FMLA claim is questioned or requires verification.

Common misconceptions regarding the FMLA 1,250-hour rule

The FMLA 1,250-hour eligibility requirement often needs clarification. After reading this guide, you’re already on your way to understanding this relatively complex but undeniably valuable protection.

Here’s a clarification of some common misunderstandings regarding what counts toward the total, the impact of different types of leave, and frequent errors in calculating hours worked:

Misconceptions and false beliefs about FMLA

- Impact of previous FMLA leave. There’s a misconception that taking FMLA leave in previous years affects the calculation of the current year’s 1,250-hour requirement. Each FMLA eligibility assessment is based solely on the hours worked in the 12 months prior to the start of the leave requested. In other words, it’s independent of any prior FMLA leave taken.

- Bonuses and other compensation. Some believe that bonus hours, such as those awarded for performance, count towards the FMLA hours. However, these hours are compensation bonuses and do not reflect hours worked.

- Voluntary hours. Volunteering for additional unpaid activities or services without obligation does not count as “hours worked.”

Common errors in calculating hours

- Failure to include all qualifying hours. Employees often overlook including all qualifying hours (especially overtime) when calculating their total hours. It’s crucial to include every hour worked, including those that extend beyond the standard workweek.

- Miscalculating part-time work. Part-time employees sometimes mistakenly think they will never meet the 1,250-hour requirement. Accurately tracking all hours worked is essential, as part-time hours count towards FMLA eligibility, just as full-time hours do.

- Record-keeping errors. Poor record-keeping can lead to inaccurate counts of hours worked. Both employers and employees must maintain accurate and up-to-date records of hours worked to ensure that eligibility is correctly determined.

Addressing these common misconceptions and errors can help employees and employers better understand FMLA eligibility requirements and ensure they are applied correctly and fairly.

Employer responsibilities under the FMLA

Employers play a crucial role in ensuring the successful implementation of the FMLA. Their duties in this area include:

- Accurate tracking and reporting. Employers must accurately track and report the hours their employees work. This ensures proper determination of FMLA eligibility based on the 1,250-hour requirement.

- Informing employees of FMLA rights. Employers must proactively notify their employees about their FMLA rights. This includes providing detailed explanations of how employees can qualify for FMLA leave and its entitlements.

- Making accommodations for FMLA. An employee’s FMLA entitlement can include a reduced leave schedule to accommodate their medical needs. While an intermittent or reduced schedule will inevitably be difficult for employers to accommodate, following FMLA procedures is critical.

- Supporting employees in calculating hours worked. Employers should help employees understand how to calculate their hours worked for FMLA eligibility. This support can include providing access to records and helping interpret the complex aspects of the law. One of the easiest ways to do this is by using a time tracking system.

- Documentation. Employers should require a medical certification from a health care provider. This serves as verification that the employee or a qualifying family member needs leave due to a serious health condition.

By taking these steps, employers don’t just meet legal requirements—they also build a more supportive workplace. Keeping accurate records, ensuring everyone knows their rights, and helping employees figure out their eligible hours make the entire FMLA process smoother.

It’s all about ensuring employees can do so confidently and clearly when they need to take leave, knowing their company has their back.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...