If you don’t work in a traditional office setting, the issue of how to pay remote employees is probably on your mind right now.

Compliance issues, currency exchange rates, minimum wage, income tax, hidden fees, and countless other challenges can plague teams looking to pay remote workers.

But before you start paying your team for remote work, it’s worth taking the extra time to make sure you’re classifying your team correctly. After all, it might be more cost-effective to classify your remote employees as independent contractors.

Let’s quickly make sure you’re on the right track.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysIndependent contractors vs. remote employees: IRS common law test

If you’re concerned about compliance issues regarding remote employees and independent contractors, it’s worth reviewing the IRS Common Law Rules. In short, there are three questions to consider:

- Behavioral: Does the employer of record have control over how the worker does their job?

- Financial: Does the employer decide the payment method for their remote workers? Does the employer pay income tax, who provides work materials, or whether they will reimburse the employee for said materials?

- Relationship: Does the employer provide benefits (i.e., pensions, insurance, vacation pay, etc.) for said remote worker?

If you answered “no” to these questions, you might want to switch gears and read our guide to paying independent contractors. If you answered “yes,” let’s look into the best methods for paying remote workers.

What you need to know when paying your remote employees

For your local employee’s pay, treat them as you would any other local employee. If you decide to hire international remote employees, you will need to determine the following:

Payment frequency and currency

Most countries require you to pay employees at least once a month. Will they be paid weekly, biweekly, or monthly? What tool(s) will you use to pay employees in their preferred currency or make the correct exchange rates?

Ultimately, these decisions are up to you. However, there might be other factors that dictate how you answer these questions.

Taxes, deductions, and local labor laws

You’ll have to withhold income taxes and be aware of the nuances that vary by country, state, or territory. In Australia, for example, you must contribute at least 10% of your remote employees’ earnings to their selected super account.

Payroll forms

Each country will have forms that you will need to fill out for your employee’s pay. For instance, when you pursue an employee in Canada for remote work, you must obtain their social insurance number (SIN) and a completed Form TD1, Personal Tax Credits Return.

Remote employee payment methods

Payroll management for remote workers involves planning and obtaining local knowledge based on each employee’s home.

Setting up acceptable payroll procedures for each country or region where your remote employees’ work might be tedious for small businesses. Local payrolls, contributions, taxes, and laws may be beyond your HR team’s bandwidth.

Here are two methods to pay your remote workforce:

1. Use an outsourced payroll provider for your international employees

One option is to outsource payroll to a dedicated payroll system provider.

These companies specialize in handling payments and benefits for remote employees to help you focus on securing the best talent. They’ll be able to legally handle your payroll because they have registered entities in every country they provide their services in.

Using an outsourced payroll system provider can simplify your payroll management process significantly and relieve you from the stress of adhering to unique laws for each team member’s home country.

Suppose you decide to hire full-time remote employees that reside in a country outside of where your company is registered. Here are three outsourced payroll system provider options that can help you with international employee payroll.

Deel

Deel automates payroll for your remote employees in more than 150 different countries. Their offering includes onboarding, contracts, expenditure management, benefits, payroll, local tax, and built-in compliance for your global workforce.

Once you hire an international employee, you can have them working in a compliant manner with just a brief setup. Just customize the contact in Deel and send them a bespoke contract that complies with their local laws.

Remote

Remote.com will help you stay compliant in more than 60 countries. They have wage and benefit simulations that you can use to run a fair and legal international remote team.

Offering the most competitive benefits package can help you attract and retain international employees. If you have questions unique to your situation, Remote.com has a suite of HR and legal experts to guide you every step of the way.

Lano

Lano gives you the confidence to hire and pay your remote employees in more than 150 countries. You can also automatically pay your remote employees in over 50 different currencies, helping you manage fluctuations. With Lano, you can monitor the status of each payment in real-time.

Lano gives you the tools to build and manage an international team quickly and easily.

2. Use a payroll platform

If you have the right personnel at your disposal, you can take on payroll internally.

Start by considering the best payroll platform for your team. If this is an area where you’re lacking experience, most payroll providers offer webinars, extensive training, or tutorial videos to help you get a feel for their product.

If you have a human resources lead at your remote company, they’ll probably be well-versed in various payroll platforms. If you don’t have a strong opinion about a payroll provider, involve them in the decision. This way, you can delegate a tedious task to an HR lead that will need little to no training on the platform.

QuickBooks

QuickBooks’ Multicurrency feature makes paying remote employees in their local currency easy.

When you toggle on Multicurrency, you can assign a currency to each customer, vendor, or bank account on your payroll hassle-free. Once you’ve made these adjustments, QuickBooks will take care of all currency conversions and pay rates.

However, you will still need to understand how to stay compliant in each country where your remote employees reside.

Gusto

Gusto’s HR capabilities make it a powerful payroll solution — but only for remote teams based in the U.S. Gusto only supports employees if they have a valid U.S. Social Security Number, work address, home address, and bank account.

From there, Gusto calculates pay rates, and files your federal, state, and local payroll taxes. They can also handle your W-2s, 1099s, and new hire forms on your behalf.

Hubstaff integration with Gusto and QuickBooks

Hubstaff is a productivity platform that allows you to track time and pay your remote employees for the work they have completed. With Hubstaff, the days of manually documenting time spent on tasks are over.

Instead, have your remote team use Hubstaff start-and-stop timer to track time. Hubstaff integrates with Gusto and QuickBooks, so you can turn your remote employees’ tracked time into timesheets and approve them with just a few clicks.

Choosing how to pay your remote employees

Ultimately, how you pay your remote team members comes down to various factors that are unique to one’s situation. Here are three main things to keep in mind when making your decision:

- Will you be paying your remote team as employees or contractors?

- Where are your remote team members located locally or internationally?

- Will you manage all this in-house or hire a payroll company?

Paying remote team members as employees comes at a cost — especially when you have a significant amount of your workforce located internationally. In this instance, you should expect to spend substantially more money when you opt to pay everyone as employees.

How to pay remote employees with Hubstaff

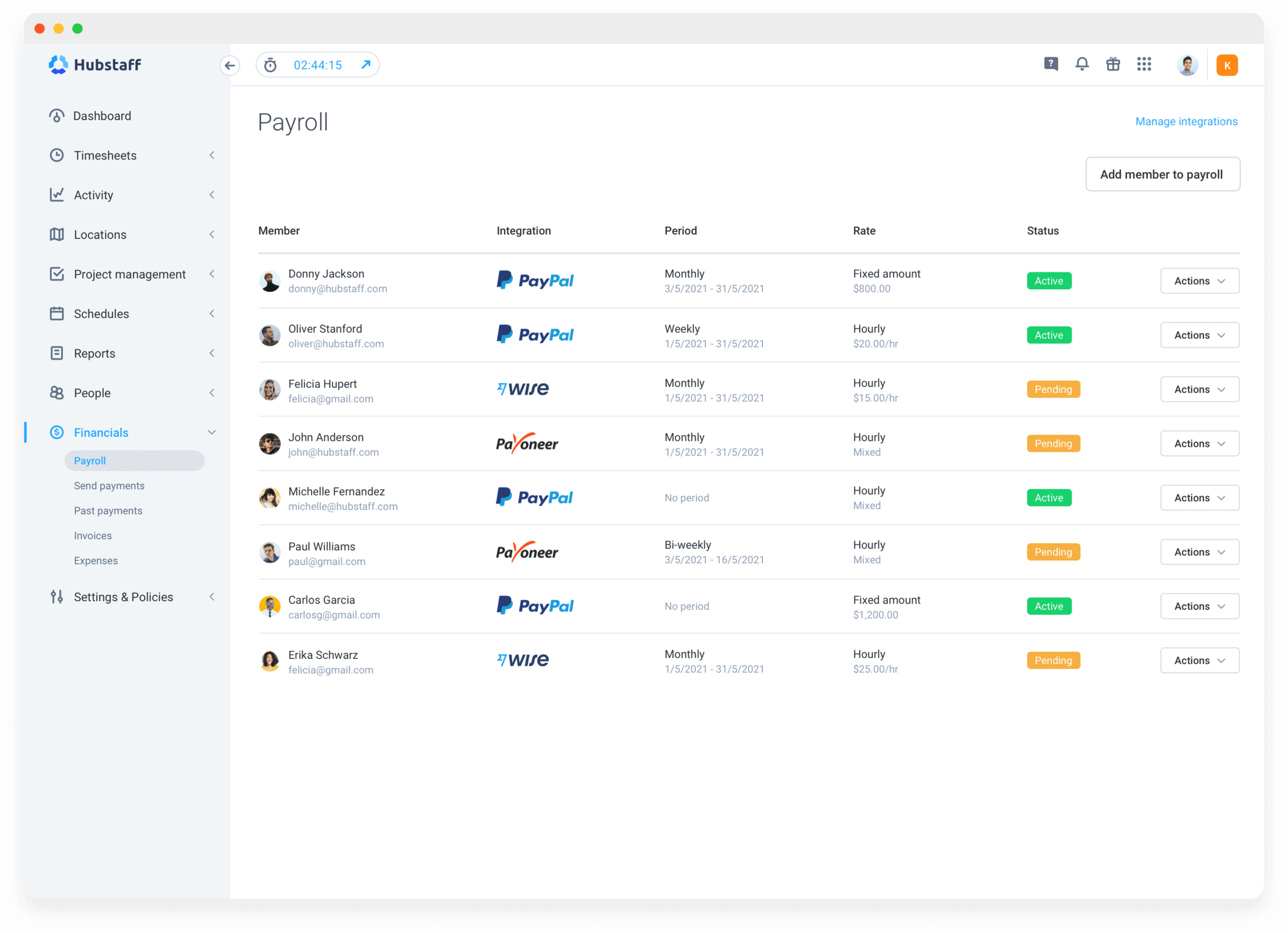

There are four different ways to pay your team members with Hubstaff.

- Manual payment method: This involves exporting the time worked in a file format of your choice so you can quickly pay your team members however you like.

- Automatic payroll: this allows you to set up payment profiles for your team members so they can be paid automatically for time worked through Hubstaff (weekly, twice a month, bi-weekly, or monthly) through integrations with PayPal, TransferWise, Payoneer, Bitwage, or Gusto.

- A one-time payment: This allows you to send a single payment to one or multiple team members.

- Pay team invoices directly from the payment gateway: This allows you to pay the Hubstaff team invoices created by your team members directly from your desired payment gateway.

With Hubstaff, it’s easy to pay your team members and keep accurate records of how much they have been paid. All payments are based on precise time data, so managers and employees have full transparency, leaving little room for error.

A real-world example

“Hubstaff does one full-time person’s job for payroll and onboarding” — Solomon Thimothy, OneIMS President and Founder.

At OneIMS, Team members must use Hubstaff to get paid, while manager-side controls allow companies to set hours for roles or projects. That helps teams get started quickly and avoid payroll issues down the line. Solomon credits these controls for the flexibility his organization offers new and existing team members.

Frequently asked questions

How does Hubstaff handle payments for remote employees?

Hubstaff automates the payment process for remote employees by tracking time and activity levels and then processing payments through payroll integrations based on the hours worked. Employers can set up automatic payroll through integrations with popular payment platforms like PayPal, Payoneer, and Bitwage.

How often should I pay remote employees?

The frequency of payments should align with your company’s payroll policies and your employees’ preferences. Standard practices include bi-weekly or monthly payments. Consistency in payment schedules is crucial for remote employees to plan their finances.

Are there specific tax considerations when paying remote employees?

Yes, there are specific tax considerations. Depending on the employee’s location, you may need to withhold payroll taxes or report earnings differently. To ensure compliance, consulting with a tax professional knowledgeable about international employment laws is advisable.

How can I ensure transparency in the payment process for remote employees?

To ensure transparency and trust, provide clear, detailed pay stubs, including hours worked, applicable rates, and deductions. Regularly update your employees about any changes in payment policies and use secure, reputable payment platforms to protect their financial information. Open communication about payment processes also helps in building trust.

Final words

Whether you choose to pay remote employees through direct deposit, a money transfer app, or another method, just be certain that you’re compliant with your state, country, or territory laws.

To be certain, you might also want to check out our other articles on money transfers:

- Easy ways to send money to India

- How to send money to Colombia

- How to send money to Ukraine

- How to send money to Brazil

- How to save money on payroll

Navigating the complexities of income taxes, deductions, and local labor laws is crucial for successfully managing remote teams, ensuring both compliance and mutual trust between employers and employees worldwide.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...