There’s so much to think about when growing a business, so it’s not surprising that many small businesses don’t keep an accurate balance sheet. We get it; that’s why we created this post explaining everything you need to know, plus a free business balance sheet template that will simplify this process.

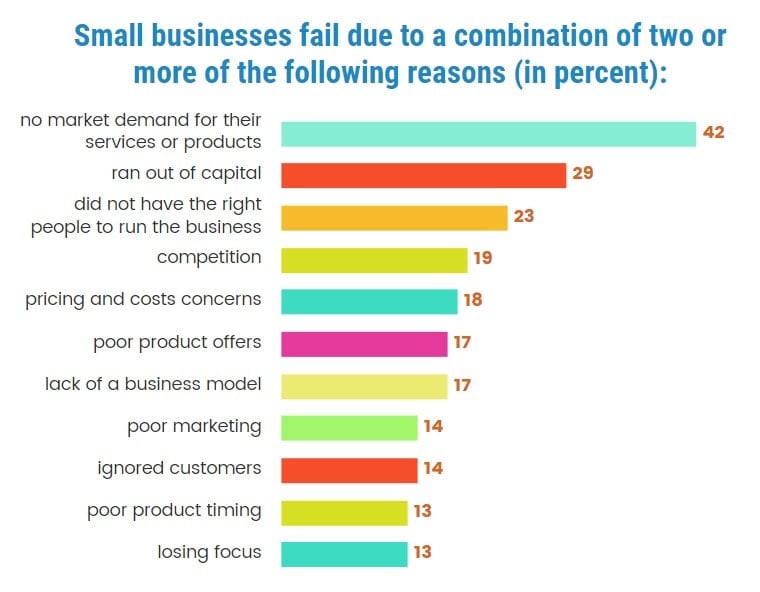

Failure to keep on top of your finances can be fatal. Looking at the stats from Fits Small Business below, one jumps out: 29% of small businesses fail because they run out of capital. Furthermore, only 40% of small businesses are profitable, while 30% break even and 30% lose money.

How can you avoid running out of capital and keep your business profitable? Keep an eye on your small business balance sheet and ensure your format is designed to give you the most critical information.

In this article, we’ll look at balance sheets for small businesses, why you need to keep them, and some tips to get you started.

Get your free balance sheet template

Sign up to get the template emailed right to you. In the meantime, let’s look at why balance sheets are crucial for your business.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysStep-by-step guide to using the free template

Once you’ve downloaded your free template, all you have to do is fill it out. We created this balance sheet format to be easy to use and customize as you need. Our simple balance sheet template includes the essential information you will need to determine your financial standing and find common financial ratios.

- Enter your current assets, including:

- Cash

- Accounts Receivable

- Short-term investments

- Inventory

- Supplies

- Pre-paid expenses

- Consider if you have other current assets like property & equipment or intangible assets and add them to the sheet.

- Calculate your current ratio: Divide current assets by current liabilities. This number should be at least 1.0 and ideally closer to 2.0.

- Enter your liabilities, such as:

- Accounts payable

- Accrued expenses

- Short-term debt (Payments due in the next 12 months)

- Long-term debt (Payments due after the next 12 months)

- Interest payable

- Taxes payable

- Accrued payroll

- Shareholder’s equity

- Calculate your debt-to-equity ratio: Divide total liabilities by Owner’s Equity. The lower this ratio is, the better.

Now, all you have to do is remember to keep this sheet current!

What is a balance sheet?

Put simply, your balance sheet shows a “snapshot” of your company’s financial standing. It’s also known as the statement of financial position. It’s critical because it shows, at a glance, what you owe and what you own. It breaks down your business profitability.

Your balance sheet itemizes your assets, liabilities, and equity. It’s important because it shows you how strong and resilient your business is at any given time. Whether it can withstand a loss and whether you should spend or save.

When it comes time to make a financial decision, such as buying new equipment or hiring more staff, your balance sheet should play a role in the process.

A balance sheet lets people outside your company quickly understand its financial condition. This is crucial for lenders who require a balance sheet to determine your business’s financial health and creditworthiness.

Potential investors will also use a balance sheet to understand where their funding will go and when they can expect to be repaid. A good track record of managing your assets and liabilities indicates to creditors and investors that you will be an excellent business to work with.

Why do I need a balance sheet?

Your balance sheet is your friend if you’re in business to make money and not just because you love working. Ignoring or failing to analyze it correctly can be the death of your business as your expenses pile up.

In a less extreme case, it can lead to financial losses you will be unaware of. Small businesses will always have rainy days; a good business maintains a minimum cash reserve for rainy day protection.

A mix of historical analysis and future focus on your balance sheet will assist your business in achieving long-term success. For this reason, it’s important not to wait until year-end to analyze your business finances.

I contacted Antonis Hannas, owner of leading data and market analysis company QAnalysis, for his thoughts.

“For us, a balance sheet is critical. Absolutely critical.

Of course, primarily, we use it to assess the current financial health of our company. This is fundamental. But more so, we use it for forecasting, risk analysis, and planning for the future.

I usually look at historical data going back at least 18 months. I can then take an average of those metrics and pull it forward, factoring in current circumstances and potential future risks.

Of course, you will need input from other company divisions to be completely accurate. What are your company’s sales figures and prospects? Is your marketing team planning to launch a new product? Will you be hiring more staff?

If you look at the company historically, you can see clear trends. These will help you to plan and implement growth strategies accurately.

My main tip for small businesses is to keep on top of your balance sheet. That means updating it regularly and knowing how to analyze it. If you’re new to the business, it’s worth watching some tutorials to understand how to do this. A strong balance sheet will make you more agile and shape a more profitable future for your business.”

Understanding balance sheet components

Navigating the financial landscape of a balance sheet requires decoding its components. Let’s break down the essentials—assets, liabilities, and shareholders’ equity—so you can unravel the mysteries behind these critical building blocks.

Assets

Definition: Assets encompass everything a company owns that holds economic value.

Categories:

- Current assets: Items convertible to cash within a year (e.g., cash, accounts receivable).

- Fixed assets: Long-term, tangible items (e.g., property, equipment).

- Intangible assets: Non-physical assets with long-term value (e.g., patents, trademarks).

Liabilities

Definition: Liabilities represent what a company owes to external parties.

Categories:

- Current liabilities: Debts payable within a year (e.g., short-term loans, accounts payable).

- Long-term liabilities: Debts payable over an extended period (e.g., mortgages, bonds).

Shareholders’ equity

Definition: Also known as owners’ equity, it’s the residual interest in the assets after deducting liabilities.

Components:

- Common stock: Shares issued to investors, representing ownership.

- Retained earnings: Accumulated profits reinvested in the business.

- Additional paid-in capital: Capital received from investors beyond the stock’s par value.

Understanding the balance sheet’s components is akin to decoding the financial DNA of a business. Assets showcase what’s in the arsenal, liabilities reveal financial obligations, and shareholders’ equity encapsulates ownership.

As you delve into the intricacies of these elements, the balance sheet transforms from a cryptic document into a powerful tool for assessing a company’s financial health.

Tips for accurate and efficient balance sheet management

Managing a balance sheet doesn’t have to feel like navigating a financial labyrinth. Let’s explore some practical tips to ensure your balance sheet stays accurate and becomes a reliable compass in your business journey.

- Make regular updates: Update your balance sheet regularly to reflect real-time financial changes. This ensures accuracy and provides a current snapshot of your financial standing.

- Categorize with precision: Classify assets and liabilities with specificity. Clear categorization enhances understanding and aids in strategic decision-making.

- Pay attention to depreciation: Consider depreciation for fixed assets. Reflecting the true value of long-term assets contributes to a more accurate financial picture.

- Keep liabilities transparent: Clearly outline the terms and conditions of liabilities. Transparent liability management fosters trust and helps avoid financial pitfalls.

- Monitor working capital: Keep a close eye on working capital (current assets minus current liabilities). Monitoring working capital ensures your business has enough liquidity to cover short-term obligations.

- Make regular reconciliations: Reconcile your balance sheet with other financial statements. Reconciliations identify discrepancies and maintain the integrity of your financial records.

Managing your balance sheet is less about crunching numbers and more about embracing good habits. By following these tips, you’re not just keeping your financial records in check; you’re empowering your business with a reliable tool for decision-making.

Common misconceptions about balance sheets

Balance sheets, integral to understanding your business’s financial position, sometimes harbor misconceptions that can lead to confusion. Let’s debunk some of the most common myths surrounding these critical documents.

- Static nature

- Misunderstanding: Treating the balance sheet as a static prediction tool.

- Clarification: It’s a dynamic snapshot of a specific moment, not a crystal ball foreseeing the future.

- Equity equals profitability

- Misunderstanding: Believing a positive equity balance guarantees profitability.

- Clarification: While equity reflects owners’ interest, profitability is gauged through the income statement.

- Asset size guarantees success

- Misunderstanding: Thinking large asset values ensure success.

- Clarification: Asset composition matters; significant assets don’t guarantee liquidity or profitability.

- Isolation of assets and liabilities

- Misunderstanding: Treating assets and liabilities in isolation.

- Clarification: Understanding the relationship is critical; the balance sheet equation demands assets equal to liabilities plus equity.

- Balance sheets are for accountants only

- Misunderstanding: Believing the balance sheet is solely for accountants.

- Clarification: Every business owner should comprehend it; it’s a practical tool for strategic decision-making.

Dispelling these misconceptions is essential for empowering business owners to leverage balance sheets effectively. Far from a mystical document, a well-understood balance sheet becomes a guiding force in the entrepreneurial journey, providing practical insights into a company’s financial standing at a specific point.

Glossary of finance terms every business owner should know

When we started our agency, I tended to shy away from complicated terms. I’m a content marketing person, not an accountant, so I can hire someone to do that, right?

This sentiment is quite common, but it’s dangerous. You need to be in control of your business, and that means knowing what’s going on with your finances, from business invoicing to payroll fees. Here are some basic accounting terms you should learn or brush up on if it’s been a while.

Accounts Payable (A/P) – This is your unpaid supplier invoices and bills (money the business owes to other businesses). Once a bill is paid, it is removed from this category.

Accounts Receivable (A/R) – These are your unpaid sales invoices (money owed to the business by customers). They are found on the balance sheet as an asset. Once the customer pays their invoice, it is removed from this category.

Working Capital – Your working capital is the cash available for day-to-day operations within your company. The available working capital measures your ability to meet short-term obligations and keep your company running smoothly. Good working capital management also improves your ability to qualify for bank loans and favorable credit terms. There are four primary sources of working capital.

- Net income

- Long-term loans

- Sale of capital assets

- Injection of funds by stockholders

Assets – These are the items of value owned by your business. For example, cash in your bank account, petty cash, accounts receivable and non-currency assets like land, equipment, vehicles, and buildings. Cash, referred to as ‘business oxygen,’ is the most evidential sign of a strong balance sheet. You need cash to pay employees, contractors, and other expenses.

Liabilities – Your liabilities are the accounts payable, accrued liabilities, taxes payable, customer prepayments, short-term and long-term debt.

Shareholders’ Equity – This is your company’s stock, additional paid-in capital, retained earnings, and treasury stock. You may need to report on this for shareholder or investor meetings.Cash flow statement – This is a financial report that summarizes a company’s cash inflows and outflows during a specific period, categorizing activities into operating, investing, and financing activities to offer insights into the firm’s liquidity and ability to meet short-term obligations.

Manage finances better with tips from the Hubstaff blog

Tools for managing your balance sheet and business finances

Today, small businesses are lucky enough to have various online accounting tools at their disposal. These can simplify and help you to manage your accounts. Here are a few of the best:

1. QuickBooks

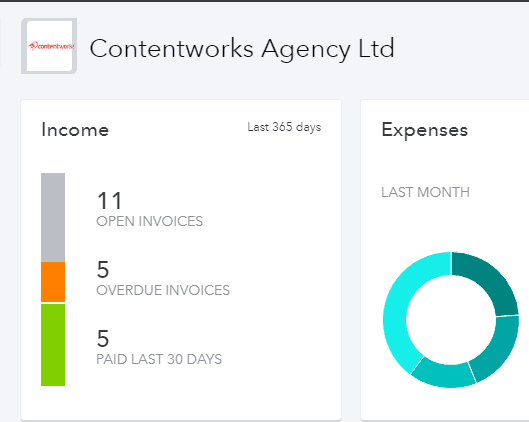

You can use QuickBooks to accept business payments, manage and pay bills, and execute payroll functions. It also gives you simple and colorful snapshots of accounting activity, highlighting essential areas like overdue invoices.

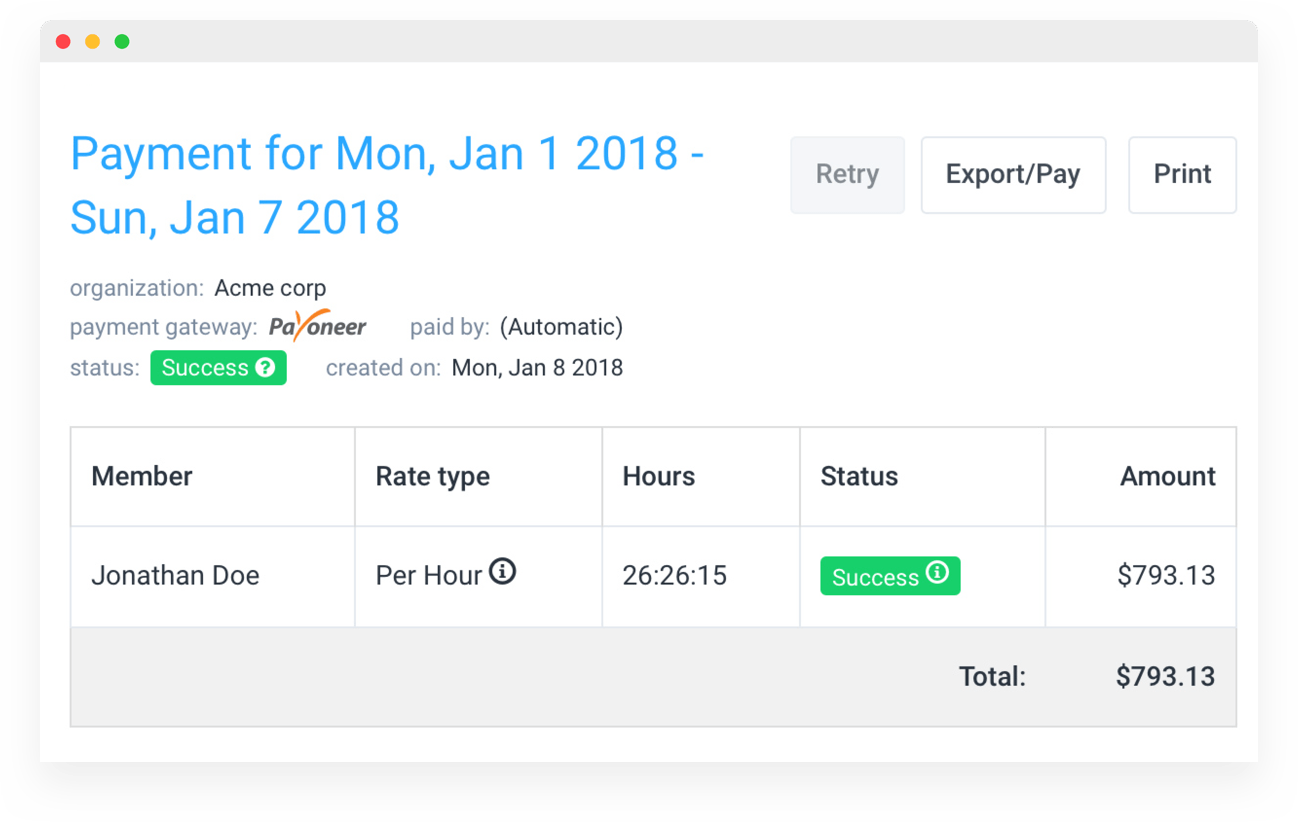

2. Hubstaff

Hubstaff allows businesses to accurately track work hours for their entire team, expenses, invoices, and team payments. Best of all, it integrates with Quickbooks, FreshBooks, Payoneer, Transferwise, and Bitwage, streamlining your operations. This app allows you to build project budgets and set weekly limits to stay within budget.

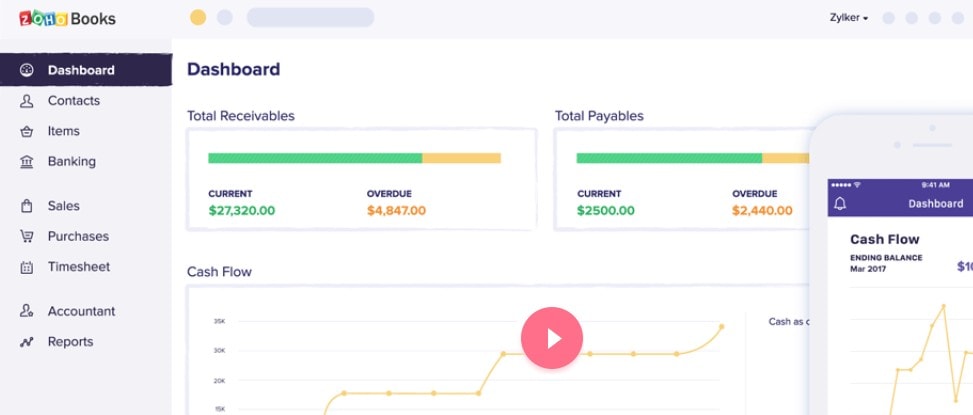

3. Zoho Books

Zoho is not just a great marketing dashboard; it’s also an easy accounting software that manages your finances, gets you tax-ready, and streamlines interdepartmental communication. Like Hubstaff and QuickBooks, Zoho is colorful, responsive, and easy to use.

Small business financial resources

Taking control of your business finances is a significant topic that small business owners will want to delve into much more. Here are some great resources to further your expertise.

Don’t forget to download your free balance sheet template.

Article – The Business Owner’s Guide to Balance Sheets

Article – How To Create A Balance Sheet For Your Business

Article – What Small Business Owners Need To Know About Balance Sheets

Video – Kane Hooper – Understanding the Balance Sheet

Video – Jacob Clifford – Bank Balance Sheets Practice

Video – Financial Education – How To Read A Balance Sheet

Podcast – Intro To Balance Sheets

Podcast – Investing For Beginners – Reading A Balance Sheet

Frequently asked questions

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific time. It outlines the company’s assets, liabilities, and equity, clearly showing its financial health.

In simple terms, a balance sheet helps small businesses understand what they own, owe, and the residual interest belonging to the owners. It’s crucial for assessing financial stability, attracting investors, and making informed business decisions.

Small businesses should update their balance sheets regularly, typically at the end of each accounting period. Monthly or quarterly updates ensure accurate tracking of financial changes and assist in making timely business decisions.

The main components include the business’s assets (what the business owns), liabilities (what it owes), and equity (the residual interest of the owners). Assets should equal liabilities plus equity, maintaining the balance.

Absolutely! Balance sheet templates are designed for ease of use, and you don’t need advanced accounting knowledge. Templates provide a structured format, making financial tracking accessible even for those with limited experience.

A balance sheet aids in strategic planning by offering insights into a company’s financial health. It helps businesses make informed decisions about investments, expansions, and resource allocations based on their financial position.

While a balance sheet provides a snapshot of a company’s financial position at a specific time, an income statement shows its profitability over time. The balance sheet reflects assets, liabilities, and equity, whereas the income statement details revenues, expenses, and net income.

Common mistakes include misclassifying assets or liabilities, omitting necessary entries, or failing to update information regularly. Accuracy is crucial, so reviewing and double-checking entries is essential to avoid errors.

Using a balance sheet template can save time, ensure accuracy, and provide a standardized format for financial reporting. It simplifies creating a balance sheet, making financial management more efficient.

Yes, the information on your balance sheet is confidential. It contains sensitive financial data, and it’s crucial to implement security measures to protect this information from unauthorized access. Maintaining confidentiality builds trust with stakeholders and protects your business’s financial integrity.

What does the future hold for your business finances?

I hope that this short guide has inspired you to work on your balance sheet or perhaps spend more time learning about them. The great news is that by utilizing free balance sheet templates like this one, you can get started immediately. Comment below or tweet us to tell us how you’re getting on!

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...