Structuring payroll is a huge business decision that’s critical to your success. Pay periods keep employees compensated in a fair and timely manner within a set period of time. They also simplify the billing, timesheet, and invoicing process so businesses can meet their payroll obligations consistently.

Understanding different types of pay structures is essential for companies with hourly and salaried employees since those two employment structures have different rules. In addition, the pay cycle must comply with tax regulations and US Department of Labor laws.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysWhat is a pay period?

Pay periods are the recurring time frames used to calculate earned wages and determine when employees get paid. They are fixed and based on the schedule payroll departments use to compensate employees.

The most common pay periods are weekly, bi-weekly, semi-monthly, or monthly. No matter which one you pick, you’ll need to calculate payroll hours with these periods in mind. The time between pay periods and deciding how often to pay your employees can make a big difference for your team and payroll.

Pay periods differ from pay dates because they represent when an employee has worked and when payment is due. The pay date is the day when the worker receives the paycheck for hours worked.

In most cases, the pay date comes a few days after the end of a pay period. The exact number of days between a pay period ending and the pay date is ultimately up to the payroll processor.

The pay period affects how an employer calculates the total gross pay for salaried and hourly workers. Gross income for hourly staff varies because it depends on the work hours. It’s the product of the hours worked and the hourly rate.

When hourly employees earn overtime, employers must apply that overtime to the pay period employees worked it. The Fair Labor Standards Act (FLSA) has stringent business overtime requirements and regulations.

The payroll schedule determines payroll frequency and the specific day team members get paid. Staff on a monthly payroll schedule receive payment on the last day of the month. While bi-weekly pay periods are the most popular structure in the US, they often result in pay period leap periods — it’s just something you’ll want to keep in mind as you consider your salary budget and the number of pay periods per year.

Types of pay periods

The US has four primary types of pay periods: weekly, bi-weekly, semi-monthly, and monthly. The choice of pay period type is critical because it affects mandatory business compliance requirements.

In addition, some states have provisions that govern the process of picking a pay period. Take a closer look at the four common pay period types.

1. Daily

Paying employees on a daily basis, often referred to as daily payroll, has both advantages and disadvantages. Here are the pros and cons of this approach:

Paying employees daily offers immediate financial benefits and can enhance employee satisfaction. However, it also comes with increased administrative complexity and costs, employer cash flow challenges, and potential compliance issues.

- Pros: Employees get immediate access to earnings, which can help them manage their finances more effectively. Daily pay can boost employee morale and satisfaction, providing immediate recognition for their work. Some argue that daily payroll employees work more efficiently and diligently, knowing their efforts are instantly rewarded.

- Cons: A daily payroll schedule can significantly increase the administrative workload for HR and finance departments, as it requires more frequent processing of payments and associated paperwork. Too Many pay periods and frequent pay date processing can lead to higher administrative costs, including processing fees, time, and resources. Daily payroll requires meticulous adherence to labor laws, tax regulations, and record-keeping.

2. Weekly

A weekly pay period is popular because it aligns with the workweek. It results in 52 pay periods a year, and they get their compensation on a set pay date every week.

Most companies pay one week in arrears on a weekly pay schedule. With weekly pay, employees turn in timesheets weekly and receive payment at the end of the following week.

- Pros: Weekly pay periods coincide with the workweek, allowing seamless compliance with FLSA overtime pay laws. A weekly pay period improves employee retention and engagement in roles with high turnover rates. They’re well suited for seasonal industries and companies where tips comprise a significant portion of employees’ wages.

- Cons: Administering weekly pay can be time-consuming for large companies. It can become expensive for companies using third-party payroll providers that charge per payroll cycle. Weekly pay increases the effort necessary to administer tax withholdings, employee benefits, paid time off, and holidays.

2. Bi-weekly

A bi-weekly pay schedule is the most popular pay period in the US. Nearly 42% of the private companies in the country use this method.

With a twice-a-month pay cycle, employees receive paychecks every other week for 26 pay periods a year. The pay structure is popular with large companies with more than 1,000 employees.

- Pros: Bi-weekly payrolls appeal to employees because they have consistent and predictable paydays. Bi-weekly pay cycles can result in three paychecks in certain months. Calculating overtime, holidays, sick time, and paid time off is easy using a bi-weekly pay schedule.

- Cons: With 26 pay periods in a year, some months will have three paydays, which may complicate the bookkeeping process. Companies may struggle to meet the extra payrolls that occur twice a year.

4. Semi-monthly

Semi-monthly pay periods have two pay dates each month, resulting in 24 pay periods a year. The paydays fall on the 1st and the 15th or the 15th and the final day of the month.

Semi-monthly pay cycles are the third most popular choice in the US. The payday will typically move to Friday if the day of the week employees are paid coincides with the weekend. Semi-monthly pay periods are popular in the logging, mining, financial, and IT industries.

- Pros: Semi-monthly pay cycles are highly consistent. They fall on the same dates every month and are easily adjustable for leap years and odd-numbered months. Companies with salaried employees may have an easier time preparing payroll since the paychecks are equal and predictable. Bi-monthly ease the process of administering employee benefits and withholding employment taxes.

- Cons: Workweeks in a semi-monthly pay cycle may overlap and make it difficult to calculate overtime. Some states, such as Massachusetts, prohibit companies with hourly employees from using bi-monthly or monthly payments.

5. Monthly

Companies with monthly pay schedules pay employees at the end of the month — resulting in 12 pay periods per calendar year. However, less than 10% of small business owners in the US use a monthly pay period, with most having fewer than nine employees.

- Pros: Monthly pay cycles simplify the budgeting process while enabling cash flow flexibility. They work well for companies with salaried employees, and the monthly pay period eases the process of administering employee benefits, tax withholdings, and budgeting.

- Cons: Monthly payrolls become highly complex for companies with hourly or non-exempt employees. Some states, such as Massachusetts, outlaw monthly pay cycles for hourly employees. Texas only allows monthly payrolls for employees with an FLSA overtime exemption.

Companies may consider fixed length and custom pay periods along these four standard options.

6. Fixed length

Some sectors, such as education, often use pay cycles outside conventional pay periods. For example, teachers and administrative staff don’t work during the summer.

In some states, public school districts allow teachers to break their annual salary into 21 paychecks or use the conventional bi-weekly schedule. Most districts often pay the additional five pay periods as a lump sum in early summer.

7. Custom

These are the most unconventional types of pay periods and typically occur when employees are paid for exceptional circumstances such as termination. Employers must process payroll differently, as resignation requires employees to receive payment outside the standard pay frequency. No federal laws govern the final payment period, so it varies from state to state. In Colorado, terminated employees must receive payment immediately. In Connecticut, employees must receive their final wages within one business day.

8. On-demand pay

This innovative payroll option provides employees the flexibility and convenience to access their earned wages immediately, aligning with the modern workforce’s desire for financial control and security.

By offering this benefit, businesses can attract and retain top talent, as potential employees are increasingly drawn to organizations that prioritize their financial health. Instant and on-demand Pay also fosters employee productivity, reducing financial stress and distractions and ultimately improving focus and performance at work. It can create a win-win situation for employers and employees, as it boosts morale, reduces turnover, and promotes a more financially stable workforce.

Employment laws regarding pay periods

Federal and state laws are significant considerations when choosing pay periods. Typically, there are no federal laws dictating the frequency of pay cycles. However, most states have specific laws regulating the number of hourly team members’ pay periods.

Massachusetts prohibits bi-monthly and monthly pay cycles for hourly employees. Texas allows monthly paychecks for employees with an FLSA overtime exemption.

Some states also have helpful legal provisions to protect workers in particular groups. For instance, Rhode Island allows childcare staff to choose their paycheck frequency.

The pay regulations in each state are available through its Department of Labor.

How to determine pay periods for your company

The best type of pay period for your business prioritizes your company’s needs, the type of work you do, state regulations, types of employees, and cash flow. You may opt for different pay periods if you have different types of employees. Prioritize these seven factors when choosing pay periods:

1. State regulations

Employers must follow the Fair Labor Standards Act and other tax and labor laws. As you determine how to pay your employees, carefully review your state’s wage and labor laws.

Start by checking the legal requirements and regulations in your jurisdiction. Different regions may have specific rules regarding pay frequency, which could be weekly, bi-weekly, semi-monthly, or monthly. Ensure that your chosen pay period complies with these regulations to avoid legal issues.

2. Workweeks

Align your pay cycles to match the workweek and simplify overtime calculations. This will streamline the payment process, ensure employees receive their pay during the correct pay period, and help you avoid payroll issues. How you structure your pay period and process payroll may depend on how your workweeks are set up.

3. Payroll costs

Choosing the right payroll service may lower your total payroll costs. Depending on your system, one pay period may cost more to pay employees. For example, daily pay period employees may be more expensive than employees with a pay date every month. Third-party payroll services often charge per payroll cycle, so having more cycles will increase your expenses.

4. Overtime

Overtime requirements and compliance may help inform your choice of a pay cycle. The best option lets you breeze through overtime calculations when dealing with FLSA-exempt or non-exempt employees.

5. Employee needs

Two-thirds of the American workforce prefers frequent paychecks because it eases financial stress. A favorable pay cycle improves job satisfaction and engagement. It may also lower your turnover rate.

Consider the preferences of your employees. Employees may prefer more frequent payments, such as bi-weekly or weekly, for better budgeting and cash flow management. Others may prefer less frequent payments, such as a monthly payroll schedule if it aligns with their financial planning.

6. Tax withholdings

Pick a payment cycle that simplifies your ability to calculate tax withholdings since this process is a mandatory business payday requirement. Payroll software improves your tax withholding capabilities, even when dealing with complex pay structures.

7. Reporting

Pay periods affect your ability to comply with labor and employment laws, recording, and reporting requirements. To meet FLSA compliance, you must maintain immaculate records of worker compensation information, including wages, tips, benefits, and other perks.

8. Seasonal Considerations:

If your business experiences seasonal fluctuations, consider how the timing of your pay periods might affect your employees during peak and slow seasons. Adjusting pay periods to accommodate seasonal variations can be beneficial.

9. Payroll Software Capabilities

Evaluate your payroll software and its capabilities. Some software may be better suited for specific pay period frequencies. Ensure that your chosen frequency aligns with the capabilities of your payroll system.

10. Administrative Ease

Assess the administrative feasibility of your chosen pay periods. More frequent pay periods, like weekly or every two weeks, may require more administrative effort to process and distribute paychecks. Still, they can also provide better accuracy for variable-hour employees. Less frequent pay periods may reduce administrative overhead but require handling more significant sums of money simultaneously.

It’s essential to strike a balance that meets the needs of your employees while aligning with your business’s financial and operational goals. Regular reviews and adjustments can help ensure your chosen pay periods remain optimal for your organization.

Common Pay Period Mistakes to Avoid

Ensuring accurate and timely payroll processing is crucial for any business, as mistakes in this area can lead to compliance issues, dissatisfied employees, and financial setbacks. Here are some common pay period mistakes that should be avoided to maintain a smooth and error-free payroll process.

- Inconsistent payroll schedules: One of the most common mistakes is irregular pay schedules. Employees rely on their paychecks arriving predictably, and any irregularities can lead to financial stress and decreased morale. To avoid this, establish a consistent pay period schedule, whether weekly, every two weeks, or monthly, and stick to it.

- Incorrect data entry: Accurate data entry is paramount in payroll processing. Mistakes entering hours worked, tax withholdings, or employee information can result in incorrect paychecks and compliance issues. Implement a robust system for data entry and double-check all entries to prevent errors.

- Overtime calculations: Incorrectly calculating overtime can be a costly mistake. Make sure you understand the overtime rules and regulations in your jurisdiction and automate overtime calculations in your payroll system to reduce errors.

- Failing to deduct and remit taxes: Employers are responsible for deducting and remitting employee taxes to the government. Failing to do so can result in penalties and legal issues. It’s vital to stay up-to-date with tax regulations and ensure accurate tax deductions with each payroll run.

- Misclassifying employees: Misclassifying employees as independent contractors or vice versa can lead to legal complications and tax issues. Understand the distinctions between employee types and use proper classification to avoid problems.

- Inadequate communication: Failing to communicate changes in payroll procedures, tax rates, or employee benefits can lead to confusion and dissatisfaction. Keep employees informed about payroll-related updates and provide clear channels to ask questions or seek assistance.

- Relying solely on manual processes: Manual payroll processing is prone to errors and can be time-consuming. Invest in payroll software and technology to automate and streamline the process, reducing the risk of mistakes and improving efficiency.

Manage pay periods for hourly employees with ease

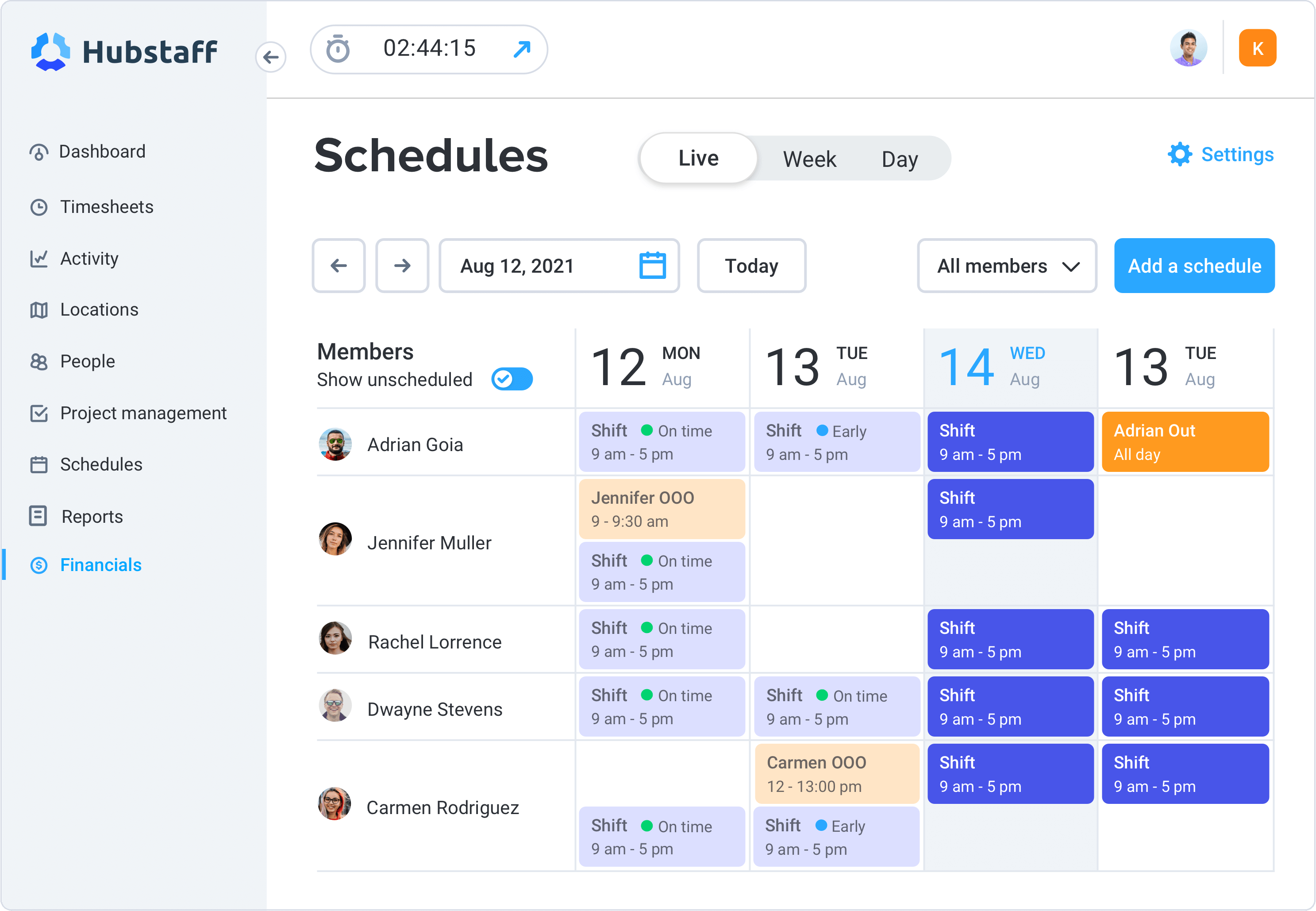

Hubstaff’s payroll tracking software manages payroll for hourly employees with easy-to-use automation and integrations that connect with Quickbooks or your favorite HR system.

Hubstaff uses a mobile app, desktop-based, or web-based tracker to track employee time. Simply set the rates and hours, then integrate your payroll method — we even offer automated international payments. Hubstaff will handle the rest.

Once you’ve reviewed the timesheets, Hubstaff will automatically calculate and dispense the wages. You can:

- Customize the payment frequency

- Schedule employees

- Pay for time off

- Make it easy for your team to clock in and out

The Hubstaff payroll system eliminates common pay period issues and will make handling various hourly rates, PTO, and pay cycles easy. Try Hubstaff today to streamline your payroll processes.

Subscribe to the Hubstaff blog for more posts like this

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...