It is essential to know the various types of pay periods and how they affect your business and your employees — but it can be confusing. One of the biggest issues is semi-monthly vs. biweekly payments.

With roughly four weeks in a month, these pay models almost seem synonymous at first glance. However, that’s not the case. How you pay your team, whether semi-monthly, bi-weekly, or bi-monthly, can make a difference.

Understanding these pay periods and choosing which is right for you depends on numerous factors like:

- The size of your company

- Your industry

- How many and what type of employees you have

- The Fair Labor Standards Act (FLSA) and any other local or federal laws

In this guide, we’ll explore different payroll options and offer insights into the benefits of each. We’ll also discuss important considerations to keep in mind to help you optimize payroll frequency and determine the best payroll solution for your needs.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysSemi-monthly vs. biweekly payroll

If you’re a little confused by all the payroll options, don’t worry. Though the difference between a semi-monthly payroll and a biweekly payroll can seem confusing, it’s not that difficult to grasp once it’s all laid out.

What is biweekly payroll?

With biweekly payroll, companies pay their employees every other week for a total of 26 paychecks per year. This model is the most common payroll option in the United States for a number of reasons.

Pros of biweekly paychecks:

Biweekly payroll is ideal if you have a combination of salaried workers and hourly employees because it works well for both. It’s the sweet spot between the constant administrative stress of weekly payroll and the employee frustration that comes with monthly payments.

Biweekly pay also makes it easy to calculate overtime for hourly workers and offers employees predictability, which is beneficial for consistent pay and budgeting.

Cons of biweekly paychecks:

There aren’t any major negatives to the biweekly pay schedule. However, it’s worth noting that with this type of pay frequency, you’ll make three payments two months out of the year, which can complicate bookkeeping for HR.

What is semi-monthly pay?

With a semi-monthly pay schedule, you’ll pay employees on two set dates a month. A lot of companies choose the 1st and the 15th of the month.

Pros of semi-monthly payroll:

Semi-monthly pay frequencies are a good option if you only have salaried employees. The frequency of a semi-monthly payment and the consistency of having set days also make it easier for your employees to budget for their personal expenses. It’s also easier to track payroll expenses and calculate benefit deductions with a semi-monthly payroll.

Cons of semi-monthly payroll:

For some employees, semi-monthly pay feels inconsistent because the set day of the payment could fall on a different day of the week each time.

For example, if you choose the 15th and the 30th for this type of payroll, that could fall on a Wednesday and a Thursday one month and a Friday and a Saturday the next month. If the payday falls on a weekend, you’ll also have to decide if you want to process the payment on the Friday before or the Monday after, as banks typically don’t process payroll on weekends.

What’s the difference between a biweekly pay schedule and semi-monthly payments?

With biweekly payroll, you pay your employees every other week. With bi-monthly pay, you’ll pay your employees twice a month on set days. While bi-monthly payments often come out to twice a week, there are actually slightly more than two weeks between payments on average. This then causes paydays to fall slightly over two weeks apart at times.

Is semi-monthly the same as monthly?

In short, semi-monthly pay periods are not the same as a monthly pay period. With a monthly pay period, you pay employees once a month, typically on the last day of the month.

Semi-monthly: how many weeks is it?

If the pay periods are the 1st through the 15th and the 16th through the last day of the month, the number of days in that second pay period will fluctuate depending on whether the month has 28, 30, or 31 days.

Semi-monthly pay schedule 2023

Below is an example of the first twelve pay periods of a semi-monthly pay schedule for 2023:

| Pay Period | Pay Period Start | Pay Period End | Payday |

| 1 | 1/1/2023 | 1/15/2023 | 1/13/2023 |

| 2 | 1/16/2023 | 1/31/2023 | 1/31/2023 |

| 3 | 2/1/2023 | 2/15/2023 | 2/15/2023 |

| 4 | 2/16/2023 | 2/28/2023 | 2/28/2023 |

| 5 | 3/1/2023 | 3/15/2023 | 3/15/2023 |

| 6 | 3/16/2023 | 3/31/2023 | 3/31/2023 |

| 7 | 4/1/2023 | 4/15/2023 | 4/14/2023 |

| 8 | 4/16/2023 | 4/30/2023 | 4/30/2023 |

| 9 | 5/1/2023 | 5/15/2023 | 5/15/2023 |

| 10 | 5/16/2023 | 5/31/2023 | 5/31/2023 |

| 11 | 6/1/2023 | 6/15/2023 | 6/15/2023 |

| 12 | 6/16/2023 | 6/30/2023 | 6/30/2023 |

Payroll considerations

Whether semi-monthly or biweekly payroll is right for your business will depend on several factors.

You should consider the following before you run payroll:

State and federal laws

Some states have laws and pay frequency regulations that mandate pay dates. For instance, employers in some states are required to pay employees twice a month and on regular paydays. Your payroll choices also need to align with the Fair Labor Standards Act (FLSA).

Paycheck consistency

Some employees might struggle with the inconsistent paydays during a semi-monthly pay schedule. It’s also worth considering your employees’ unique needs and whether a biweekly pay schedule would be more beneficial.

Budgeting and planning

If certain tasks, such as budgeting and cash flow projections, are more challenging for your company and HR team, consider switching to a different pay frequency.

Payroll Schedule preferences

Other factors could also influence what payroll type benefits your company and employees more. For example, automated payments are becoming increasingly common for everything from utilities to subscription services, so automating your payroll could help your employees keep their expenses on autopay, too.

Payroll providers

Payroll automation is beneficial for both employees and employers because it can:

- Simplify administrative work

- Help employees manage their finances and budget better

- Improve cash flow for businesses

- Reduce the likelihood of error during manual payroll

As mobile technology advances and people become more reliant on their phones, new tools and payroll apps are popping up to optimize the payroll process for increased efficiency.

These mobile technologies can help with data collection so you can analyze user behavior and improve your payroll going forward.

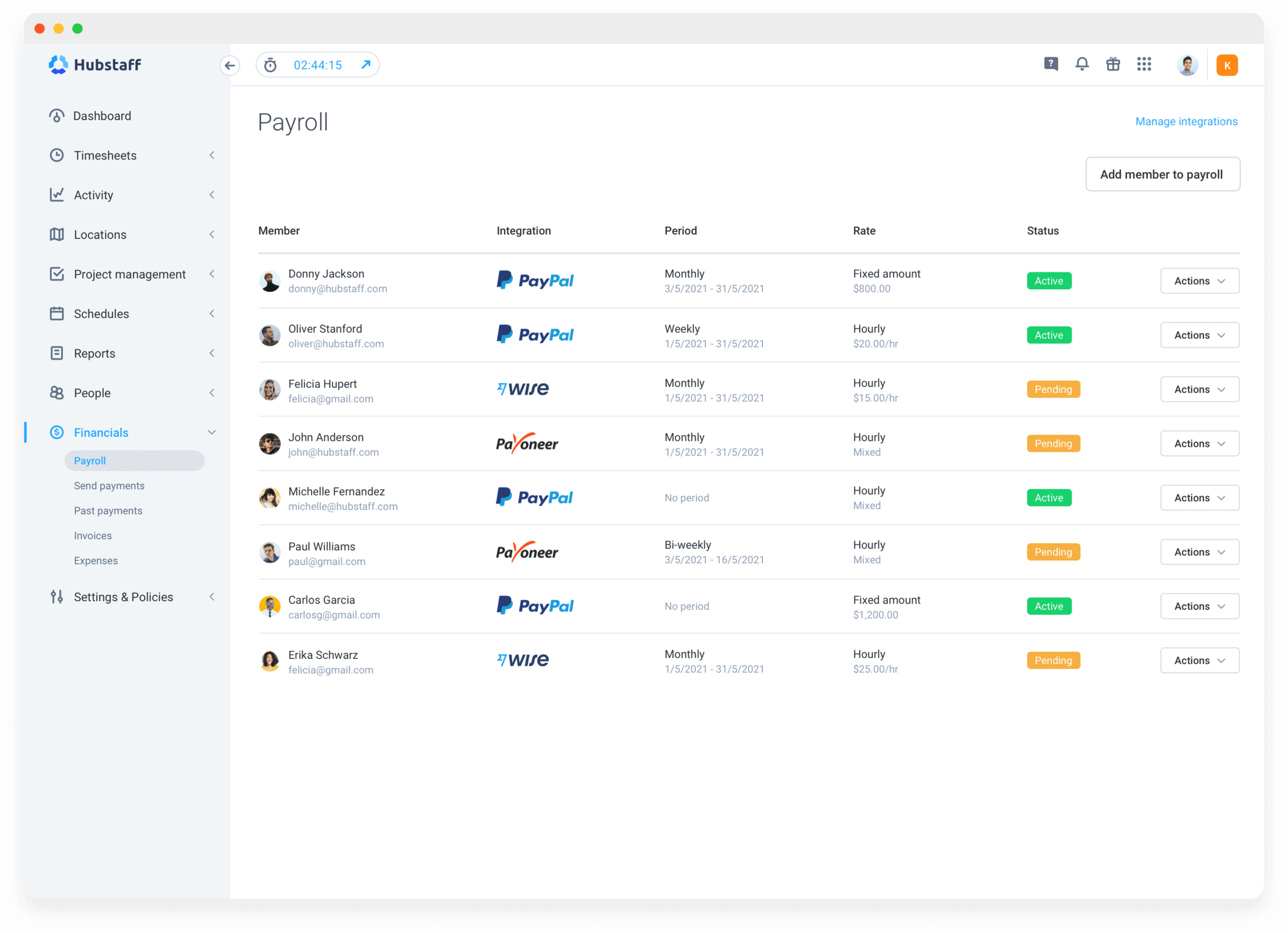

Master payroll with Hubstaff

Are you struggling to manage payroll efficiently for your team? Hubstaff helps you maximize productivity and master the art of payroll with numerous resources and tools, like our semi-monthly vs biweekly payroll vs semi-monthly calculator to help you calculate payroll hours.

We also offer automatic payments and a wide array of integrations with your favorite payroll providers. You can also try Hubstaff free for 14 days and see for yourself!

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...