The challenge of managing payments for freelancers and consultants intensifies as the month-end approaches. Hours spent on manual payroll, timesheet reviews, and budget tracking in Excel have resulted in an unexpected error.

The prospect of revisiting the entire process is daunting. Enter expense trackers – the solution to automate calculations, catalog invoices, assess budget adherence, and provide a straightforward way to gauge team profitability.

No more manual headaches; it’s time for efficient financial management.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 days5 Best Expense Tracker Apps For Personal Use

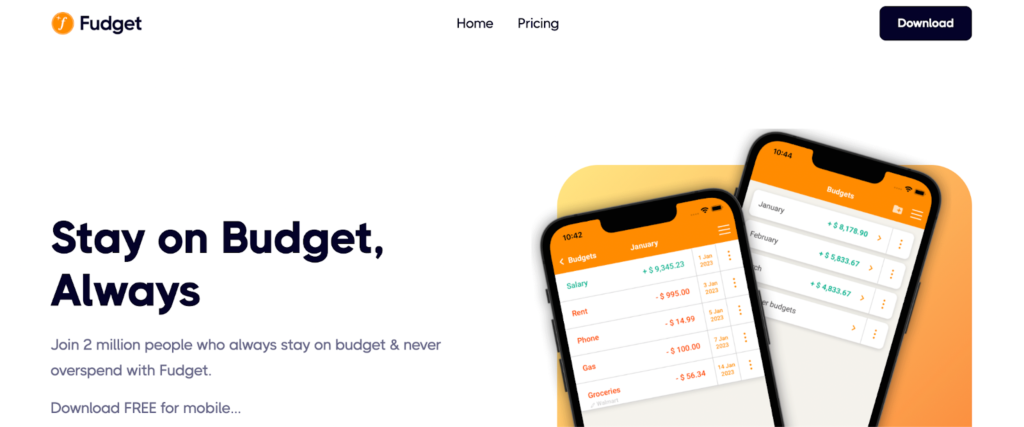

1. Fudget

Are you looking for a simple, no-frills expense tracker to get the job done? Fudget is a simple and fast alternative to feature-rich, complex budget planners and personal finance apps. There are no categories to manage, no charts to interpret, and no learning curve — simply add in your expenses and budget.

- Price: Free plan, paid options starting at $14.99 for 6 months

Features

- Create simple lists of incomings & expenses – keep track of the balance

- One-tap adding and editing

- Star an income/expense to repeat it on future budgets

- Use monthly, weekly, or however you like

- Choice of currency and symbols

- Universal app – install on any device

2. Wally

Wally is an intuitive personal finance app that helps you compare your income to your expenses, understand where your money goes, and set and achieve goals. The money management app lets you seamlessly keep track of the details as you spend money: where, when, what, why, and how much.

- Price: Free

Features

- Balance your income and expenses

- Understand where your money goes

- Easily track a daily budget

- Scan receipts

- High-speed with location services

- Smart notifications

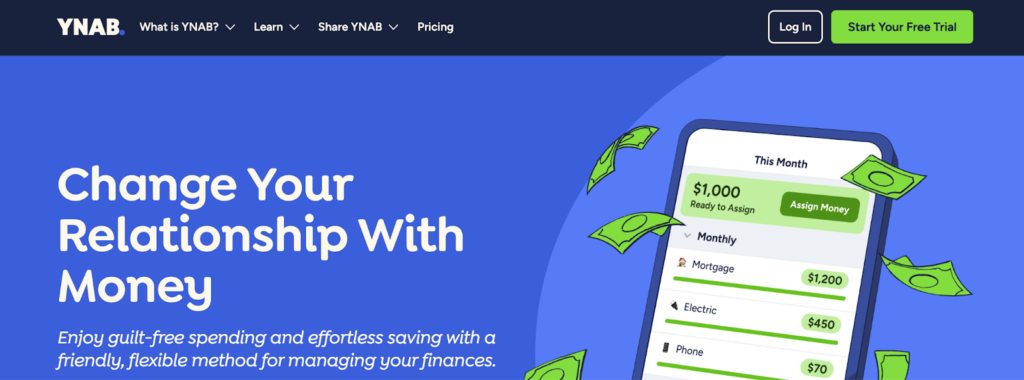

3. YNAB

You Need a Budget (YNAB) is a comprehensive budgeting tool designed to empower individuals and households with effective financial management. With a focus on proactive budgeting, YNAB goes beyond tracking expenses, offering a holistic approach to help users take control of their finances, eliminate debt, and build a secure financial future.

Price: 14.99/month

Features

- Zero-based budgeting

- Real-time syncing

- Expense tracking and categorization

- Goal setting and tracking

- Debt paydown tools

4. Goodbudget

Goodbudget is a budgeting tool that simplifies financial management for individuals and families. Offering a user-friendly interface and focusing on envelope budgeting helps users allocate and track their finances effectively.

Price: Free plan, paid plan starting at $8 per month

Features

- Envelope budgeting system

- Real-time expense tracking

- Shared budgeting

- Savings goals

- Debt paydown tools

- Reports and insights

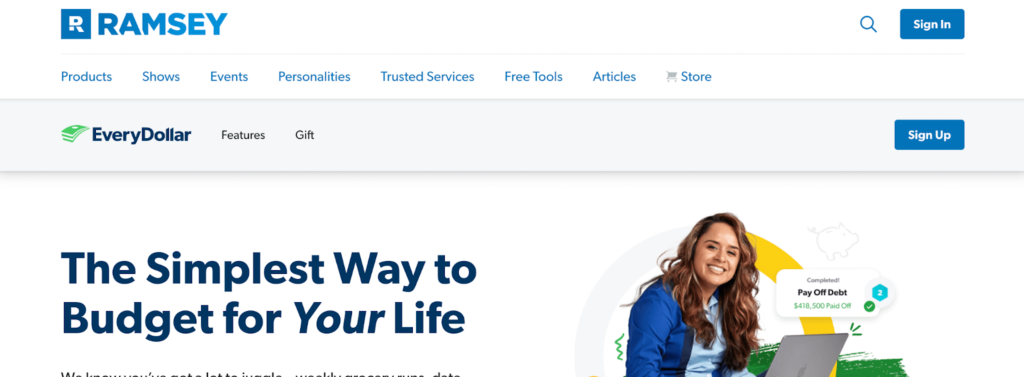

5. EveryDollar

EveryDollar is a user-friendly budgeting tool that empowers individuals to take control of their finances. Developed with simplicity, it facilitates the creation and tracking of budgets, helping users achieve their financial goals through intentional and informed spending.

Price: Free plan, paid plans starting at $129 per year

Features

- Zero-based budgeting

- Customizable budget templates

- Expense tracking

- Goal setting and monitoring

- Debt paydown tools

- Monthly reporting

- Bank account integration

5 best expense tracker apps for small businesses

1. Dollarbird

Dollarbird is a collaborative calendar-based expense tracker for individuals and groups. Track and forecast your money as quickly as adding events to a calendar, making it easy to make sense of your financial situation, plan ahead, and manage your money. If you are a visual planner and love scheduling, this tracker is perfect.

- Price: Paid options starting at $4.99 per month

Features

- A simple calendar-based interface where you can add, keep track and visualize your transactions

- Automatic balance calculation for each day or month and a transparent breakdown of your past and planned transactions

- Option to collaborate with your partner, family, or friends to manage your finances and stay up to date on everyday money matters

- Your data is stored in the cloud, available on all your devices regardless of the platform you’re on

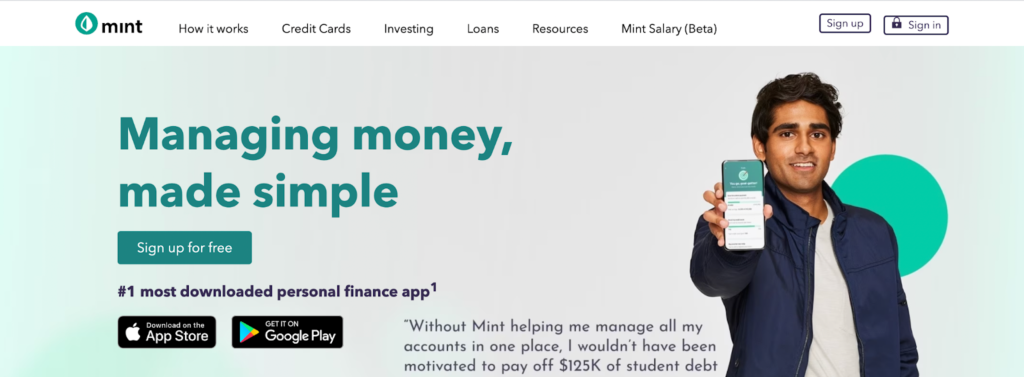

2. Mint

Mint helps you effortlessly manage your finances in one place. Users can create budgets with numerous spending categories and receive warnings with brightly colored graphics when they are nearing the edge of their money.

- Price: Free, paid plans starting at $4.99 per month

Features

- Credit score access

- See bills and money in one place

- Get alerts and schedule payments on the spot

- Say goodbye to late fees

- Stop logging into multiple sites

- Deliver payments fast

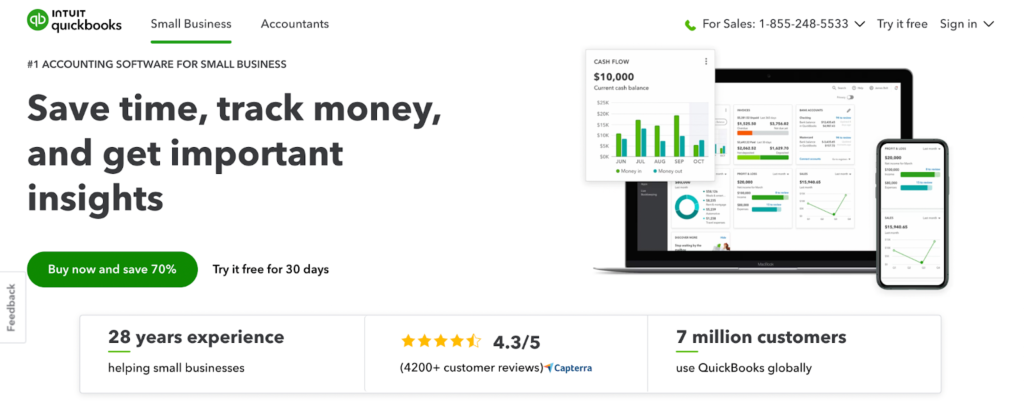

3. QuickBooks Online

QuickBooks Online is a versatile accounting tool tailored for small businesses. Offering cloud-based accessibility, it streamlines financial management with features designed to simplify invoicing, expense tracking, and overall accounting processes.

Price: Plan plans start at $15 per month

Features

- Cloud-based accounting

- Invoicing

- Expense tracking

- Bank reconciliation

- Financial reporting

- Tax preparation

- Payroll management

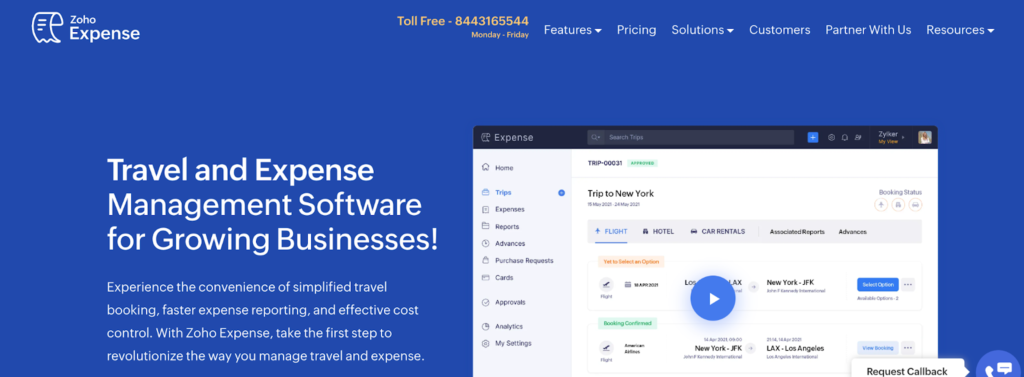

4. Zoho Expense

Zoho Expense is a powerful expense management tool designed to streamline and simplify the tracking of business expenses. Its user-friendly interface and robust features offer seamless automation for expense reporting, receipt management, and reimbursement processes.

Price:

Features

- Expense tracking

- Receipt management

- Automated expense reporting

- Approval workflows

- Integration with accounting software

- Multi-currency support

- Policy enforcement

- Mobile accessibility

- Real-time updates

- Analytical reporting

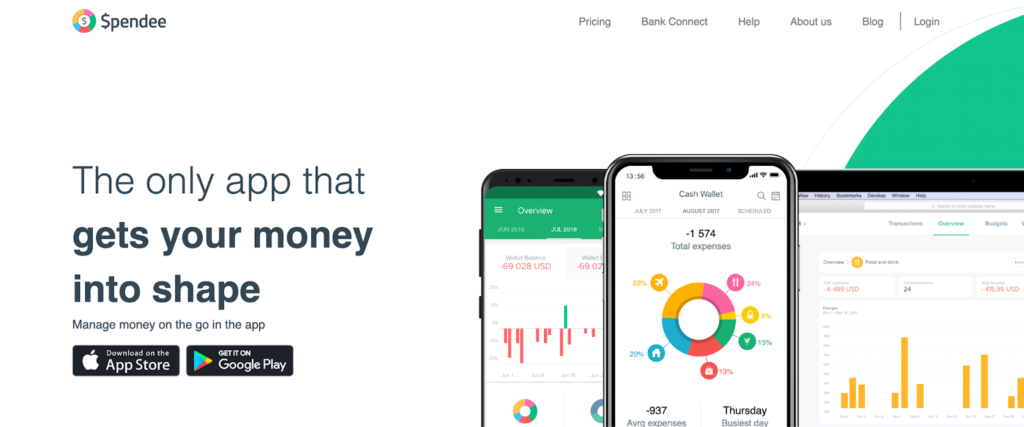

5. Spendee

Spendee is a versatile finance tool that simplifies money management for individuals and small businesses. An intuitive interface enables users to track expenses, set budget goals, and gain insights into their spending habits for smarter financial decisions.

Price: Paid plans starting at 2.99/month

Features

- Expense tracking

- Budget goal setting

- Multiple currency support

- Real-time expense updates

- Customizable categories

- Budget overview

- Financial insights

- Bank account synchronization

- Receipt scanning

5 best expense tracker apps for business expenses

1. Hubstaff

If you’re looking for a full-featured expense and time tracker, Hubstaff is your go-to solution. Hubstaff helps you quickly get your finances right with its all-in-one time tracking, invoicing, and payroll features, putting time and expense tracking at the center and killing the rest of the tedious admin work.

- Price: Free plan, paid options starting at $7 per month

Features

- 30+ integrations, including project management, accounting, CRM, helpdesk, and scheduling integrations

- Time tracking

- Screenshots

- Internet and app monitoring

- Online timesheets

- Automatic payroll

- GPS and locations

- Reporting

2. Expensify

Expensify is a comprehensive expense management tool designed for businesses and individuals. Streamlining the expense reporting process offers user-friendly features to automate expense tracking, receipt management, and reimbursement workflows.

Price: Paid plans start at $5 per user/month

Features

- Automated expense tracking

- Receipt management

- Real-time expense reports

- SmartScan technology

- Policy enforcement

- Expense approval workflows

- Automatic currency conversion

- Mobile accessibility

3. FreshBooks

FreshBooks is a comprehensive accounting and invoicing tool for businesses and freelancers. With its user-friendly interface and robust features, FreshBooks simplifies financial management, offering invoicing, expense tracking, and business reporting solutions.

Price: Paid plans start at $204/year

Features

- Invoicing

- Expense tracking

- Time tracking

- Project management

- Client communication

- Estimates and proposals

- Online payments

- Reporting and analytics

- Multi-currency support

- Mobile accessibility

4. Concur

Concur is a leading expense management solution to streamline and automate corporate spending. With a focus on efficiency, it simplifies expense tracking, travel booking, and invoice management for businesses, ensuring accurate financial control.

Price: Contact their sales team for custom pricing

Features

- Expense tracking

- Travel booking

- Invoice management

- Receipt digitization

- Policy enforcement

- Approval workflows

- Integration with accounting software

- Real-time reporting

- Mobile accessibility

- Global compliance

5. Rydoo

Rydoo is a versatile expense management tool designed to simplify corporate spending. With its intuitive platform, it facilitates seamless expense tracking, receipt management, and travel bookings, streamlining financial processes for businesses of all sizes.

Price: Paid plans starting at $10 per user/month

Features

- Expense tracking

- Receipt management

- Travel bookings

- Per diem management

- Approval workflows

- Integration with accounting software

- Multi-currency support

- Mobile accessibility

- Policy enforcement

- Reporting and analytics

How to choose the right expense tracker app

In the era of digital convenience, finding the right expense tracker app can transform the tedious task of tracking expenses into a streamlined and efficient process. Here are some essential tips when selecting the perfect expense tracker app.

- User-friendly interface: Opt for an app with an intuitive and user-friendly interface. A user-friendly design ensures you spend less time figuring out the app and more time managing your expenses.

- Compatibility and accessibility: Choose an app compatible with your devices (phone, tablet, computer). Accessibility across devices ensures you can track expenses anytime, anywhere.

- Category customization: Look for apps that allow customization of expense categories. Tailoring categories to your specific spending habits enhances accuracy and organization.

- Integration with bank accounts: Opt for apps that seamlessly integrate with your bank accounts. Integration reduces manual data entry, minimizing errors and saving time.

- Expense reporting features: Choose an app with robust reporting features. Advanced reporting capabilities provide valuable insights into spending patterns and financial trends.

- Automated receipt tracking: Consider apps with automatic receipt tracking. Automated monitoring reduces the chance of losing receipts and simplifies the reimbursement process.

- Budgeting capabilities: Look for apps that offer budgeting features. Budgeting tools help you set financial goals and stay on track with your spending plan.

- Data security: Prioritize apps with robust security measures. Protecting sensitive financial data is crucial; a secure app ensures peace of mind.

Choosing the right expense tracker app is about finding a seamless companion that fits your lifestyle and financial management needs. By considering factors like user-friendliness, compatibility, customization, and security, you’re not just picking an app – you’re investing in a tool that can simplify your financial journey.

So, take your time, explore your options, and let your chosen expense tracker app be the sidekick in your quest for financial efficiency.

Benefits of using expense tracker apps

In a world where every penny counts, expense tracker apps emerge as unsung heroes in financial management. Let’s delve into the many advantages these digital companions bring to the table, transforming how we track and understand our expenses.

- Effortless expense tracking: Simplify the process of tracking expenses effortlessly. With an expense tracker app, you can log your spending as you go, eliminating the need for cumbersome manual record-keeping. This seamless integration into your daily routine ensures that every transaction is accounted for, making financial management a breeze.

- Real-time visibility: Gain real-time visibility into your financial transactions. You can stay informed and aware of your current financial standing by having instant updates on your expenditures. This real-time visibility eliminates surprises at the end of the month, empowering you to make informed decisions on the fly.

- Improved accuracy: Enhance accuracy in expense recording. Unlike traditional manual tracking, which is prone to human error, expense tracker apps minimize the risk of inaccuracies. The automated nature of these apps ensures that your financial records are precise and reliable, providing a solid foundation for decision-making.

- Financial awareness: Foster a heightened awareness of your financial habits. Visualizing your spending patterns through the analytical tools offered by expense tracker apps promotes a deeper understanding of your financial behavior. This heightened awareness empowers you to make conscious choices and cultivate healthier financial habits.

- Receipt preservation: Digitally preserve and organize receipts. Say goodbye to paper clutter; expense tracker apps allow you to capture and store digital copies of your receipts. This helps maintain a neat and organized record and proves invaluable for reference purposes and during tax season.

- Financial goal setting: Support the setting and achievement of financial goals. Expense tracker apps provide a structured platform for setting and monitoring financial goals. By tracking your progress, adjusting spending patterns, and celebrating milestones, you can turn your aspirations into tangible achievements on your financial journey.

Expense tracker apps aren’t just tools; they are your financial allies, bringing many benefits beyond mere expense tracking. From saving time and improving accuracy to fostering financial awareness and goal-setting, these apps empower individuals to take charge of their financial destinies.

Tips for maximizing the use of expense tracker apps

Whether you’re a business owner or just looking to gain better control over your personal finances, these tips will help you unlock the full potential of your chosen expense tracker app.

- Regularly review and categorize transactions: Set aside time to review and categorize your transactions. Regular review ensures accuracy, and proper categorization enhances the insights you can derive from your spending patterns.

- Leverage automation: Automate the tracking of recurring expenses. Automation saves time and ensures you never miss recording recurring transactions, providing a comprehensive financial picture.

- Explore analytical tools: Dive into the analytical tools offered by the app. These tools can provide valuable insights into your spending habits, helping you make informed decisions and identify areas for potential savings.

- Sync with bank accounts: Sync your expense tracker with your bank and credit card accounts. Automatic syncing minimizes manual data entry, providing real-time updates and reducing the risk of errors.

- Set financial goals: Utilize the tool’s goal-setting feature. Setting specific financial goals and tracking your progress directly within the app adds a motivational element to your financial journey.

Your chosen expense tracker app is a powerful tool, but its true potential is unleashed when you incorporate these tips into your financial routine.

Final words

The best expense-tracking app will include automation and analytical tools to transform your tool into a personalized financial advisor. So, embrace these tips, make the most of your cash flow, and witness how it becomes an indispensable ally in your journey toward financial success.

Tracking your expenses will help your team and business stay on budget and work towards a profitable future – no more going over budgets, simple mistakes, and insufficient data. Eliminate the hurdles and minimize your time spent on expenses and budgets. Get it right the first time, remove human error, and easily keep track of everything for your team’s records.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...