Construction bookkeeping is a form of bookkeeping unique to the construction industry. Its purpose is to enable construction companies to have a better understanding of their financial situation through tracking and recording both expenses and incoming payments.

Construction bookkeeping, while challenging, is an essential part of running a construction company.

Whether you like it or not, you’ll need to find a way to manage your company’s bookkeeping if you want to:

- Track costs and revenue accurately

- Protect project budgets

- Manage projects effectively

- Find ways to reduce costs

In this blog post, we’ll look at:

- Why construction bookkeeping is important

- 10 construction bookkeeping tips

- How to choose the right construction bookkeeping software

- More resources for further reading

If you want to skip ahead, click on the topic to jump directly to that section.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysWhy construction bookkeeping is important

Construction is a complex machine with many moving parts. This can make it difficult to track revenue and costs on a single project, let alone many.

Here are six aspects of the industry that make effective construction bookkeeping vital.

Scattered custom projects

The decentralized nature of the industry makes construction bookkeeping so unique.

No two projects are the same. It costs money just to move people and equipment to different sites. If you operate across state lines, you may also need to account for additional tax payments.

The more projects your construction company manages and the more workers you contract, the more important it is to have your accounts in order.

Direct and indirect costs

Direct costs are those associated with a specific project. They include labor, equipment, materials, etc.

Indirect costs are those which are essential to running your business across projects. Examples include repairs to equipment, insurance, transportation, and software.

You need to record both direct and indirect costs if you want to track and spend efficiently.

Contract value and duration

The high price and length of construction projects make payment scheduling and collection unique.

In most industries, commissioned contractors get paid upon delivery of a product or service.

However, construction projects can take months or even years to complete. This makes accurate bookkeeping essential.

External influences

Project costs vary according to the weather and season in which work is due to take place, as do the cost of materials and strain on workers and equipment.

You also need to keep in mind that the construction industry is highly susceptible to political and economic fluctuations.

It’s not uncommon for circumstances beyond your control to impact the price of materials, equipment, and labor costs.

Contract retainage

According to the Construction Financial Management Association, pre-tax net profits average between just 1.4% and 3.5% for contractors and subcontractors.

This is why contract retainage can be so devastating.

Contract retainage, which is the amount of money that customers can withhold until they are satisfied with a project, is typically 5-10% of a contract’s value. This can amount to as much as 50% of a project’s net profit.

If you manage many projects at once, strong retainage management is essential. It will ensure you have capital in the event that a customer withholds money owed.

Unique payroll considerations

Keeping track of payroll is another element where construction bookkeeping is essential. Unfortunately, it’s not as simple as agreeing on compensation with a worker and paying them the same rate per project.

Construction companies usually need to pay their workers what’s known as a prevailing wage.

A prevailing wage is the standard hourly rate for a worker in a particular state or locality determined by regulatory agencies and each state’s State Department of Labor.

Union rates, travel pay, and taxes can also impact how much you’ll need to pay your workers.

10 construction bookkeeping tips

Here are ten tips that can help to simplify and improve the way you handle construction bookkeeping.

Tip 1: Record all details about payments and invoices

You probably already know that you should be keeping all your business receipts.

Apart from giving you insight into where your money is going, receipts also serve as proof of your business expenses in case you ever get audited.

Note down all the information from your receipts and invoices in case you ever need it. You can do this manually or using bookkeeping software.

If you decide to go the manual route, you’ll need separate bookkeeping journals for:

- Accounts payable – This is where all your company’s bills go. You should include items such as rent, utilities, equipment, and insurance here.

- Accounts receivable – You’ll record payments from clients into this journal. Each entry should include the date, the client’s name, the amount, and any outstanding balance.

- Job costs – This journal should include items such as payroll, subcontractor payments, and material purchases.

You should keep all three of these journals updated regularly to know how your business is doing, as well as prepare for a potential audit.

Tip 2: Use job costing to manage project costs and general business ledgers

Job costing is a process that helps you determine the costs of working on a project.

It allows you to estimate labor, material, and overhead cost, as well as determine how much you should charge for the project.

Manual job costing can be very time-intensive, especially when it comes to complex projects. However, you can simplify the entire process with the help of software.

Whether you decide to do job costing manually or using software, the same steps apply.

First, break down the project into phases, and then list all the tasks needed to complete each phase.

Once you create a list of tasks, divide these into three expense categories:

- Labor – Calculate how much you’ll need to pay your workers by multiplying their daily rate with the estimated number of days needed to complete the project. Make sure you account for taxes, worker’s compensation, and overtime.

- Materials – When you calculate material costs, include the cost of both direct (e.g., concrete, steel) and indirect (nails, screws) materials. Include the cost of material delivery and potential waste, too.

- Overhead – Finally, account for overhead costs, such as rent, utilities, and salaries for in-office workers. Make sure also to include miscellaneous expenses such as travel costs, professional services fees, and marketing and advertising costs in your overhead expenses.

You should also add your income and expenses from each project into a general ledger to get an accurate overview of your gross and net income.

Tip 3: Use multiple bank accounts

Keeping all your company’s money in a single bank account makes it harder to understand how you’re doing financially because all the money in the bank account might not necessarily be yours.

Some of it is likely reserved for things like payroll, covering expenses, and paying taxes.

This is where having multiple bank accounts can help.

You could have one account reserved for paying expenses, another one for managing payroll, and a third one for receiving payments for clients.

This helps you get a better idea of how much money is coming in and going out of your business every month.

It also makes it easier to stay on top of bookkeeping.

Tip 4: Account for contract retainage

As we mentioned earlier, contract retainage can account for 5 to 10 percent of your contract value.

To ensure you aren’t surprised by a customer withholding part of the fee you’re owed, make sure you account for contract retainage properly when budgeting for a project and invoicing clients.

The simplest way to account for retainage is to include two sets of information on your invoices.

The first set should cover information on the progress milestone met and reflect the total amount authorized for the services.

The second set should contain the retainage value shown as a credit on the invoice.

This would result in the net amount of the invoice reflecting the actual dollar amount the client owes you.

Once you complete the project, you can then issue a final invoice for the entire value of the retainage.

Tip 5: Use milestone payments

Milestone payments are payments paid out after achieving a defined stage of progress on a project.

The main benefit of charging a client in milestone payments is that you don’t need to wait until you fully complete the job to get paid. This can significantly improve your cash flow.

Using milestone payments also makes it easier to identify payment problems, which, in turn, enables you to stop working until you receive payment for a milestone.

Contractors usually request payments using a payment application, with the two most popular ones being the AIA 6702-1992 and ConsensusDocs 710.

Tip 6: Choose the right revenue recognition method

Revenue recognition is the process of officially recording how and when your business generates revenue.

There are a number of different revenue recognition methods you can use. The three methods that are the most relevant to the construction industry include:

Completed contract method

With the completed contract method, you recognize revenue only after completing a project. Construction companies often use this method for short-term contracts, especially those where contract costs can be hard to estimate.

By delaying revenue recognition until after you complete a project, you can also defer the recognition of related income tax.

You can use this method of revenue recognition even if you’ve received payments during the contract period.

Installment method

With the installment method, you only record revenue once you’ve received payment from the client. This means that you recognize income in the accounting period when it’s collected, and not at the time of sale.

The installment method is usually used when your client makes payments over time. In these cases, there’s a risk that you won’t collect the full payment, so it’s wise to wait until you actually receive the payment to recognize it as income.

Percentage of completion method

The percentage of completion method involves ongoing recognition of revenue. When using this method, you recognize revenue as a percentage of the work your company completed during a period.

This method of revenue recognition allows you to recognize your gains and losses related to the project in every reporting period during which the project is active.

Contractors usually use this method for long-term projects.

Tip 7: Automate your bookkeeping

You should also consider automating your bookkeeping. Apart from saving you time, automated bookkeeping helps reduce human error, removes some security concerns, and saves money.

Most existing bookkeeping solutions automate one or more aspects of bookkeeping. However, there’s still no software available that can automate the entire bookkeeping process.

The main reason for this is that bookkeeping isn’t a standardized service. Businesses have different bookkeeping needs which vary based on industry, company size, federal and state regulations, as well as a number of other factors.

However, most businesses need the following bookkeeping services:

- Transaction categorization

- Bank account reconciliation

- Financial statement preparation

- Handling of bills and invoices

You can automate these using a combination of the following tools:

Botkeeper

Botkeeper is a bookkeeping solution that uses artificial intelligence and machine learning combined with human accountants to deliver a comprehensive bookkeeping service.

You can use Botkeeper to connect your books to your bank account and simplify reporting. It can also organize and pay bills for you, as well as collect payments and follow up on outstanding invoices.

Expensify

Expensify is a software solution designed to help businesses track, organize, and categorize receipts and expenses. You can sync it with your bank account to import expenses automatically or simply take a photo of a receipt to import it into your account.

There’s also the option of emailing digital receipts to an Expensify email address to import expenses that way.

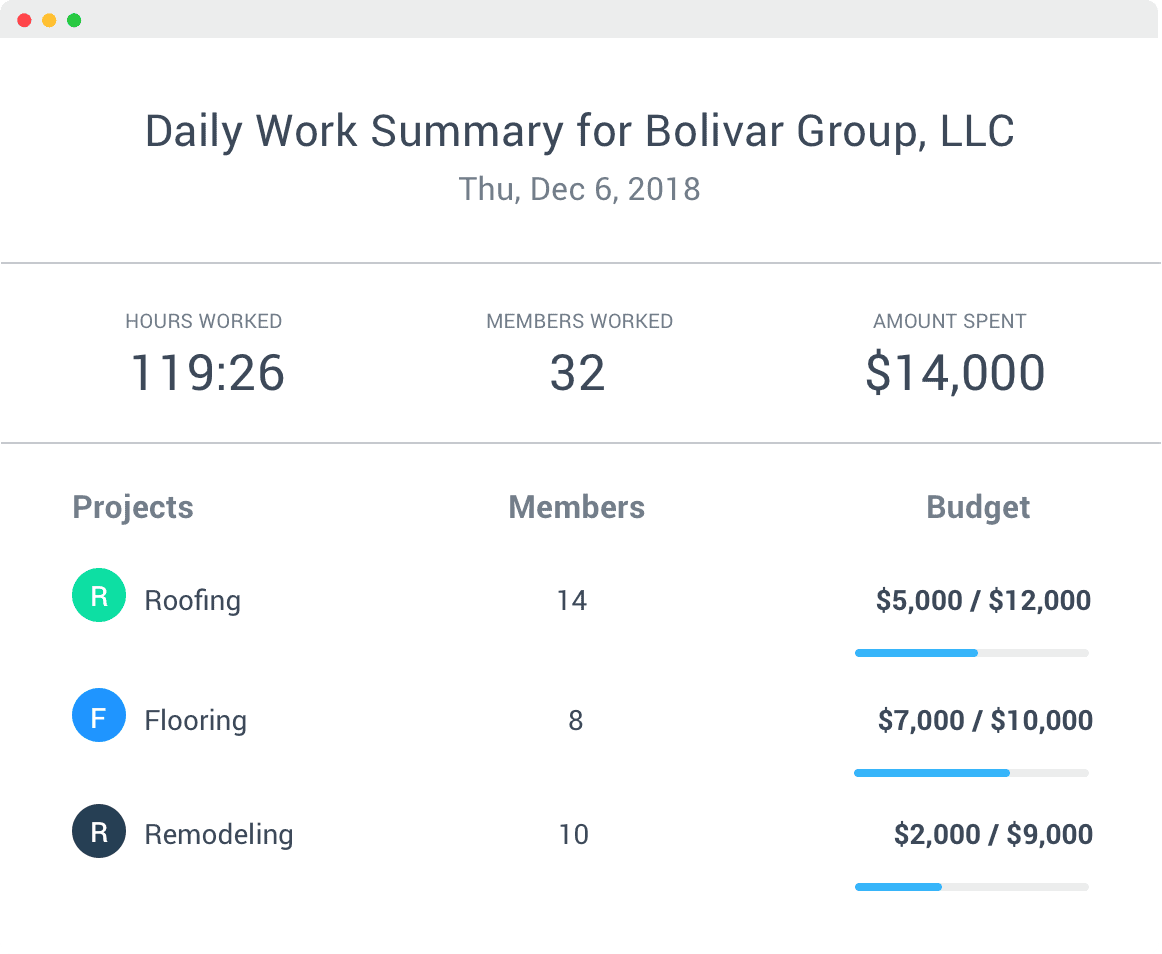

Hubstaff

Using Hubstaff’s time tracking app for construction businesses, you can automatically generate time cards for your workers. This ensures payroll receives accurate data for the time workers spend on-site, as well as time spent traveling.

You can also export the timesheets as evidence of workers’ locations. This reduces the likelihood of any disagreements with customers over the exact time workers started or ended their shifts.

Lastly, as Hubstaff records workers’ arrival and departure times, there is no need for them to note down this information manually. This means that they can dedicate more time to completing their work duties.

Tip 8: Hire an accountant

Hiring an accountant to take care of your bookkeeping can save you a significant amount of time, as well as eliminate bookkeeping and accounting errors.

If you decide to hire an accountant, look for one with experience in your industry because they’ll know how to handle your company’s accounting needs most effectively.

Since this person will be responsible for maintaining all your financial information, you’ll want to make sure they have experience in handling all of the following:

- Financial recordkeeping – Includes maintaining your general ledger at all times.

- Bill payment – Involves managing expenses and making sure you pay your bills on time.

- Payroll – Your accountant should also make sure your employees and subcontractors receive their payments on time.

- Tax preparation – They should know how to file and pay taxes, as well as maximize deductions.

- Financial advising – Your accountant should be capable of reviewing your ledger and determining opportunities for financial growth.

Additionally, while a non-certified accountant could handle some of your bookkeeping needs, you should focus on certified and licensed accountants to stay on the safe side.

While there are many places where you can find a certified accountant, your best option is to browse the American Institute of Certified Public Accountants database. It lists thousands of licensed CPAs who can help with all your accounting needs.

Alternatively, you can talk with other business owners and ask if they can recommend a certified accountant.

Tip 9: Backup your records

Losing your bookkeeping records due to a natural disaster, a computer virus, or hardware failure can be devastating.

You can avoid this by backing up all your records using services such as Backblaze or IDrive.

When performing backups, your best bet is to follow the 3-2-1 rule, which states that you should:

- Have at least three copies of your data

- Store two copies on different media

- Have one copy hosted off-site

This will significantly reduce the chances of losing your data.

How often you should back up your data depends on how frequently you update it, with more frequent updates requiring more backups. In most cases, you should perform a backup at least once a week.

It’s also important to test the validity of your backups periodically. This will ensure that you don’t end up with corrupted backups that you can’t use to recover your data.

How to choose the right construction bookkeeping software

There are plenty of bookkeeping solutions out there you can use to automate and streamline your company’s bookkeeping. Here are a few tips on how you should go about choosing your new construction bookkeeping solution:

Take advantage of free trials

Some solutions, like Hubstaff, offer a free trial to provide you with an opportunity to test the software and determine if it’s the right fit for your needs.

Make sure to take advantage of these free trials when you’re shopping for your next bookkeeping solution.

Focus on must-have features

When looking for a new bookkeeping solution, you can make your job easier by focusing on tools that offer must-have features such as:

- Core accounting – Your bookkeeping software should allow you to manage accounts payable, accounts receivable, and your company’s general ledger.

- Expense management – You need the ability to submit, process, and track expenses so that you have a better idea of where your company’s money is going.

- Bank account reconciliation – You’ll also want your bookkeeping software to help you reconcile your bank account with your financial records.

- Billing and invoicing – Creating and sending invoices are also essential features you should look for in a bookkeeping solution.

- Payroll management – A good bookkeeping solution can help you simplify and manage payroll. Look for a solution that can calculate, process, and distribute payments to your employees and subcontractors.

- Financial reporting – It’s important that your bookkeeping solution allows you to track your business’ key performance metrics. It should include profit and loss statements, expense reports, and balance sheets.

Any bookkeeping solution you choose should have these core features at a minimum. If your business has any unique bookkeeping needs, you’ll want to look for a solution that caters to those needs as well.

Look for ease of use

Opting for a solution that requires extensive training before you can use it is not only going to cost you time but also risk frustrating both you and your employees.

Try to find a solution that is easy to set up and intuitive to use.

Intuitive solutions have their most common functions presented in a single menu rather than spread over half a dozen different sections.

Their user interface guides you through whatever you want to accomplish and allows you to achieve what you set out to do on the first try.

The advantage of intuitive software is that you don’t need to spend time learning how to use it and can take advantage of all its features straight away.

Manage your construction bookkeeping effectively

Construction bookkeeping is a crucial part of running a construction business.

Although it’s sometimes challenging, you can significantly simplify bookkeeping by hiring a bookkeeper or accountant to handle it for you.

Alternatively, you can take advantage of a dedicated bookkeeping software solution to manage your bookkeeping more easily.

If you’d like to learn more about financial management in the construction industry, check out the following blog posts:

- Learn how to handle construction cost overruns

- Read our top 5 cloud accounting solutions for small businesses

- Discover how to find the right construction time clock system for you

Subscribe to the Hubstaff blog for more posts like this

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...