India and other countries have a large pool of talented virtual assistants who can help your business succeed while charging a reasonable rate. If you want to take advantage of the ample opportunities of outsourcing, it’s time to learn how to send money to India.

One of the most difficult obstacles is choosing the best payment option. You’re probably outsourcing to India because you’re looking for a great hourly rate, so you don’t want to offset that savings by running up fees on payments.

In this post, we will take a look at some efficient, secure, and affordable ways to pay teams in India — or anywhere else around the globe.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysIt’s never been easier to pay your team in India

There are a number of easy and efficient ways to pay teams in India. Which is the best for you?

Each option has some unique advantages and disadvantages to consider. It’s imperative that you do thorough research before making your final decision. Here’s what you should consider when searching for a payment method to send money to India:

- Speed – How soon do you need it to get there? You may end up paying more if speed is a priority.

- Exchange rate – Not all currencies hold the same value. Are you getting the best rate possible?

- Fees – Are you paying more than you should? For instance, sending money using a card may require additional fees.

- Convenience – How easy was the experience from start to finish? Going to the bank, account creation, and approvals are a major inconvenience worth taking into account.

Track, manage, and pay international teams

Automate payments based on tracked time for easy, accurate payroll

With these priorities in mind, we’ve compiled some of the best methods for sending money to India.

Here are the best ways to transfer money to India

Below are some of the best ways of sending money to India.

- ACH transfer

- Wise

- Money orders

- Remitly

- Wire transfer

- Xoom.com

- MoneyGram

- Western Union

- PayPal

- Hubstaff

- Transfast

- Personal Checks

- Email money

- NRI-NRE account

By price: Cheapest services for sending money to India

ACH transfer

An ACH transfer, or Automated Clearing House transfer, is a great option for businesses based in the U.S. In fact, many of the P2P payment services you’ll find on this list operate by initiating an ACH transfer on your behalf.

If transfer fees are important to you, using an ACH transfer is the way to go. ACH transfers come in two forms: debit and credit. Debit transfers tend to be free, but credit transfers might cost you about $3 per transfer.

According to The Balance, “ACH payments are good for small, frequent, non-mission-critical payments” such as direct deposit of pay or monthly bills. Unfortunately, it might take several business days for the recipient to receive anything.

Pros:

- Convenient

- Can be free at some banks or money transfer services, with small fees at others

Cons:

- Not the best option if you’re in a hurry as it can take 3+ days

Wise

Wise (formerly TransferWise) markets itself as a cheaper way to send money abroad.

Other transfer apps will simply provide international conversion rates (i.e. $1 in the U.S. = ₹74.46 in India). Wise goes a step further by giving you the real exchange rate.

This shows you not only the numerical conversion rate of the transaction, but also the buying power. This is super helpful when negotiating pay rates for team members in India.

Like other money transfer options, Wise can take a while to process. If you’re looking for a fast method, you might want to look elsewhere.

Pros:

- Cheap because of the middle-market exchange rates. ($13.01 – 0.65% conversion fee)

- Convenient (online or in-app)

- Available in 230 countries

Cons:

- Can take 2-3 business days for Canada-to-India transfers

- Business and personal accounts need to be verified

- No status updates for recipients to monitor

- Transfers are sometimes delayed

- MasterCard only (Visa coming soon)

Money orders

Money orders are one of the most affordable choices for sending money abroad. However, they are susceptible to fraud.

Most banks offer this service and charge very little. You’ll need to deposit the international money order into your bank account. Some sort of ID is usually required for cashing the checks — which can be sent in the local currency.

As added security, the full amount can be recovered if lost.

Pros:

- Economical, especially if your bank waives fees for having an account with them

- Safer option: ID required and can be traced

Cons:

- You’ll have to go into the bank or a Western Union branch to send

- Can take a while to receive it

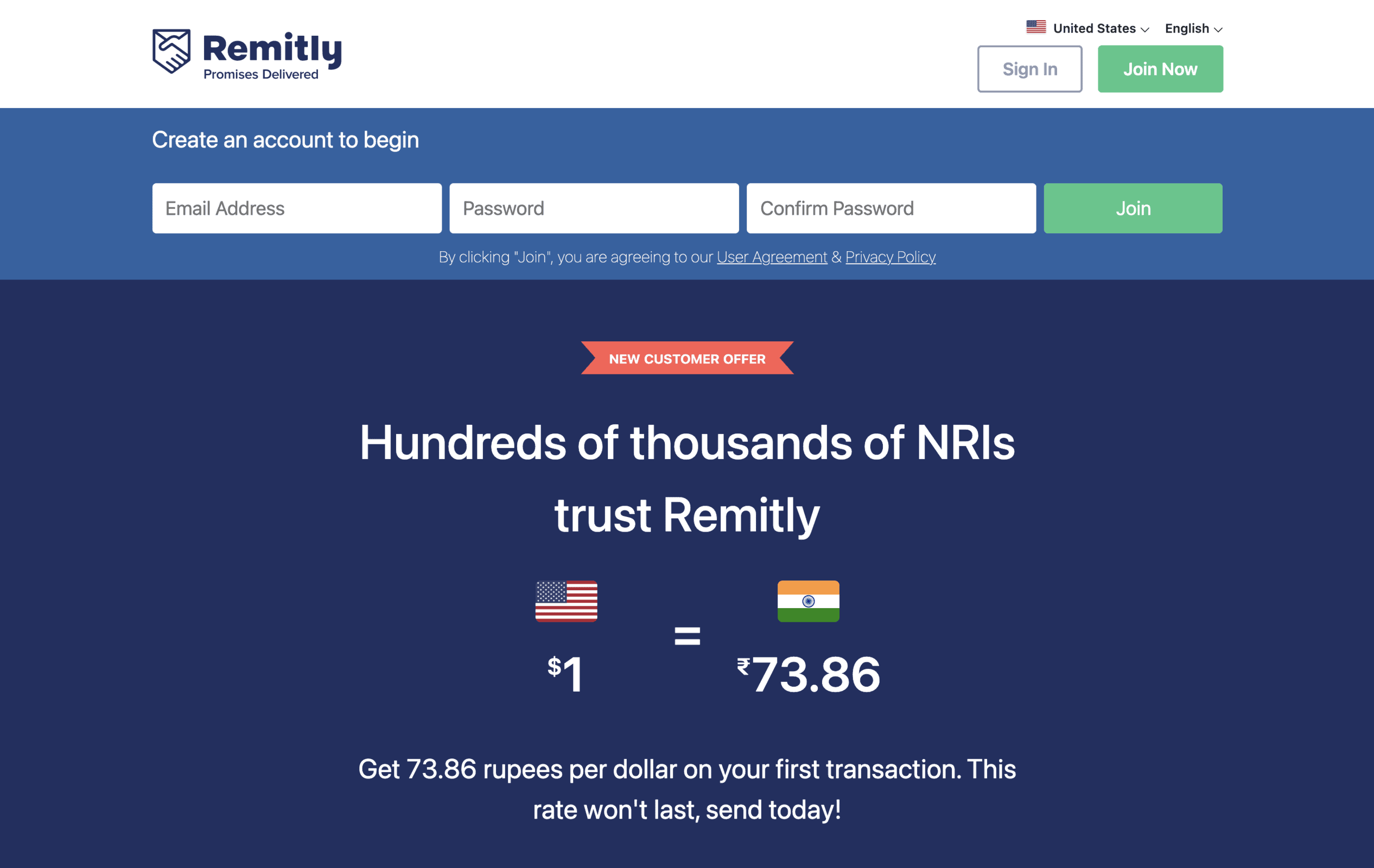

Remitly

Remitly is another emerging player in the fintech world. The stable, fast, and secure money transfer service has very low fees — and none for transfers that are over $1000. But what really sets it apart from other options on this list is its morals.

Remitly has pledged $5 million rupees to companies providing aid to India during the COVID-19 pandemic. This includes food, oxygen, and protective equipment.

Remitly is a stable, fast, and secure money transfer service with very low fees.

Pros:

- Cheap transfers – $3.99 for transfers up to $1,000 (no fee for transfers above $1,000)

- Basic rates are processed within 3 business days (no fees); express rates arrive in four hours or less (fees included).

- One fixed exchange rate

- Up to $30,000 transfers

Cons:

- Hidden currency conversion cost of $13.

- Can only transfer up to $30,000

By speed: Best options for quick money transfers

Wire transfer

Wire transfers have been a money transferring staple for over 50 years. They’re extremely secure, fast, and reliable. But, as one might expect, they’re a bit outdated when it comes to convenience.

If you decide to use this method, you’ll probably need to go to a physical branch of your bank (or another agency) in order to send the money. Some banks like ICICI offer wire transfer services on their website, though.

As soon as you provide the institution with all necessary information about the recipient, they will initiate the wire transfer. Every bank handles the process a bit differently, so you’ll have to check with your bank to get the most accurate information.

Pros:

- Very quick service (usually within 24 hours)

- Secure. You’ll work directly with your bank or an accredited company like Western Union to initiate a wire transfer

Cons:

- You’ll pay a fee for the speed – anywhere from $10-35 USD (check with your bank for the most accurate fees)

- Once the money is sent, you can’t get it back. Make sure you send it to the right person

- You’ll have to go to a bank or other physical institution

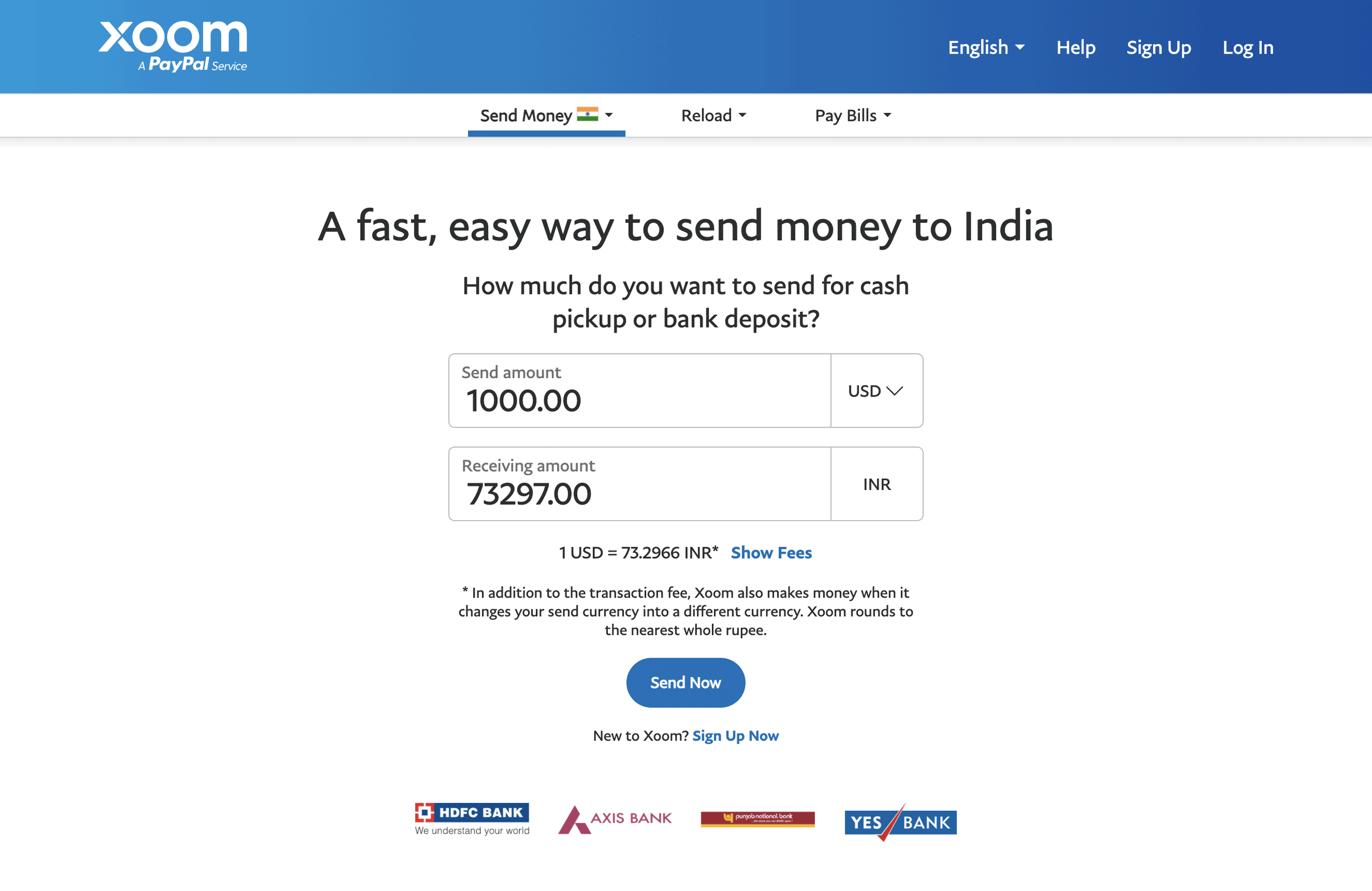

Xoom.com (part of Paypal)

Xoom (powered by PayPal) is regarded as one of the best money transfer services worldwide. They’ve been providing quick, affordable, and convenient money transfer services since 2001.

The best perk of Xoom is online-to-offline money transferring. This means that recipients can withdraw money at a specified location in India as soon as the online transaction is complete. They won’t need a bank account or internet connection to receive funds.

Pros:

- 24/7 multilingual customer service

- Flat $4.99 fee no matter how much you send

- Money arrives in minutes in most cases

Cons:

- Basic accounts limit your sends to $2,999 per day

- Xoom rounds to the nearest rupee, so you’ll actually be charged a bit more as a result

- Credit/debit card fees of up to $90 to some countries

- Limits on the money you can send daily, monthly, and biannually – these limits depend on your account level

By ease of use: The easiest options to send money

MoneyGram

MoneyGram is a big market player in international money and remittance transfers. It helps hundreds of thousands of people around the globe transfer money to India and other countries on a daily basis.

MoneyGram is very fast and offers a same-day transfer — albeit at a slightly higher fee than some other services. However, it is still an affordable, fast, and consistent service if you’re planning to send money to India.

Pros:

- Very fast transfers – most are finalized within 10 minutes

- Global network of 350,000+ agents in over 200 countries worldwide.

- Fraud protection makes it secure and reliable

- Very low or non-existent transfer fees to bank accounts

- More than 80 years of trusted service

Cons:

- $10,000 per month limit

- Exchange rate margins are poor and can go as high as 5.05%

- Required documentation varies across different countries

Western Union

Western Union has been a fixture in the money transfer space for over a century. Its dependability, convenience, and ease of use are the main reasons for its longevity.

With branches in almost every country in the world and a local withdrawal option, it’s no wonder it’s one of the most popular remittance solutions. The service is quickly gaining popularity for business transactions, too.

You can also send up to $50,000 per day to the State Bank of India, ICICI, HDFC, and other major banks. However, it’s important to note that transfer times will vary — even up to a week in some cases.

Since the fees depend on both the amount and the destination, Western Union is not recommended for small transactions.

Pros:

- Convenient and easy-to-use app

- Over 125,000 locations in India for pickup

Cons:

- Can take up to a week (faster if using debit or credit, but fees apply)

- Can get very expensive, so not recommended for small amounts

- Fees and rates are unpredictable and change by location and type of transfer

PayPal

PayPal is considered the largest online payment processor. With PayPal, you can easily transfer money from one account to another without directly using your credit card or bank account.

The advanced search feature is a secure way to ensure that you’re sending money to the correct recipient. Each user has their own unique link and QR code.

You won’t have to worry about hidden fees either. Transactions are free for both senders and recipients.

Pros:

- Safely encrypted

- Mobile friendly

- No fees for personal use

- Prevents fraud and helps with payment mistakes

Cons:

- Charges 2.9% (plus additional $0.30 fees) for business use

- 1% fees for instant transfer (Free transfers take 1-3 days)

- Account freezes occur until you verify aspects of your account

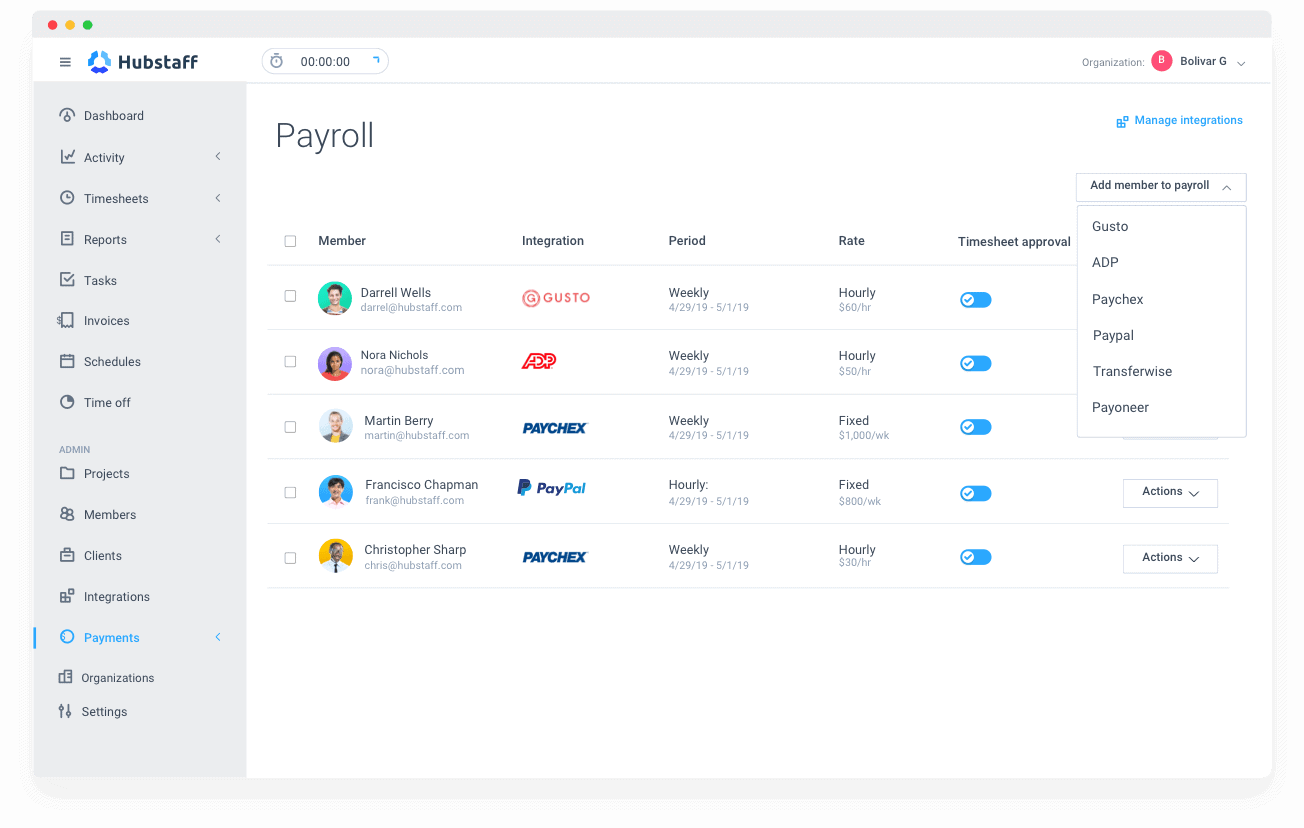

Automatic money transfer to India with Hubstaff

Hubstaff is a time tracking software that tracks time down to the second. You can set hourly rates and pay everyone on your team simultaneously from one central location — even if their preferred payment methods are different.

Whether it’s through PayPal, Wise, or other tools on this list, you can automate the entire process. You’ll get automatic reminders to review work hours and payments will only be sent with your approval.

Hubstaff’s automatic payments are fast, inexpensive, and reliable. Plus, you get access to a suite of productivity tools that help everyone on your team get more done.

Pros:

- Best for easy, automatic payments on an ongoing basis

- Easily pay remote teams, contractors, freelancers, and virtual assistants for time worked

- Use timesheet approvals to ensure you’re sending the right amount every pay period

- Activity scores and optional screen captures ensure that you’re only paying for time spent on your projects

Cons:

- You need a payment integration with a tool like PayPal in order to send money.

Transfast

Like PayPal, Transfast focuses on convenience. Simply enter the currency and where you want to send money to get started.

Transfast is great for the recipient. They partner with banks and cash pickup locations worldwide as part of their payout network. This makes it easier for your recipients to collect funds — even without an internet connection.

Pros:

- Simple website experience with an app available

- The service has been around for 25+ years

- Free if you pay by bank

Cons:

- Takes 3-5 business days to receive the money.

- Fees for debit/credit card

Other ways to send money to India

Personal checks

Another option for transferring money to India is by sending a personal check.

This method is fairly secure, but also time-consuming. It’s nice knowing that checks that don’t reach their intended destination can be canceled. However, this can slow the process down considerably.

Even if they do receive payment quickly, your recipients may not be able to cash the check immediately. Due to fraudulent check scams, bank verification of the deposit is necessary. There’s also an additional fee that needs to be paid for the exchange rate.

Pros:

- Secure because it’s written out and verified

- Can be canceled anytime

Cons:

- Some banks may not accept foreign checks

- Exchange rates apply and might need to be paid by the recipient

- Slow process (needs to be mailed)

- Risk of being lost in the mail

- Fraudulent check scams make it challenging too

Email money transfer

Email money transfers are pretty easy. All you have to do is fill in a form on your bank’s website, add the recipient’s email address, and answer a security question.

The recipient will need to provide the same answer to the security question and the money transfer process will begin. It may take up to five days to complete, but there are no extra charges.

Many people consider this type of transfer unsafe. No personal information is shared, but the convenience makes it all too easy for phishing scams. Always double-check any email addresses involved.

Pros:

- A low-cost way to send money to India

- Safe for the sender because the email initiates the send but does not physically transfer money

Cons:

- Not available at all financial institutions

- Bad for recipients. This method is commonly used in phishing scams

- Slow method that can take up to five days to complete

NRI-NRE account

An NRE (Non-Resident External) account is designed for NRIs (non-resident Indians) who need to transfer foreign earnings back to India.

The greatest advantage is that you can deposit money in U.S. dollars but recipients can withdraw it in Indian Rupees. As long as you’re an NRI, you won’t have to pay taxes on the amount sent to your NRE.

Many freelancers in India prefer this service because of its convenience. It can be a little time-consuming to set up an account if you don’t already have one, though. You’ll then have to wait up to a week for the payment to process.

Pros:

- Favored by freelancers and NRIs

- Ability to deposit in one currency and withdraw in another

Cons:

- Not a quick process

- Account is in Indian currency and exchange rate fluctuations could cost recipients money

Subscribe to the Hubstaff blog for more posts like this

Whatever method you choose, be sure to communicate with your contacts in India to avoid any misunderstandings.

Consult your virtual employees about which payment methods they would prefer — and don’t forget to do some research of your own before making a decision.

Check out these cybersecurity tips to protect your remote team:

How to Protect Your Team: Expert Tips for Work From Home Security

Avoid Disaster With These 8 Small Business Cyber Security Tips

Frequently asked questions

Sending money is always a little nerve-racking. If you’re still not sure which route to take, here are some answers to a few FAQs about transferring money to India:

How can I send money to India instantly?

If you don’t have time to wait for payments to process, the fastest methods are Xoom, MoneyGram, and PayPal. You’ll need to wait for payments to process (usually up to a few hours), but it’s much faster than some of the other alternatives.

What is the cheapest way to send money to India?

Transfast and Western Union allow you to send money at a cheaper rate than other options. Transfast offers better exchange rates than some of the alternatives on our list and offers a Value+ service. If conducted with a bank account, Western Union offers some fee-free transactions.

How can I send money to India without fees?

Transfast’s Value+ service is a fee-free solution for sending money to India. If you pay via bank transfer, Xoom is free as well.

How can I send money to India without a bank account?

Both PayPal and Xoom allow you to send money to India without a bank account. Once your recipients set up a PayPal or Xoom account, they can store the money there if they need to.

Can I use Google Pay to send money to India?

Yes, but you’ll need an internet connection, an Indian bank account, and an Indian phone number per Google Pay’s support page.

This article was originally published in March 2018. It was updated in August 2021.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...