As your business grows and you hire new employees, you’ll want to know the difference between salaried vs. hourly employees. Depending on the circumstances and the type of business you run, one might be a better option than the other.

Understanding how they differ can give you a better idea of which to choose when hiring employees. Our guide will explain the differences between salaried and hourly employees to help you decide which payment style to use.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysThe difference between salaried and hourly employees

Salaried and hourly employees differ in how they’re paid and their overtime pay eligibility. The ideal model will depend on your specific business and staff.

While hourly employees receive an hourly rate based on the number of hours they work, salaried employees receive the same amount every pay period.

Unlike salaried employees, hourly employees can earn overtime pay when they exceed 40 hours in a work week.

Remember that your payment scheme will differ if employees are considered exempt or nonexempt. Let’s cover the differences before returning to our discussion of salaried vs. hourly employees.

Exempt vs. nonexempt: A quick overview

Exempt employees are individuals who may not receive overtime pay for working longer than a 40-hour work week. Employees with exempt status will need to meet these three requirements:

- They must be salaried employees who make at least $684 per week or $35,568 per year.

- Employees must meet the Fair Labor Standards Act’s (FLSA) requirements for exemption by holding specific executive, outside sales, or administrative roles (see the Department of Labor’s fact sheet for more details).

- The business must maintain FLSA time tracking compliance.

On the other hand, nonexempt employees will qualify for overtime pay and bonuses if they exceed 40 hours of work in a work week. Learn more about the differences between exempt and nonexempt.

Overtime generally counts as time and a half above the hourly wage when working extra hours. Federal and state law dictates these requirements, so ensure you’re in compliance.

The following table illustrates the differences between salaried vs. hourly employees.

| Salaried workers | Hourly workers |

|---|---|

| A fixed amount of pay per pay period. | The amount of money earned depends on the number of hours worked. |

| Lack of overtime hours and pay. | Employees receive overtime pay when working more than 40 hours per week. |

| Personal and work time often blend together. | Tends to make for better work-life balance. |

| Employees receive benefits like health insurance, retirement plans, sick days, and paid time off (PTO). | Hourly positions may not include other benefits or perks. |

| Employers often hold full-time salary employees to a higher standard. | Hourly jobs tend to be held to a lower standard. |

| Employees are often more secure in salary positions. | Work schedules can vary depending on the employer’s designated work hours. |

What does salary pay mean?

The U.S. Department of Labor defines salary pay employees as anyone who receives payment on a “salary basis” — an employee who receives regular pay at a fixed rate regardless of the employee’s performance or logged hours.

Employees will receive a steady pay rate while often enjoying other benefits such as PTO and sick leave.

Typically, employees and employers will discuss the work salary throughout the job interview, and the employer may disclose the base salary in a job listing.

Benefits of having salary employees

Whether you own a small business or a larger organization, there are many reasons to have salaried employees.

If you’re unsure whether to hire salaried vs. hourly employees, some of the specific benefits of hiring salary employees include:

- Easier payroll — Unlike hourly pay that varies based on work completed, salary pay is much easier to calculate. You pay the same set amount each pay period without needing adjustments.

- Increased flexibility — Salaried employees also benefit from increased flexibility. They can work around interruptions that may develop, including emergencies or other events in employees’ personal lives. Flexibility will help ensure the employee’s work schedule doesn’t suffer because of these events.

- Eliminate the potential cost and headache of overtime — If you pay employees overtime, you’ll need to calculate these extra costs. Reviewing overtime can be a tedious step. Additionally, overtime pay can lead to more expenses for your business. Instead of overtime, salary employees receive benefits packages that include comp time. These benefits are easier to manage and potentially more cost-effective.

What does hourly pay mean?

Hourly pay is the amount of money that part-time or full-time employees earn for every hour of work.

When an employee works hourly, they receive a fixed pay rate per hour. This includes any fractional hours worked. Hourly employees often don’t typically receive the same benefits as salary employees. Generally, hourly work doesn’t come with the kind of job security that salaried jobs provide.

Benefits of having hourly employees

On the other hand, hiring hourly team members generates many benefits. Some of these advantages to keep in mind:

- Hourly workers can receive minimum wage — Businesses that are just starting out and don’t have large payrolls can benefit from hiring minimum wage hourly employees. In these cases, paying an hourly wage may make more sense than hiring salaried employees. The lowest rate that hourly employees can receive is the federal minimum wage, which is currently $7.25. While state minimum wage laws can increase this amount, you may wind up saving more money than you would with exempt salaried employees. The latter must receive at least $455 per week, which translates to $11.38 an hour.

- More control over hours and costs — When hiring salaried employees, you must pay a fixed full-time rate regardless of how much business you get. You’ll benefit from a bit more flexibility in this regard when you hire hourly staff. You can schedule team members for fewer hours if you’re dealing with a slower season. This method is generally easier than hiring part-time salaried workers.

- Save money on benefits — Many hourly employees don’t receive the same benefits as their salaried counterparts. If these employees don’t work full-time, you may not need to pay for potentially unaffordable benefits packages.

Which is better, salary or hourly?

If you’re looking to hire employees but are still on the fence between salaried vs. hourly employees, consider the pros and cons of each.

Both come with unique advantages that can make them beneficial for your business. For example, hiring hourly employees can help save on benefits, while hiring salaried workers can make certain payroll tasks easier. On the other hand, you may struggle to find hourly employees who are as skilled and qualified as salaried employees.

You weigh the benefits of each for your business, but it’s also essential to keep employee morale in mind. Although younger employees entering the job market for the first time may be willing to sacrifice higher pay and benefits, more experienced and skilled workers may want to negotiate a salary.

The choice between salaried vs. hourly employees ultimately depends on your business’s needs and goals. If you require highly experienced and specialized staff, you may want to hire salaried workers. Conversely, hourly employees may be ideal if your goal is to save more money and remain more flexible as you grow.

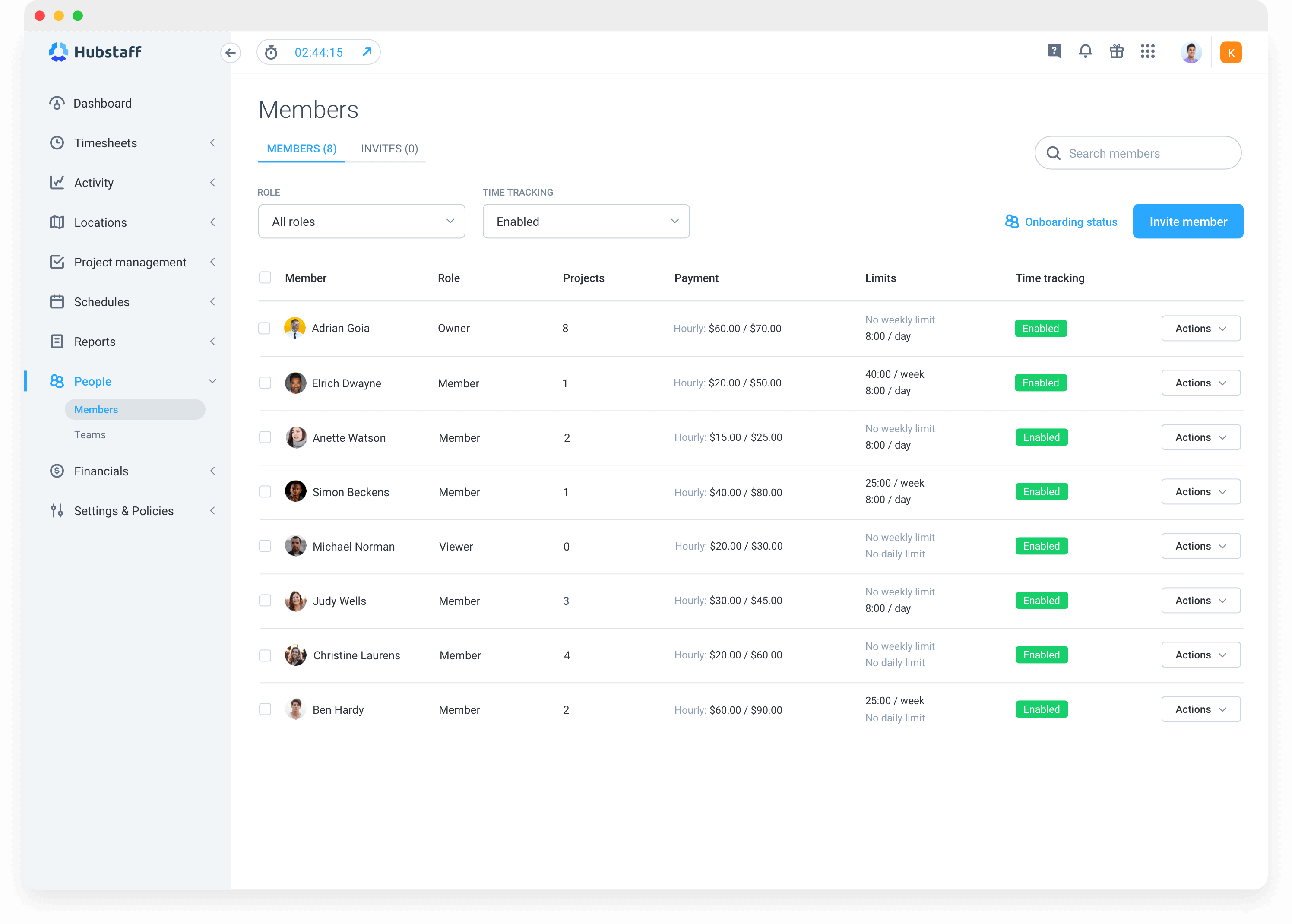

To help with employee payroll and time tracking, check out Hubstaff’s employee time tracking software for your business. No matter if you pay your team by the hour or by salary, if your team works on the road or in another country, our all-in-one payroll, shift scheduling, and automated payment platform will save you time and energy. Check out a free demo today.

Subscribe to the Hubstaff blog for more posts like this

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...