As a freelancer or a small business owner, you work hard. You provide a phenomenal product or service, work with your clients to ensure they’re satisfied, and get paid when all is said and done. Well, almost.

There’s another step that you’re missing: Freelancer invoicing software.

Invoicing is one of the least exciting parts of freelance life. But it has to be done. And if you want things to go smoothly—invoices being received, paid on time, easy to gather for taxes and financial tracking—you need a system to create invoices.

The invoicing apps below take the pain out of this process. We’ll look at eight great pieces of online invoicing software for freelancers, and then we’ll go through some tips on making your invoicing process as effective as possible. Take a look and think about advanced features you might need, like recurring invoices or unlimited invoicing.

Boost your team’s efficiency with Hubstaff's productivity tools

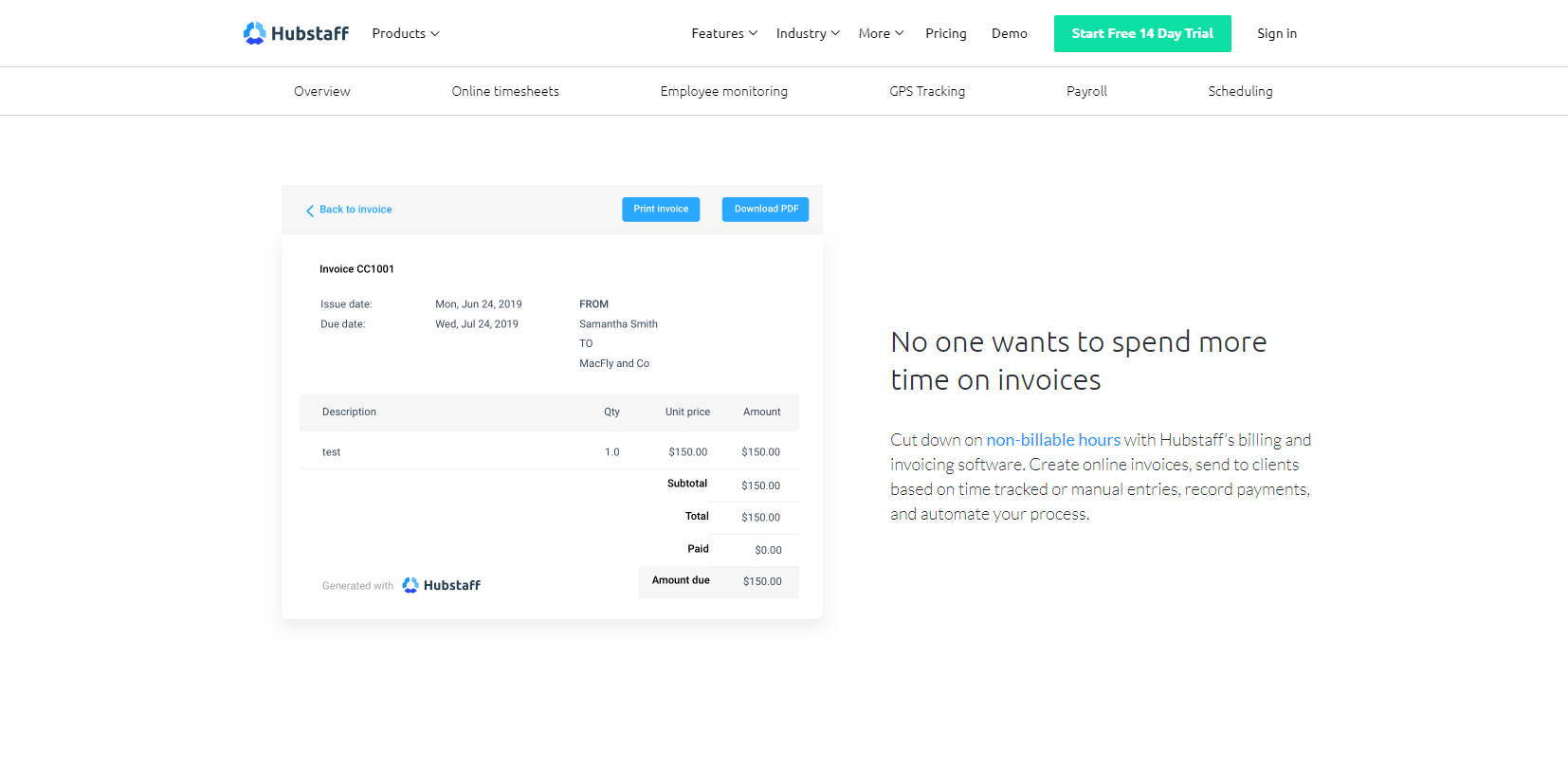

Try it free for 14 days1. Hubstaff

Hubstaff’s online invoicing software has distinctive features integrated into all our options. Get what you need with all the data backing it up.

Our feature-rich platform allows you to invoice clients for individual items or time tracked via Hubstaff, integrating project management and time tracking without needing another tool. The invoice generator can quickly create accurate, automatic line items for projects and tasks.

You also have the option to build invoice templates and set billable and payable rates to keep track of the project expense, making it easier to issue unlimited invoices. You also can set the amount to bill for each project or person. Add notes, tax, PO numbers, and more in just a few clicks.

Once generated, you can send the invoices in multiple formats, such as HTML, PDF, or email. You can even see when a client has viewed the invoice. To help with accounting, you can record a full or partial payment against the item. We also support businesses that need to send unlimited invoices and link those expenses to project management software.All of these features are available on plans starting at $10 per month. A free trial is also available so you can try out the app.

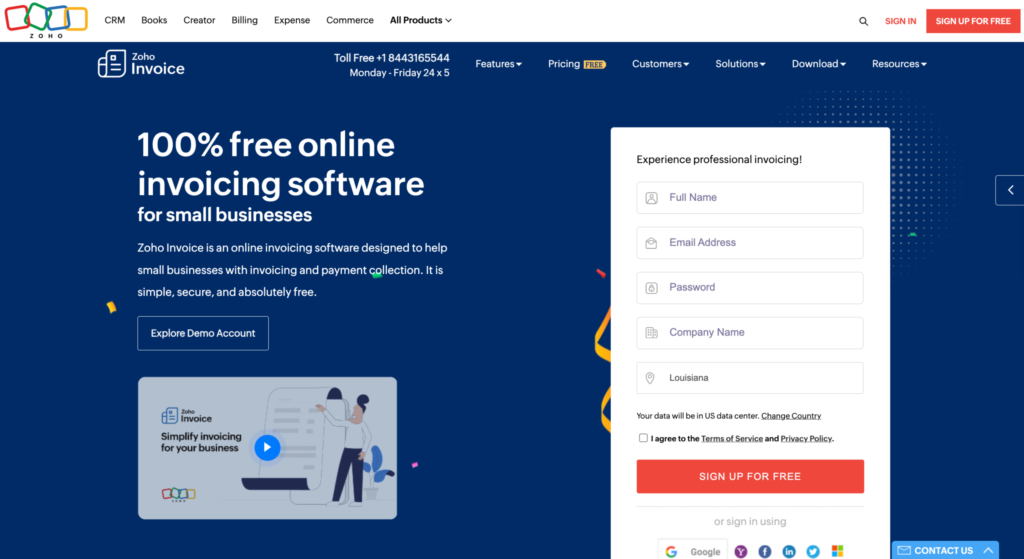

2. Zoho Invoice

Zoho Invoice makes creating and sending well-designed invoices easy through its invoice software. Even with the free account, you can customize every detail on your invoice to reflect your brand. The service is an invoicing system integrated with several payment gateways, including PayPal, Stripe, 2Checkout, and WePay.

With the invoicing software free account, you’ll get one user and up to 1,000 invoices per year. There are limitations to the number of scheduled reports you can run. Plus, you’ll need to rely on a single currency for your contracts.

If you need to step up your plan to add more clients, customers, or team members, paid plans start at $20 monthly. You should jump to the Zoho Invoice Professional version at a higher price point as your complexity or size increases.

Zoho Invoice also integrates well with Zoho’s other suite of apps, which includes marketing, email, HR, and business process tools. Mobile invoicing makes Zoho a good choice for people on the go, and mobile access to their wide variety of other freelance business tools is excellent for freelancers and small business owners who do a lot of traveling.

Don’t forget that Zoho Invoice integrates with Hubstaff for easy time tracking and reporting, too!

3. FreshBooks

FreshBooks’ invoicing software looks highly professional, thanks in part to its top-notch invoice software. User reports and reviews say it is straightforward to use and customize so that each invoice matches the style and message of your brand. It accepts credit card payments right from the invoice to add to the sense of professionalism, along with accurate sales tax calculations.

People also like the ease of the mobile app and the support offered, even for its lower-tier options. Automatic reminders for unpaid invoices, late fees, and the ability to accept deposits for work not yet done make FreshBooks an excellent billing software option for small business owners and freelancers. Invoice tracking, recurring invoices, discounts, tax calculations, and billable hours tracking are among other features that make this a standout option. You can even automatically import expenses from your bank account.

All of this power comes with a cost, though. After a free trial, you’re looking at $19 monthly for up to five clients. If you need up to 50 clients, the rate increases to $33 per month or $60 for unlimited clients and invoices.

Freshbooks integrates with Hubstaff for easy FreshBooks time tracking and reporting.

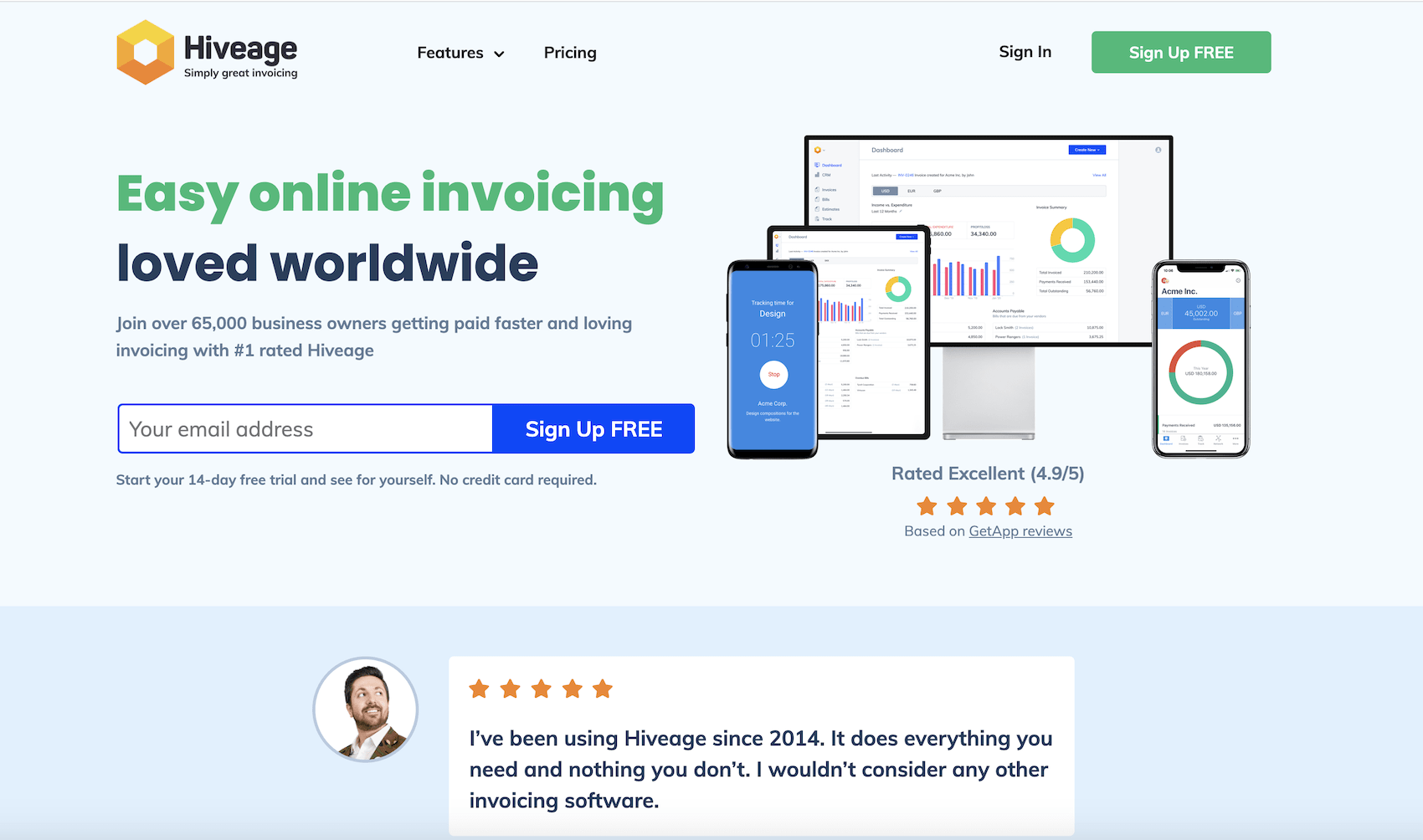

4. Hiveage

Hiveage offers various services, and this invoice generator system for small businesses and freelancers is one of the best for growing a freelancing business.

Hiveage invoicing software has updated its plans recently, so it’s important to review them based on your needs. The free plan now comes with unlimited invoices and estimates but is limited to five clients. Paid plans, starting at $16 per month, slowly increase the number of clients and team members you can, adding financial reports, recurring billing, and greater customization.

Payment reminders, bank transfers, time and expense tracking, 12 online payment gateways, CRM-powered dashboard reports, and a variety of other features that you’d expect to come with an online invoicing solution are available across most plans. Upgrades also enable you to customize invoices, use your specific domain, and get personalized support.

Users rate it high in terms of value for their money and features like easily flagging how long an invoice has been outstanding. The most common drawbacks on review sites are concerns with support, and some features are difficult to turn off.

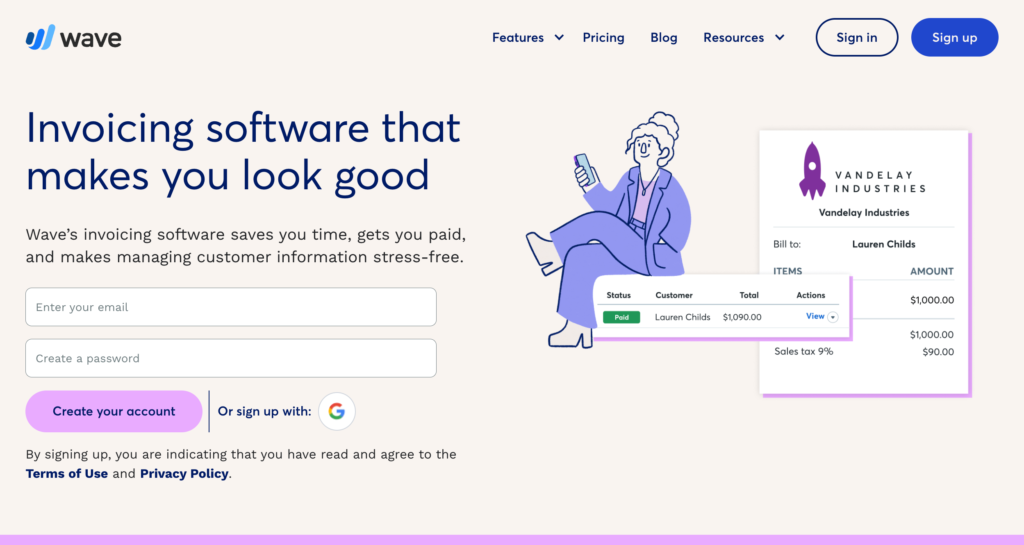

5. Wave

If you’re just starting, Wave offers a comprehensive suite of billing and invoicing tools for businesses like yours. It’s a solid solution with most of what you need for free, while you can pay for advanced options like payroll.

Users won’t need to pay for a customized invoice, so you look professional from day one. This is one of the few hosted invoice tools with that high level of free functionality, so you get that power anywhere you need it.

Wave invoicing software offers customizable invoices, recurring billing, bank transfer options, and payment reminders. Automatic status updates and payment receipts mean you don’t have to spend extra time managing the entire invoicing process. And if you use the Wave Accounting software app for your small business, the invoices integrate into your financial tracking.

One drawback some freelancers face is needing to use Wave’s payment processor for online payments. That means you’ll pay their rates to receive your customers’ bank deposits, credit card payments, or Apple Pay. Credit card transaction fees start at 2.9% plus $0.60.

It’s not a significant issue but worth noting based on user reviews.

6. Momenteo

For freelancers looking for the best invoicing software that lets them invoice hassle-free after finishing projects, Momenteo gets the job done.

Momenteo lets freelancers customize their invoices, which helps create a professional and respectable brand image. The app also offers expense management and allows you to check the invoice status—ideal for those looking to set up recurring invoices—after they have been sent, so you don’t have to keep following up on your clients if they haven’t seen the invoice yet.

While Momenteo’s free plan comes with all its features and two active clients, it doesn’t support the ability to accept online payments. The paid plans start at $6.95 per month, though its starter option will feature Momenteo branding on invoices.

It’s simple and direct, making it a smart fit for freelancers who want a tool without all the bells and whistles.

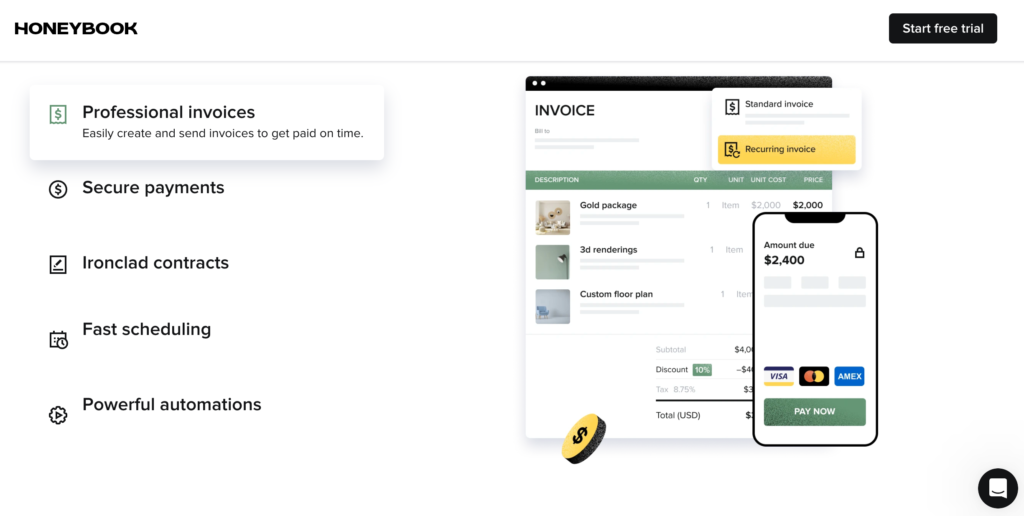

7. HoneyBook

HoneyBook offers a professional-looking invoice platform for freelancers that’s easy to start and send to clients. Customization is fast, and features like invoice scheduling and payment reminders are intuitive. It’s a robust tool and has reliable mobile options.

From the client’s perspective, HoneyBook makes paying easy via a link that supports multiple payment types and devices. That means you can work with small or large businesses and only need to provide a little support for getting paid. You can manage invoices more easily while getting insight into your billable hours.

It allows for different payment terms, which can help freelancers as they move to new business models that take retainers and deposits, offer one-time rates, or set up recurring billing. You’ve got a full management tool, and its starter plan comes in at $19 per month with no limit to clients, projects, or invoices.

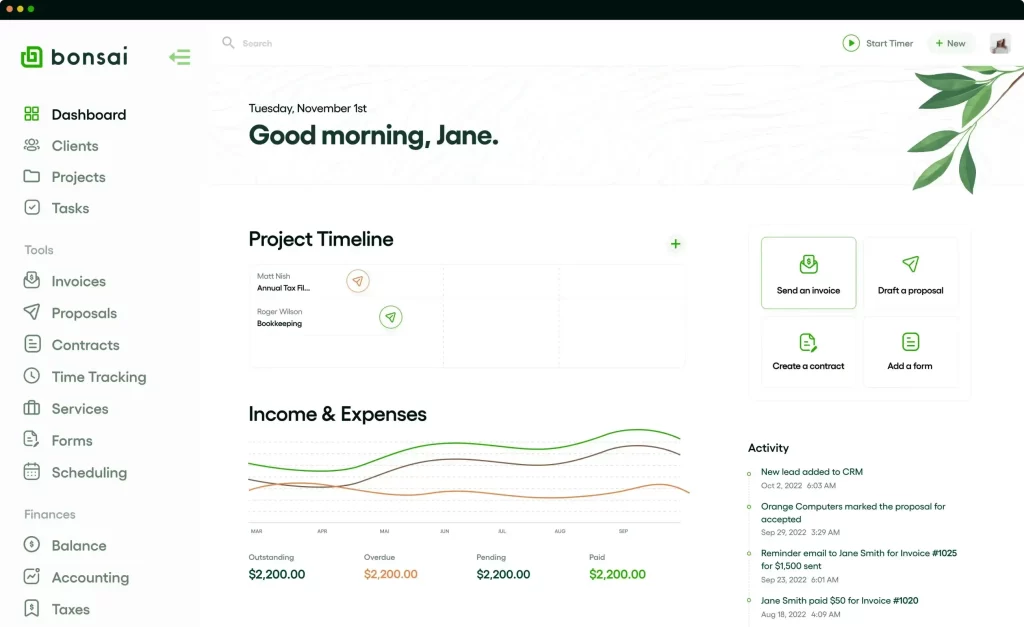

8. Bonsai

Sometimes, freelancers need a powerful friend. Bonsai might be an interesting option for your invoicing if that’s the case.

Compared to the other tools on our list, Bonsai is a more inclusive option that adds invoicing and financial planning to project management and even some customer relationship management. It comes with a robust dashboard to track timelines and expenses as well as accounting elements like taxes.

It has solid reviews, intuitive templates, and client-friendly invoices.

The Starter plan costs $21 per month for core features, though it includes Bonsai branding. The most compelling option may be its Professional upgrade, $32 per month, which gives you a branded client portal for payments and management. Higher tiers offer more integrations, subcontractor support, and even hiring templates. It’s a step up when you’re in growth mode.

Selecting the Right Invoicing Software for Freelance

Any list of tools can make your decision harder or easier, depending on what you know when getting started.

To help you select the right invoicing software for freelance operations, begin with your needs. Think about the functionality required to help you today and what you might want as you grow. Questions to ask include:

- How many clients do you have now?

- How many clients will you expect to have at your high point in 2024?

- How do they like to pay you?

- What information do they want on an invoice, and does that require you to create custom invoices?

- How many people will need access to your software?

- How many employees or partners do you expect to have?

- And how much time do you have to learn a new or complex system?

Those should help you clearly understand your needs. If you only plan on having a couple of customers, any of the free plans on our list should work. If you already have ten or more, you likely need a paid option and should compare that across all brands.

When prompt payments are an issue, or you’re constantly sending multiple invoices, features can make a huge difference in what accounting services and invoicing app is right for you.

Our last question is also essential to understanding whether you’ll really use a new tool. If you don’t have much time in your week for new software, stick to something familiar or intuitive. On the other hand, if you like new tools and are willing to learn, some of the higher-priced options may have advanced project management tools that help improve your business.

The core criteria to come back to are having what you need today, fitting with your current schedule, and the ability to scale so you don’t need to replace the software if you have a great 2024.

Tips to make the online invoicing process easier

Once you’ve chosen an invoicing tool or free invoicing software, it’s time to improve your payment process. You could just send invoices and try to remember to follow up, but if you put some effective practices in place, the entire process will be smoother.

Remember these five things when invoicing to get paid faster and with less effort.

1. Automate billing with integrated invoicing software

The more integrated your apps are in your invoicing software, the more time they’ll save you. For example, if you track your time with Hubstaff, you can use the FreshBooks integration to import your time and invoice it. That’s much easier than doing it all manually.

2. Use a checklist for account setup

When you set up an account for client management within your invoicing system, collect as much information as possible. Using project management tools can streamline this process, making it easier to collect payments and keep track of freelance invoice templates or customized invoices you use.

Remember to look for processes that might need to be set up. The most common is recurring invoices or integration with time tracking tools.

3. Get paid fast

Maintaining cash flow is crucial when operating a freelance or small business. Offering multiple preferred payment methods like Apple Pay, PayPal, or credit card can minimize payment delays. Automated or automatic payment reminders can also be set to prompt clients, ensuring you collect payments on time.

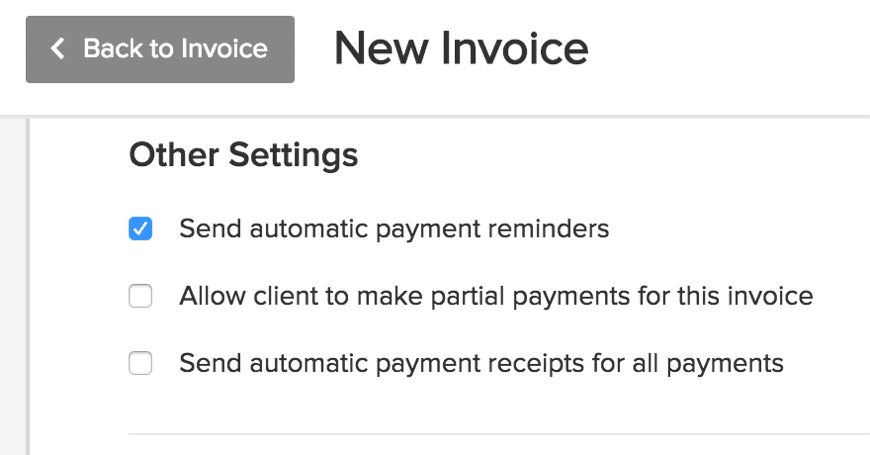

4. Automate reminders

Many online invoicing systems offer automatic payment reminders. Don’t feel like you’re being annoying; set up these reminders as soon as you can. These reminders can go a long way in helping you collect payments, especially when you’re handling unlimited invoicing.

5. Constantly monitor your invoicing systems

Make it a habit to check your invoicing apps regularly. This is crucial for anyone who wants to send invoices efficiently and keep track of them. Through regular monitoring, you can ensure that you get paid faster and fewer things fall through the cracks.

Monitoring also helps you see if you need to expand your invoice app to something larger. Hitting ceilings may mean you need support for unlimited projects or a more robust accounting tool. Look for what invoicing feature you want to improve your payment schedule or payment integrations and improve your online invoices and business operations.

Share your favorite invoicing software for freelancers

When running a freelance business or small operation, understanding your invoicing software is absolutely necessary. You can turn this chore into a smoothly running automated process with the right tools and habits.

That gets easier when you like the tool you have for sending automated reminders, offering multiple payment options, and reviewing invoices. So, we want to hear your favorite tools and what makes your invoicing simple and effective.

And be sure to share your best invoicing tools and tips in the comments below!

Subscribe to the Hubstaff blog for more posts like this

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...