When it comes to growing your team, employee cost is more than just the sum of each new employee’s base salary.

For instance, if an employee’s base salary is $50,000, it will actually cost you somewhere around $62,500-$70,000.

Learning how to determine the cost per employee can help business owners make smarter hiring decisions, but there are other factors to consider.

The actual cost of employee remuneration is the sum of their total compensation, benefits package, taxes, and other overhead expenses.

Your human resource team should know these calculations and keep them in mind when talking to a new hire about their annual salary.

Understanding the cost of a new employee will likely change how you think about employee productivity and retention.

Let’s take a closer look at the cost of employees.

Table of Contents

- How to determine employee cost

- How to calculate employee cost

- Variables for employee cost

- Hidden employee costs

- How understanding employee costs can cut down on expenses

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysHow to determine employee cost

When determining employee cost, you’ll find that it comes out to about 1.25 to 1.4 times the team member’s salary.

However, that number depends on the business owner’s benefits, overhead costs, and the number of employees they have.

According to 2021 data from the Bureau of Labor, the salary costs for private industry team members were an average of $26.86 per hour worked. Benefit costs came out to an average of about $11.22.

There are some mandatory taxes and employee benefits that U.S. business owners are required to provide. Some companies may even go a step further and choose additional perks like 401K matching and tax-exempt transit credits.

When you bring on a new employee, you need to be aware of the total cost you will be paying to get them on board. From worker’s compensation to medicare taxes, there is a lot to consider.

This guide can help you determine your cost per employee in the private sector. We’ll break down each aspect of employee cost to simplify this process.

Employee recruitment and hiring

Job seekers won’t always be lining up around the block to work for you in this day and age. In a lot of cases, you’ll have to factor in recruiting costs. Let’s take a look at the average recruiting cost for an employee.

According to SHRM, hiring a new employee can cost $4000 or more. But where is this cost coming from?

There are some pretty concrete expenses related to hiring. For example, you need to post the position on job boards like Indeed and LinkedIn. These job boards may have a fee required to post or promote your job posting.

Internal recruiters will also need applicant tracking software to handle this process. If you don’t have the internal bandwidth, external recruiters can be expensive.

Once a potential candidate moves through the process, there will be other fees like background checks and drug tests to pay for, depending on your industry. A background check costs about $10-$20, and a drug test costs around $30 per test.

Plus, there are hours of admin work to consider. Someone has to create the job posts, list them online, do paperwork, and handle interviews.

A solid time tracking platform with reporting features can help you nail down how this process will affect employee payroll.

Onboarding and training

Onboarding costs will vary depending on the industry, but they can be expensive for many employers.

For example, in-office teams will have to pay for new software and equipment like computers, keyboards, and office equipment. Field service teams might have to pay for new uniforms, hardware, or protective gear.

No matter what field you work in, training is another cost to factor in. Fortunately, creating a strong onboarding program can help regulate these costs.

Wages

The primary budget item employers factor into employee cost is base salary.

In 2020, the national average wage for someone located in the United States was $55,628.

Of course, a team member’s wage will depend on location, experience, and job duties. Other factors like overtime and bonuses can also impact this number.

Let’s look at some of the factors that you should be factoring into employee wages.

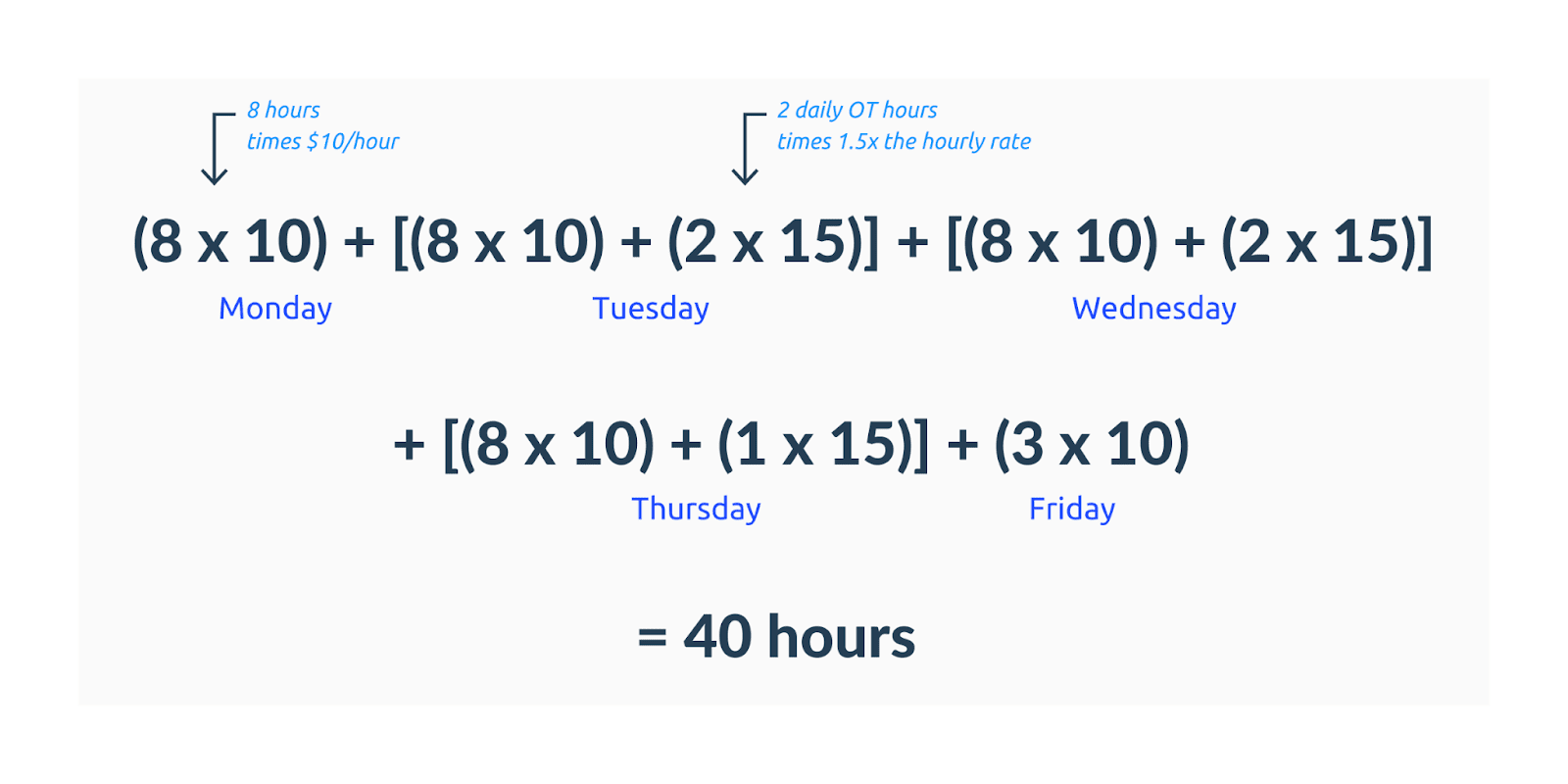

Overtime

Hourly and non-exempt employees are eligible for overtime when they work more than their allotted hours. While overtime definitely costs employers, it’s an unavoidable cost of doing business in some industries.

Overtime laws vary depending on the state. However, there are no limits to the number of overtime hours a team member in the United States can work. Using a time tracking system can help employers track overtime costs. It can also help you cut down on overtime hours and manage employee workloads better.

This not only helps you reduce your bottom line but also helps to prevent burnout.

Bonuses and promotions

On average, salaries increased 2.8% in 2021.

This stat reminds us that employers need to factor in annual wage increases, bonuses, and promotions when assessing total employee cost. They’ll also need to budget for irregular increases like equipment or holiday bonuses.

Benefits

Benefits are another significant factor when determining the total cost of employee compensation packages. These packages may include retirement plans, health care, and paid time off.

Benefits matter when planning your budget, but they are in your control. If your employee cost is too high, consider how you can tweak your benefits to save money.

However, a robust benefits package can help you retain and recruit top talent. Retention and recruitment issues can cost a company a considerable amount of money, so you’ll need to stay competitive within your industry.

You can also consider offering perks like flexible schedules and remote work that won’t cost you money but will keep employee morale high.

Retirement

Many employers provide a retirement plan for their employees. While this isn’t mandatory, it is a perk that potential team members look for.

According to the Bureau of Labor Statistics, 67% of companies offer a 401k retirement plan with an average match of 3.5% of team members’ salaries.

PTO

Per the Family and Medical Leave Act (FMLA), employers are required to provide up to 12 weeks of unpaid, job-protected medical and family leave each year.

After one year of employment, over one–third of private industry team members will receive 10-14 days of paid time off. This time off accounts for around 7% of total employee compensation.

Health care

Under the Affordable Care Act (ACA), business owners must offer health insurance to employees who work full-time hours. Small businesses may be exempt from this rule if they have less than 50 team members.

Often, health care is the most expensive cost to employers, costing $14,542 per year.

Taxes and insurance

Nothing is certain except death and taxes. This statement rings true for employers and team members alike.

How much do taxes cost employers? The IRS offers this extensive Employer’s Tax Guide. If you’re not up for reading a 50-page document on taxes, we’ll summarize it for you.

FICA

FICA (Federal Insurance Contributions Act) is a mandatory payroll deduction covering Social Security and Medicare. Social Security and Medicare provide benefits for retirees, children, and those with disabilities.

Employers are required to cover 6.2% for Social Security and 1.4% for Medicare.

FUTA

The Federal Unemployment Tax Act (FUTA) requires employers to provide payments for unemployed people. Companies pay 6% on the first $7,000 earned by each team member.

However, some employers receive a 5.4% FUTA tax credit, so their total payment is 0.6%.

SUTA

State unemployment tax (SUTA) and State Unemployment Insurance (SUI) can also increase your employee cost. The percentage you pay as an employer will depend on the state.

That said, most SUTA tax ranges between 2.7% and 3.4%. To learn more about the tax rate in your state, check out this website.

Worker’s Compensation

Employers are required to pay Worker’s Compensation insurance to cover employers who are injured on the job.

With worker’s comp, employers are charged a percentage on each $100 of an employee’s salary. Of course, the cost per $100 of covered wages depends on both the state and your industry. With a quick glance, you can see that rates range from $0.51 to $2.27 per $100.

Additional Insurance

On top of health insurance, there are a few other optional insurance fees that employers may need to factor into their budget.

- Dental Insurance

- Life Insurance

- Professional liability coverage

Dental and Life insurance policies are optional, but you’ll probably need to add them to your employee benefits package to compete with other employers. Professional liability insurance is another optional layer of protection corporations offer.

Subscribe to the Hubstaff blog for more posts like this

How to calculate employee cost

We’ve been throwing a lot of numbers and percentages around, so you’re probably wondering how this all adds up.

These costs vary depending on several factors, but here is an example that employers can use to estimate employee costs.

For this example, we’ll be using the average wage for a U.S. worker in the state of Ohio. We’ll also assume that their employer offers average retirement and health care contributions.

| Employee base salary | $55,628.60 |

|---|---|

| Retirement (2.5% of salary) | $1,390.70 |

| Health care (average cost in Ohio) | $201.00 |

| FICA (7.6% of base salary) | $4,227.70 |

| FUTA (6% of first $7,000) | $420.00 |

| SUTA (2.7% of base salary) | $1,501.90 |

| Worker’s compensation ($0.74 for each $100 of base salary) | $411.60 |

| Total employee cost | $63,781.50 |

You can try this employee cost calculator to find your own employee cost. Once you have established your employee cost, it can also be helpful to determine your labor cost percentage. This percentage will vary depending on your industry. Ideally, your labor cost percentage should be 20%-35% of your gross sales.

Variables for employee cost

Now that you’ve got an idea of your total employee cost, let’s look at some of the variables that may impact this cost.

Location

As you’ve now learned, the cost of compensating an employee can vary drastically depending on the state, city, and cost of living.

Tax rates will depend on the state where your business or your employee is located in. Similarly, income varies depending on the cost of living in the area your employee or business is located.

States with the most expensive payroll tax rates include New York (12.75%), Hawaii (12.70%), and Maine (11.42%). The states with the cheapest payroll tax rates are Alaska (5.06%), Tennessee (5.75%), and Delaware (6.22%).

Whether your company or team members are based in the United States or other countries will impact your employee cost. Some countries have very high labor costs. Non-wage labor costs are the highest in Sweden (32.0% of total labor costs) and France (31.9%).

Industry

Your industry is one factor you can’t change to save money on employee costs. But, you should be aware of fluctuations in your industry’s compensation average.

Employee pay and benefits vary by industry, so you will need to match what your competitors offer if you want to retain employees. The industries with the highest corporate taxes are the advertising, aerospace, and apparel industries.

Additionally, some industries have more contract team members or pay hourly wages instead of salary. Both of these factors can cut down your employee cost drastically.

Remote teams

Remote teams cost less overall compared to in-office teams. Some of the expenses you need to consider for in-office employees include rent, utilities, and supplies.

Here at Hubstaff, we’re partial to working remotely. We have had a fully remote workforce since 2012.

Building a strong remote work culture isn’t always easy, but once you do it, both you and your employees will reap the rewards and freedom.

If your business requires an in-office presence, these are some of the expenses you can expect.

- Office space: renting office space is one of the biggest expenses for an on-site workforce. As teams grow, this expense will only increase as more office space is needed.

- Utilities: Along with the cost of rent, heating, cooling, and lighting your office space will also add to your overall cost per employee. The more team members you have, the higher your utility cost.

- Supplies: As a business owner, you will need to provide office supplies and tools for your employees. This could be anything from pens and post-it notes to keyboards and space heaters.

On the other hand, remote work comes with some costs to employers. Fortunately, many of them are optional.

Remote employers can calculate the cost of supplying software, devices, and even flying employees out to events in their employee cost budget.

Hidden employee costs

There are several employee cost factors that business owners might not realize are hurting them in the long run.

Many of these factors are necessary, but budgeting for them can help you anticipate any surprise additions to your budget.

Meetings

Meetings are essential, but too many can cost you money and prevent employees from being productive.

Employees have reported spending 550 to 750 hours in meetings every year. While not all meetings require you to pay for flights, all that time can hurt productivity. Establishing policies like no meeting days can help employees increase their productivity and manage their time better. Still, lack of communication can lead to wasted time and re-doing work.

Continued education and training

Paying for training and continuing education adds up.

In 2020, businesses spent between $581-$1,678 per employee on ongoing education and training. Investing in your employees is always the right thing to do, but be conscious of this expense when budgeting employee costs.

Socialization

All work and no play makes for a disengaged workforce. But how much fun is too much?

Retreats, coffee hours, and team lunches are great for morale. Still, you need to budget for these moments of team camaraderie.

For example, an employee retreat is about $700/night for each team member. To save money, you can get creative and hold virtual retreats.

How understanding employee costs can cut down on expenses

Now that you know your total cost per employee, what can you do with this information?

Most companies will want to try to bring their total employee cost down. To make the most of your expenses, try an employee time tracking software that cuts down on overtime and improves employee productivity.

With a software like Hubstaff, managers can monitor employee costs and track profitability. Our software can also help you ensure projects don’t go over budget and employees don’t exceed their scheduled hours.

As a business owner, knowing your cost per employee is vital. Bringing this cost down can help your bottom line. You should work this number into your budget and ensure that costs don’t sneak up on you.

Do you have any tips for calculating employee cost that you didn’t see in our guide? Leave us a comment below.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...