Tracking business expenses is a crucial part of financial management.

Small business owners and self-employed freelancers often struggle with the accounting aspects of running a company. However, to boost profitability and keep costs low, make sure numbers take top priority.

One way to do this is to ensure your spending habits align with budgets. Expenses also inform future forecasting and project estimating, making expense tracking important for every department within an organization.

Keep reading to gain insight on accurately tracking your business expenses. You’ll learn some proven strategies to support your financial business goals.

Boost your team’s efficiency with Hubstaff's productivity tools

Try it free for 14 daysTracking different types of business expenses

Expense tracking is the process of monitoring spending activity. Whether for personal or business reasons, expense tracking is best done in real-time.

Record expenses by logging receipts, incoming invoices, and other business-related costs. Make sure you track all expenses from debit card and credit card usage, ACH bank account transactions, and cash purchases.

Companies use various forms of accounting ledgers to maintain their records. Whether you use accounting software, spreadsheets, mobile expense tracking apps, or a paper-based system, expense tracking is vital for every phase of a business, from development to expansion.

When used in conjunction with budgets and income records, this activity allows business leaders to get a bird’s eye view of the overall financial health of an organization.

The Small Business Administration explains that expense tracking is necessary for maintaining a “sustainable balance between profit and loss.” This activity enables companies to identify areas where curbing spending will provide growth opportunities.

Furthermore, accurate records are essential for preparing financial statements — balance sheets, cash flow statements, profit and loss statements — used to apply for loans and inform internal and external stakeholders.

When your bookkeeping department consistently follows best expense management practices, IRS reporting and tax filing processes are more accessible and efficient, relieving stress and reducing costs for your company.

Depending on the business and industry you own or manage, you will likely track recurring and non-recurring spending.

Recurring expenses are typically the same each month: loan payments, equipment rental, insurance, legal fees, and minimum supply replenishment for product manufacturing.

Non-recurring business expenses vary from month to month. Some examples include office supplies, repair and maintenance, severance pay, certain capital investments, and one-time purchases, such as new computer systems and cash purchases for equipment.

Benefits of tracking business expenses

As you can see, businesses have many expenses to keep track of, and the process may seem overwhelming.

However, the benefits gained from leveraging money management strategies are worth the effort.

Along with helping a business gain a competitive edge in the marketplace, detailed expense tracking provides the following benefits.

As you read through these benefits, remember: you can’t just set up a tracking system and then forget it. Regularly checking in to your spending activity allows you to gain real-time insights into your financial health and spot red flags.

Control finances

Failure to control business expenses accurately will ensure business failure.

Taking control of your finances reduces or eliminates unnecessary overspending on everything from office supplies to employee meals and travel reimbursement.

Furthermore, comparing spending to the working budget identifies areas where the budget may need adjustments or if employees do not follow company spending guidelines.

Think of better financial control as an avenue to allocate resources effectively, resulting in opportunities to improve profit potential — one item, one department, or one day at a time.

Improve money management

Understanding where, when, and how you spend improves money management overall.

Automation tools, including mobile apps and integrated software solutions, save time and money.

A system that flags unusual spending behavior based on your company’s standards reduces risks of going over budget and enforces compliance standards and vendor relationships that guarantee best-pricing agreements.

When used to inform training processes, trailers can use expense management data to explain purchasing protocol during the onboarding process.

Proper training ensures that new and veteran employees understand how to use your budget as a guide to controlling buying decisions.Another benefit of a money management tool is tracking tax-deductible expenses. Home office upgrades, employee development and education costs, bank fees, business travel, uniform reimbursements, and other IRS-approved expenses help companies claim all the tax deductions they deserve.

Ease of business forecasting

Future forecasting becomes precise when you base it on actual spending in the past. Tracking fixed expenses — monthly bills, subscription fees, or loan payments — provides insight into business cost management.

Take extra time calculating the average cost of varied expenses. Varied expenses go up or down based on current pricing and availability.

One example of a variable expense in today’s environment is fuel. Gas prices fluctuate, with some localities offering tax holidays while others are seeing increases.

With so many variables contributing to the price variances, estimating long-term financial impact is challenging at best.

But, tracking the expense category highlights trends valuable for forecasting future fuel, shipping, associated costs, and other supply chain increases.

Equipped with information about fixed and variable expenses, companies gain insight into whether or not they can afford to invest in one-time purchases.

Your company may consider expanding or replacing aging equipment, and accurate forecasting informs timing and better money management strategies.

Leveraging the power of automation makes forecasting more efficient, especially if the technology monitors credit card spending and automatically sends information to an integrated accounting software program.

In addition, automated expense tracking makes generating reports more cost-effective and less labor intensive.

Subscribe to the Hubstaff blog for more posts like this

Quickly resolve problems

Complete visibility is crucial for controlling spending. When the bookkeeping department has to track down or correct receipts that are not accurate, it takes more bandwidth and more money to get a clear picture of where your company stands financially.

Organizations that track expenses in real-time can quickly spot trends slowing down their bookkeeping processes.

Along with improving receipt submission quality and timing, expense management strategies help companies achieve financial goals by identifying ways to lower production costs through negotiated vendor contracts.

Tip: Having a written receipt submission policy that explains what is and is not an acceptable receipt and the penalties for submitting unacceptable receipts or submitting receipts late will dramatically improve spending behavior.

The best expense tracker apps can even help you improve your credit score by helping you reduce spending, resulting in a more acceptable income to debt ratio.

And, every business owner who has ever been turned down for a loan based on a problematic credit score can appreciate how vital a quick resolution can be when money is tight.

Determine profitability

Comparing a monthly budget to monthly spending and bank account balances helps a company know if they are operating in the red or the black.

Determining an organization’s profitability at a glance involves creating accurate financial statements. Unlike a cash flow statement, which reflects income and expenses over a period of time, a profit and loss statement (P&L) demonstrates a company’s ability to create profits by examining generated sales compared to managed expenses.

A P&L generally includes several types of expenses, such as expenses associated with the cost of sales, general operating expenses, and administrative overhead.

Some P&L statements may list subcategories under a single heading called “operating expenses.”

Expense management tracking enables in-depth reporting for marketing, employee benefits, general administration, computer and technology spending, fulfillment, and other subcategories.

Another benefit of using financial statements as a guide is that these reports inform investing and debt management decisions. You might use extra cash on hand (realized profits) to create an emergency fund or pay down debt to lower interest fees.

Best strategies for expense tracking

Every business has unique expenses. Your costs might be calculated based on buying premade items and reselling them or a process that involves research and development that leads to in-house production.

If your work is custom, your budget will need to be similarly proprietary, too. Your budget should guide spending behavior and prevent overspending.

Although your actual expenses may differ from other companies, you should consider a few common crucial steps when starting expense tracking.

Categorize your expenses

Breaking down dozens of expenses into specific categories when using a manual system can be tedious. However, keeping track of your business records can help you save money.

For one thing, you’ll find it easier to get all the IRS deductions you’re eligible to take. According to Mazuma, missed employee expense deductions as one of the top five tax deductions small businesses leave on the table when filing their annual returns.

And as mentioned above, a breakdown created based on your specific financial goals and expenses provides opportunities to renegotiate vendor contracts for everything from monthly landscaping and cleaning services to office supplies and insurance coverage.

Update tracking regularly

The Pittsburgh Financial Endowment Foundation reminds clients that expense tracking is not a “set it and forget it” type of process. They advise tracking every expense, along with all incoming bills, daily.

Following their advice is a fantastic strategy. The formula should include updating your tracking policies as your company contracts or expands.

Updates might include:

- Adding new vendors

- Editing spending limits

- Ensuring all employees with buying authority have proper credentials

- Creating or deleting categories to reflect the current business model

Save digital and paper receipts

Even if you use mobile apps and a fully integrated accounting system that includes expense management features, always keep paper receipts.

The IRS does encourage digital receipts, and having copies of this data is prudent. Digital records, cloud storage, and automatic backups can protect your data.

But even cloud data loss can occur for a variety of reasons. Malicious activity, user error or accidental deletion, and over-writing data are the three most common reasons cloud data is lost.

A non-virtual, physical backup can be a good idea. Check with your state and local taxing authorities, CPA, or bookkeeper to see how long you should retain paper receipts.

Keep a monthly expense report

A monthly expense report allows you to track spending separated by expense categories.

You can use an Excel spreadsheet, a paper ledger, or a budgeting app. The important thing is to keep track of your expenses, so you know where your money is going.

There are a variety of worksheets and expense report templates available online today.

For example, an employee expense report may have columns to categorize transportation, meals, phone, lodging, fuel, and entertainment spending.

Some employee expense reports have space to log time spent with specific clients or on certain projects, enabling accurate comparison to the monthly budget figures and billing.

Unlike spending categories in an employee expense report, a small business monthly expense report typically includes columns for rent/mortgage, utilities, property taxes, insurance, licensing and fees, professional services, marketing, and other operational expenses.

Keeping monthly expense reports helps business leaders achieve their financial goals based on real-time data. And as part of an overarching expense management strategy, monthly expense reports inform training processes, purchasing policies, and certain financial decisions, such as establishing savings goals.

Tip: Motivate your employees to keep their paper receipts and submit them to the bookkeeping team, or log their expenses using their monthly expense tracking tools.

One of the best ways to encourage tracking and reporting is to remind your employees that managing business finance simplifies managing personal finance.

When creating a personal budget, they will have all the information they need to track the cost of work-related items and how much they can expect to receive in reimbursement.

For instance, if your company pays mileage instead of reimbursing actual fuel costs, the employee can quickly calculate the difference and add or subtract that amount from their personal budget.

Closing thoughts

Expense tracking is a valuable tool for monitoring company spending. You can track your expenses for each employee, each department, or the company overall.

You need a working budget to maximize the benefits of expense trackers and calculators. It is important to note that budgets and expense tracking programs have a circular relationship. Budgets inform spending policy, and tracking spending informs budgeting and forecasting.

Managing business finances is not always easy. However, the benefits far outweigh the effort spent. Whether your company is overspending on supply replenishment or is looking for ways to reduce the tax burden, tracking expenses by category offers a path to fix those problems.

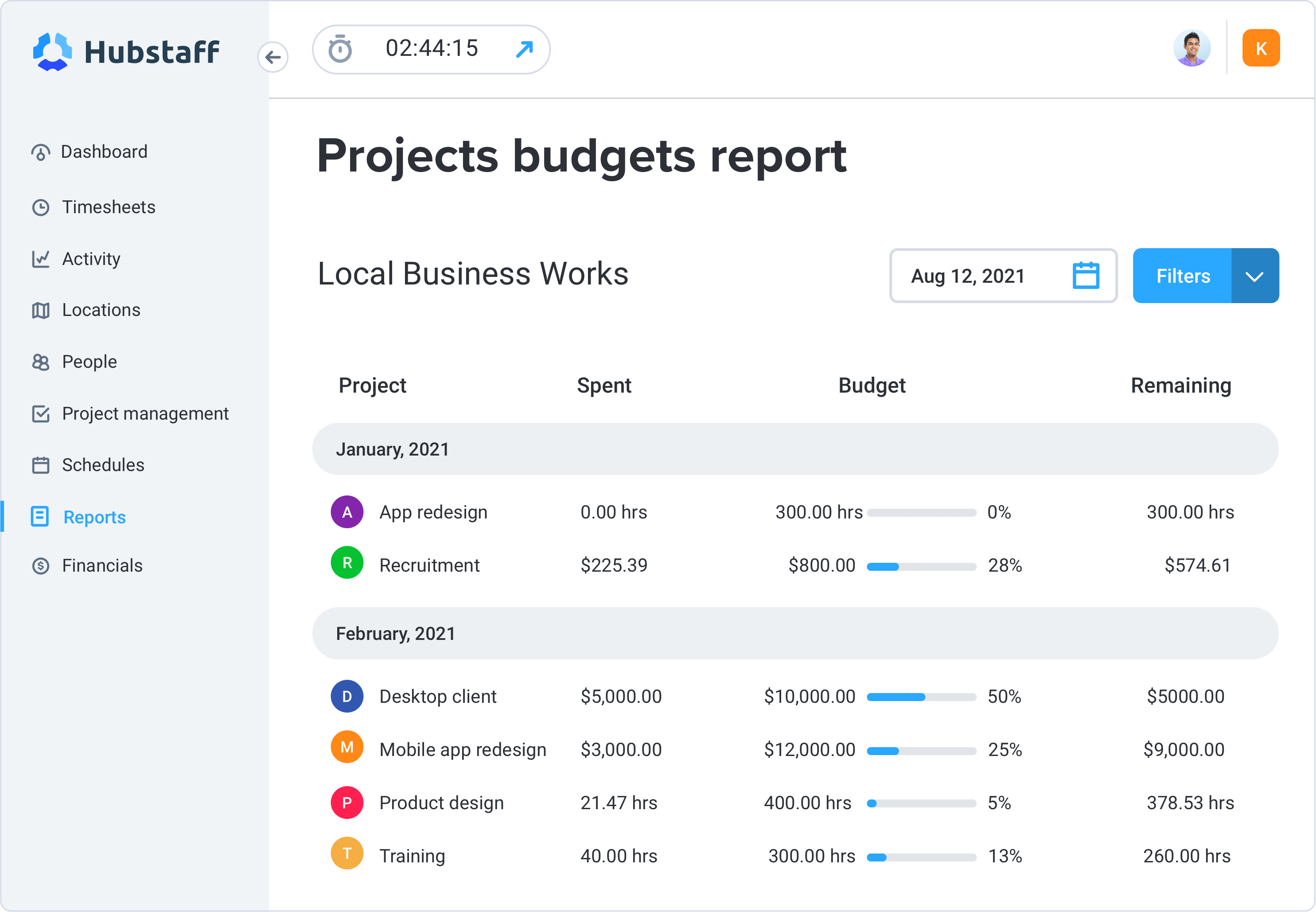

Hubstaff offers a feature-packed software solution to simplify tracking company expenses. Use our software to store digital receipts and connect tracked time to specific clients or projects.

Our workforce management tools allow managers to take control of their budgeting, payroll, and invoicing processes for improved money management throughout an organization.

Are you struggling to meet your company savings goals? Does your P&L reflect a lower profit margin than you would like? Contact our team for a software demo today.

Most popular

How to Calculate a Raise: Practical Guide for Employers

By 2030, the US alone will lose $430 billion annually due to low talent retention — and a lot of this turnover stems from low pa...

How to Survive and Thrive in an 80-Hour Work Week

It’s hard to believe that only a century ago, the 80-hour work week was the norm in the United States. Then, in 1926, the Ford M...

Mastering Workforce Scheduling: Techniques and Tools for Success

Imagine a workday where scheduling your workforce effectively ensures that every shift is perfectly aligned with your business nee...

Top Time Trackers for Virtual Assistants: Enhance Efficiency and Accountability

Virtual assistants (VAs) have a lot of responsibilities — and so do the people who hire them. With so much to keep track of, a t...